Overview :

The EUR/USD pair rallied upwards strongly yesterday to breach the bearish channel's resistance and settles above it, opening the way to turn to the upside on the intraday and short-term basis, starting bullish correction for the raise measured from 1.0638 to 1.0707, noting that the first main station is located at 1.0707, which breaching it represents the key to achieve additional gains that reach 1.0707. The bullish bias will be suggested for today, supported by the EMA100 that carries the price from above, taking into consideration that breaking 1.0707 will stop the expected rise and push the price back to the main bearish track again. A medium term topped could be in place already, on bullish convergence condition in daily RSI.

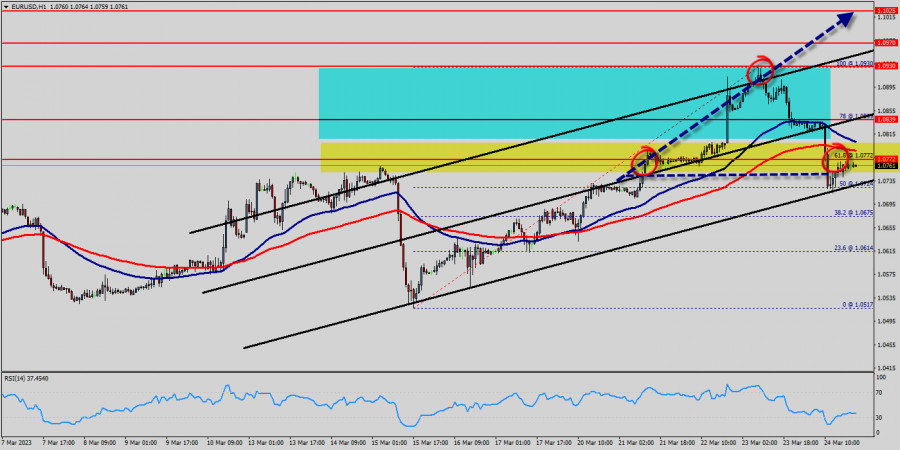

The bullish bias will be suggested for today, supported by the EMA100 that carries the price from above, taking into consideration that breaking 1.0819 will stop the expected rise and push the price back to the main bearish track again. A medium term topped could be in place already, on bullish convergence condition in daily RSI. Intraday bias is now on the upside for 61.8% retracement of 1.0819 to 1.0866 at 1.0880. The EUR/USD pair traded higher and closed the day in the positive territory around 1.0866. On the hourly chart, EUR/USD is still trading above the moving average line MA (100) H1 (1.0866). Accordingly, the bullish outlook remains the same as long as the EMA 100 is pointing to the uptrend. This suggests that the pair will probably go above the daily pivot point (1.0819) in the coming hours.

The EUR/USD pair will demonstrate strength following a breakout of the high at 1.0866. The situation is similar on the one-hour chart. Based on the foregoing, it is probably worth sticking to the north direction in trading, and as long as the EUR/USD pair remains above MA100 H1, it may be necessary to look for entry points to buy for the formation of a correction. Probably, the main scenario is continued growth towards 1.0927. The expected trading range for today is between 1.0819 support and 1.0927 resistance.

Intraday bias is now on the upside for 61.8% retracement of 1.0667 to 1.0707. The EUR/USD pair traded higher and closed the day in the positive territory around 1.0707. On the hourly chart, EUR/USD is still trading above the moving average line MA (100) H1 (1.0667). Accordingly, the bullish outlook remains the same as long as the EMA 100 is pointing to the uptrend. This suggests that the pair will probably go above the daily pivot point (1.0667) in the coming hours. The EUR/USD pair will demonstrate strength following a breakout of the high at 1.0707. The situation is similar on the one-hour chart.

Based on the foregoing, it is probably worth sticking to the north direction in trading, and as long as the EUR/USD pair remains above MA100 H1, it may be necessary to look for entry points to buy for the formation of a correction. Probably, the main scenario is continued growth towards 1.0760. The expected trading range for today is between 1.0667 support and 1.0760 resistance.

Weekly review :

Euro parity still in play ahead of decisive US inflation data, for that common currency came within whisker of 1.0845 this week. Right now, the EUR/USD pair is still moving around the price of 1.0845. The currency pair EUR/USD is trading below the resistance levels of 1.0927 and 1.0900. The euro to US dollar (EUR/USD) rate has risen about 0.5% month-to-date to trade around 1.0845. The raise is comparable to gain last seen for three weeks, when the European Central Bank unleashed its massive stimulus programme.

The EUR/USD pair continues to move upwards from the level of 1.0064, which represents the double bottom in the hourly chart. The pair rose from the level of 1.0064 to the top around 1.0800 USD. Today, the first resistance level is seen at 1.0927 followed by 1.0955 and 1.0985, while daily support is seen at the levels of 1.0845 and 1.0819. According to the previous events, the EUR/USD pair is still trading between the levels of 1.0845 and 1.0927. Hence, we expect a range of 82 pips in coming hours (1.0927 - 1.0845). The first resistance stands at the price of 1.0927, therefore if the EUR/USD pair succeeds to break through the resistance level of 1.0927, the market will rise further to 1.0955.

This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to rise higher towards at least 1.0955 in order to test the second resistance (1.0985).

The US Dollar and the Euro are two of the most prominent and well-known currencies in the world. The Euro versus US Dollar (EUR/USD) currency pair has the largest global trading volume, meaning it is the world's most-traded currency pair. Whether you find the instrument easy or difficult to trade on, it's not a pair that many traders neglect, due to its daily volatility and price movement.

Thus, the market is indicating a bearish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

Today, support is seen at the levels of 1.0845 and 1.0819. So, we expect the price to set above the strong support at the levels of 1.0845 and 1.0819; because the price is in a bullish channel now. The RSI starts signaling upward trend. Consequently, the market is likely to show signs of a bullish trend. Thus, it will be good to buy above the level of 1.0845 with the first target at 1.0927 and further to 1.0955 in order to test the daily resistance.

If the EUR/USD pair is able to break out the daily resistance at 1.0955 , the market will rise further to 1.0985 to approach support 3 in coming hours or two days. However, the price spot of 1.0985 and 1.0955 remains a significant resistance zone. Therefore, the trend is still bullish as long as the level of 1.0845 is not breached.

The EUR/USD pair rallied upwards strongly yesterday to breach the bearish channel's resistance and settles above it, opening the way to turn to the upside on the intraday and short-term basis, starting bullish correction for the raise measured from 1.0819 to 1.0865, noting that the first main station is located at 1.0927, which breaching it represents the key to achieve additional gains that reach 1.0927. According to the previous events, the EUR/USD pair is still trading between the levels of 1.0845 and 1.0927.

Hence, we expect a range of 82 pips in coming hours (1.0927 - 1.0845). The first resistance stands at the price of 1.0927, therefore if the EUR/USD pair succeeds to break through the resistance level of 1.0927, the market will rise further to 1.0955. This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to rise higher towards at least 1.0955 in order to test the second resistance (1.0985). The US Dollar and the Euro are two of the most prominent and well-known currencies in the world.

The Euro versus US Dollar (EUR/USD) currency pair has the largest global trading volume, meaning it is the world's most-traded currency pair. Whether you find the instrument easy or difficult to trade on, it's not a pair that many traders neglect, due to its daily volatility and price movement.

Thus, the market is indicating a bearish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. Today, support is seen at the levels of 1.0845 and 1.0819. So, we expect the price to set above the strong support at the levels of 1.0845 and 1.0819; because the price is in a bullish channel now. The RSI starts signaling upward trend.

Consequently, the market is likely to show signs of a bullish trend. Thus, it will be good to buy above the level of 1.0845 with the first target at 1.0927 and further to 1.0955 in order to test the daily resistance. If the EUR/USD pair is able to break out the daily resistance at 1.0955 , the market will rise further to 1.0985 to approach support 3 in coming hours or two days.

However, the price spot of 1.0985 and 1.0955 remains a significant resistance zone. Therefore, the trend is still bullish as long as the level of 1.0845 is not breached.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/Cm1xu26

via IFTTT