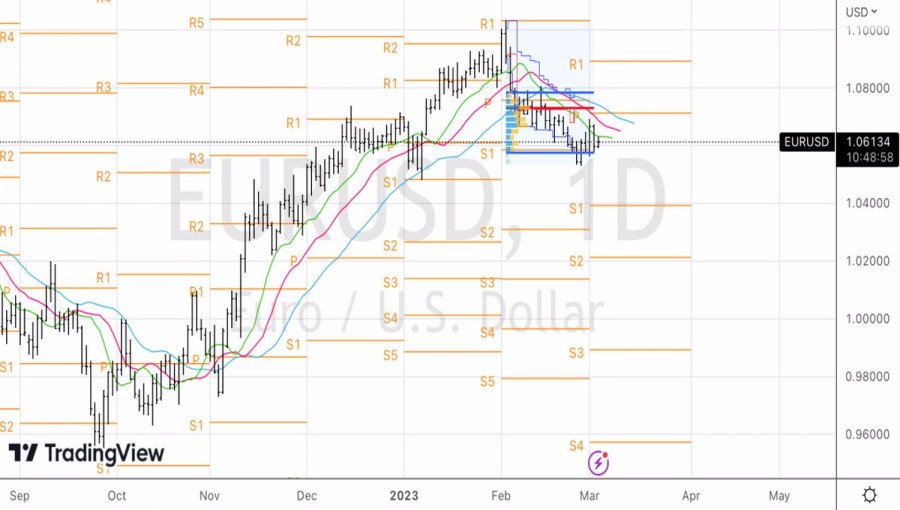

While EURUSD struggles to stay above 1.06, awaiting crucial U.S. labor market data for February, investors and central bankers are slowly coming to a consensus. Derivatives have long seen the European Central Bank's deposit rate peak at 4%, and Governing Council member Pierre Wunsch notes that this forecast may prove accurate if underlying price pressures in the eurozone remain elevated. Barclays, Bank of America, BNP Paribas, Danske Bank and Morgan Stanley are all talking about the same mark. It is a nice figure, a record in the history of the ECB, but will its achievement be enough to revive the uptrend in the main currency pair?

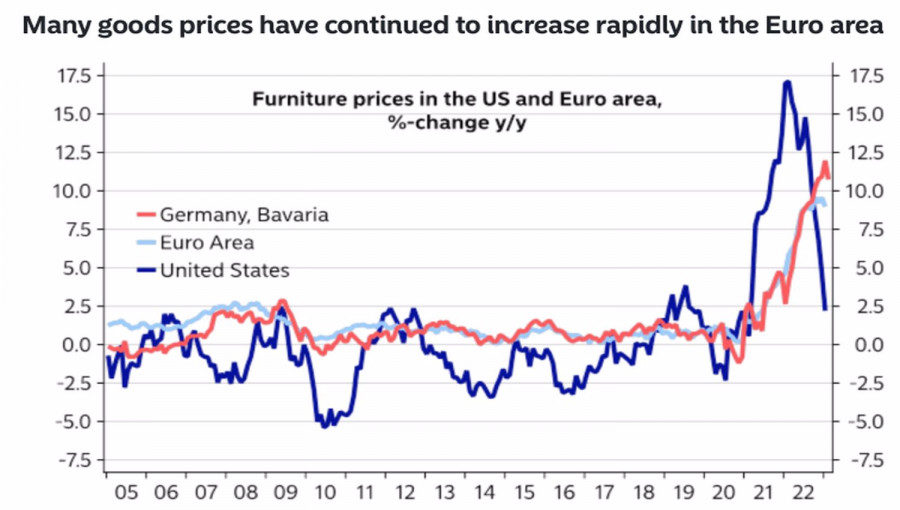

Morgan Stanley was one of the last major banks to raise its forecast for the deposit rate ceiling from 3.25% to 4%, citing the fact that core inflation in the eurozone is likely to peak later than expected. And that peak itself will be higher. The ECB will raise the cost of borrowing by 50 bps in March and May after which it will move to a smaller step of 25 bps. Thus, monetary tightening will continue until the autumn since European inflation refuses to slow down. Whereas U.S. commodity prices are already doing so, the picture is different in the eurozone and Germany.

The dynamics of commodity prices in the U.S., eurozone, and Germany

It could be over much sooner in America. There is not much left before the Federal Funds rate ceiling at 75 bps, and if February data shows that January's hot data were only a temporary spike due to favorable weather, the cost of borrowing will not get there at all. It will stop at 5.25%, just as the December FOMC forecast suggested.

The March 10 U.S. jobs and inflation data reports on March 14 were critical to understanding what the Federal Reserve would do, said its representatives Christopher Waller and Rafael Bostic. Strong macro data and the central bank raises rates further, on the other hand, weak data and it stops and tries to assess what's happening. There is a lot at stake, including the dollar's strength, rising Treasury yields and falling U.S. stock indices. Just as the dynamics of these assets changed sharply in February, they could change in March.

It isn't surprising that in such conditions, EURUSD begins to feel sad in consolidation, rushing from its upper to lower limit and vice versa. Things started to wind down only at the end of the week, by March 3. However don't be fooled, it is the calm before the storm.

Technically, the formation of a wide-range inside a bar on the EURUSD daily chart makes it possible for us to use a breakout strategy. We are talking about placing pending long positions from 1.0675 and short positions from 1.0575. Nevertheless, there are still high risks of false breakouts before the release of the US employment report for February. On the other hand, we might see good movement before the data is released.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/OctLkbx

via IFTTT