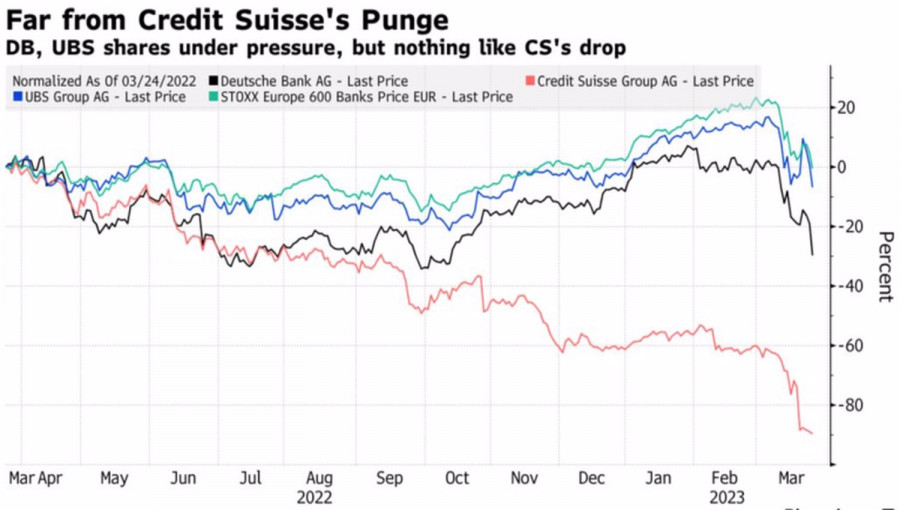

The market sells first, and then it is sorted out. The sharp collapse of EUR USD was the result of the implementation of this principle. Deutsche Bank's announcement about the early repayment of previously issued syndicated bonds caused another wave of panic in the financial markets. The bank's shares collapsed by 15%, showing the worst dynamics since the recession of 2020, and the euro collapsed against the US dollar to 1.0715. The irony is that Deutsche Bank made its statement in order to confirm its strong position. I wanted the best, it turned out as always.

Dynamics of shares of European banks

Due to the banking crisis, the futures market has radically changed its opinion about the fate of the federal funds rate. Before the collapse of SVB, CME derivatives saw a ceiling at 5.75%, now they see a maximum of 5.25%. Given the fact that their opinion in February coincided with the position of Fed Chairman Jerome Powell, who insisted on continuing the cycle of tightening monetary policy, it can be assumed that if not for the bankruptcy, the FOMC forecast would have been different. Most likely, the consensus estimate would be 5.75%. In fact, it remained at a level between 5% and 5.25%.

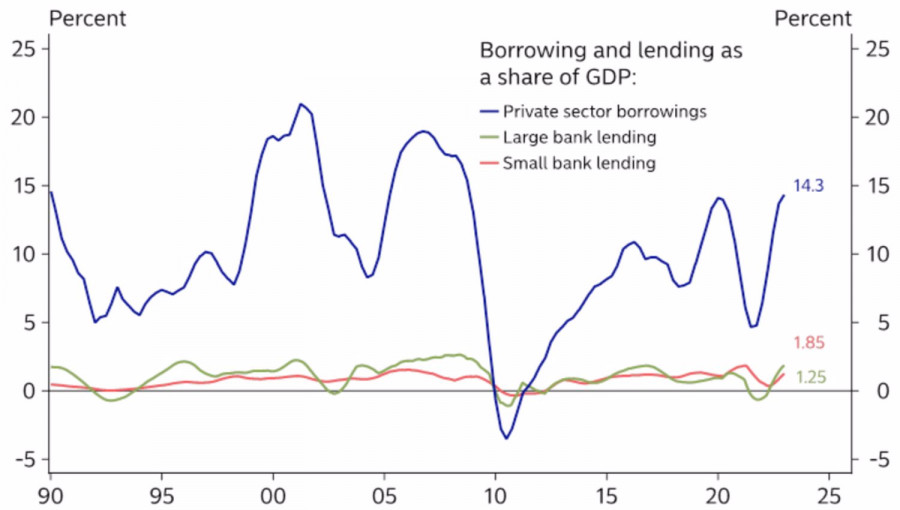

This means that the Fed considers the banking crisis equivalent to an increase in the cost of borrowing by 50 bps. Isn't that too much? The fact is that in the United States, small banks account for only about 2% of the total volume of loans in the economy. While the large banks account for 3%. Everything else is provided by the bond and promissory note markets.

Dynamics and structure of loans in the US economy

In my opinion, the impact of bankruptcies on US GDP is exaggerated. Stabilization of the situation in the US banking system will return investors' interest in inflation, which continues to be hot. According to forecasts by Bloomberg experts, the index of personal consumption expenditures and the base PMI in February will grow by 0.5-0.6% on a monthly basis. What kind of victory over inflation can we talk about? It may well be that the theme of the Fed's continued cycle of monetary tightening has left to return. And it does not allow us to put a cross on the U.S. dollar.

At first glance, everything is fine with the euro. Despite the banking crisis, business activity in the service sector continues to grow by leaps and bounds. As a result, the composite purchasing managers' index in March reached 54.1, the highest level since June. The members of the Governing Council continue to adhere to the hawkish rhetoric. Thus, the head of the Bundesbank Joachim Nagel argues that it is necessary not only to raise rates to a restrictive level, but also to keep them there for as long as necessary to ensure sustainable price stability.

I suppose that if not for the panic around Deutsche Bank, the euro would have continued to rally.

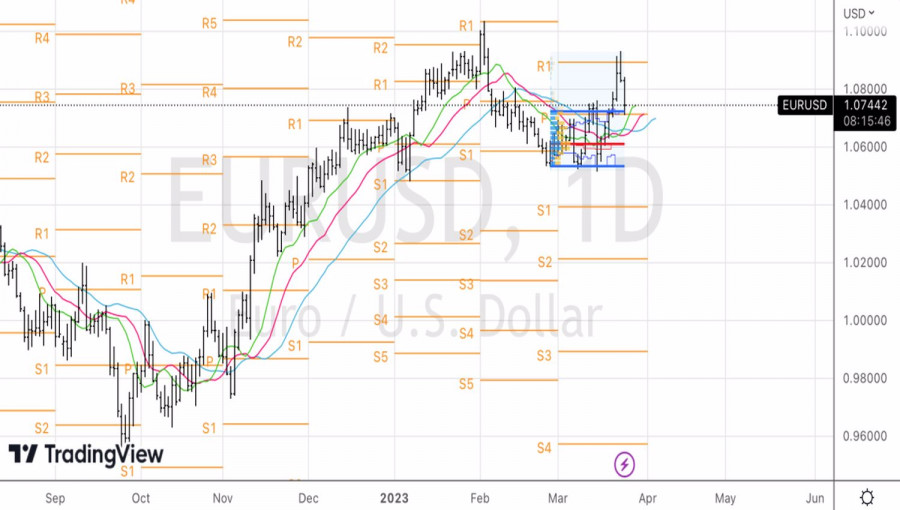

Technically, on the EURUSD daily chart, there is a pullback to the uptrend. The rebound from the upper limit of the fair value range and the pivot level at 1.0715 suggests that the bulls are strong. Let's use the corrective movement to form longs.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ruw86C1

via IFTTT