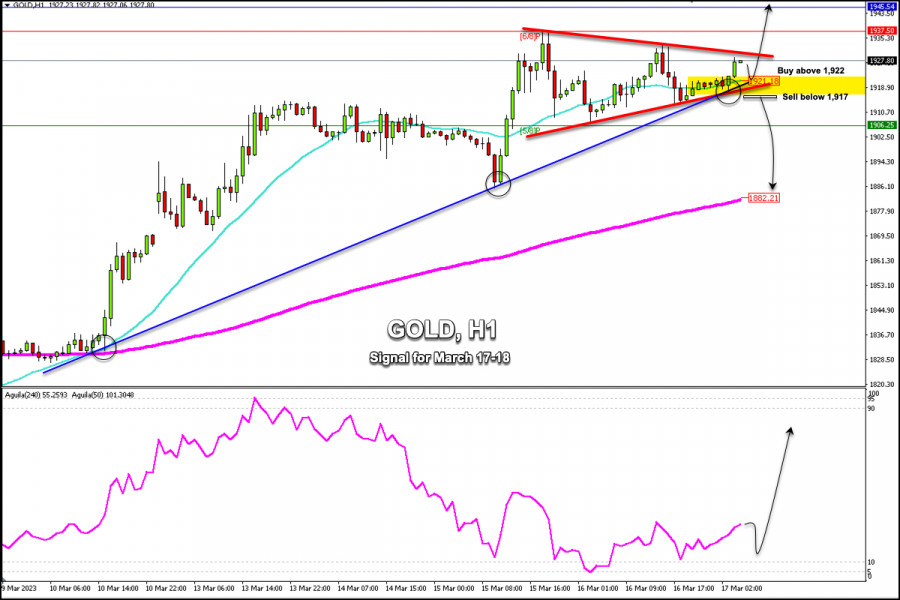

Early in the European session, Gold (XAU/USD) is trading around 1,927, above the 21 SMA, and within a symmetrical triangle formed in the last 48 hours.

The outlook for gold remains bullish. If it consolidates above the daily pivot point (1,920), it could continue rising to reach 1,945, the level which coincides with the third weekly resistance.

A technical bounce around the 21 SMA located at 1,921 could give us the opportunity to resume buying with targets at 1,937 and 1,945.

On the contrary, in case gold breaks the uptrend channel formed since March 10 and consolidates below 1,917 in the next few hours, we could expect a further bearish movement and the instrument could reach 5/8 Murray located at 1,906 and finally could fall towards the EMA 200 located at 1,882.

According to the 1-hour chart, gold has upside potential. It is likely that if it trades above 1,920 (21 SMA), we could expect it to reach the resistance zone of 1,945.

Our trading plan is to watch a key level of 1,921 which could set the trend for gold. If it trades below this level in the next few hours, it will be considered an opportunity to sell and could accelerate the bearish movement until the price covers the gap left at 1,867.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/bkmW1Bs

via IFTTT