Overview and trading tips on EUR/USD

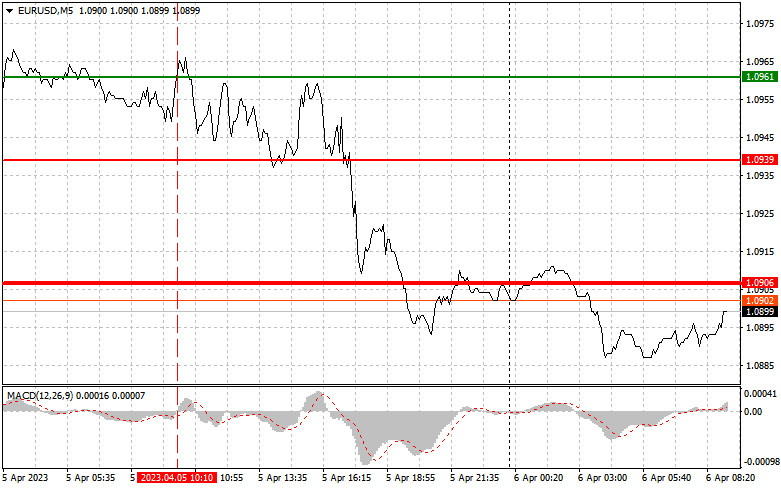

The 1.0961 level was tested at the moment when the MACD was just starting to move up from the zero mark. This confirmed the correct entry point for buying the euro. But, unfortunately, the signal entailed losses. No other signals were formed.

The PMI figures for the eurozone's services sector and the composite PMI index disappointed traders, which did not allow the buy signal to work out properly in the first half of the day. The US data was also not better. After an unsuccessful jump, the euro came again under selling pressure. Today EUR/USD is expected to trade quietly since there are no important statistics. In the first half of the day, market participants will get to know the reports on Germany's industrial production and the PMI index for the construction sector. Strong data can prop up the euro, but I don't expect a big upward movement. So, I'm betting on the implementation of scenario No. 2 for selling. In the second half of the day, the US Labor Department will release a weekly update on initial claims for unemployment benefits. Besides, FOMC member James Bullard will also come up with his comments. If everything is clear with the weekly jobless claims. We will hardly learn anything new there. However, the speech of the Fed policymaker may spur a slight surge in market volatility.

Buy signal

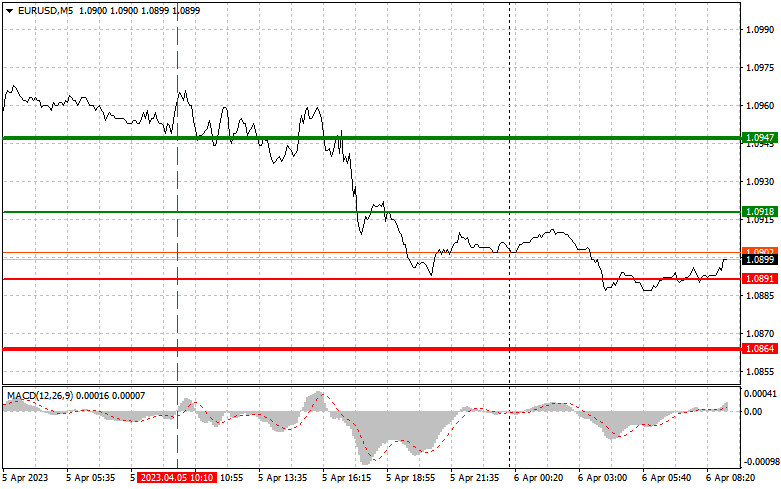

Scenario #1: Today, you can buy the euro when the price reaches around 1.0918 (green line on the chart) with an upward target at 1.0947. At the 1.0947 point, I recommend exiting the market and also opening short positions in the opposite direction, expecting a 30-35 point move from the entry point. We could hardly count on EUR/USD's growth today, although the bulls may re-enter the market. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting its rise from it.

Scenario #2: You can also buy the euro today in case of two consecutive price tests of 1.0891 while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a reverse market turnaround upwards. You can expect the price growth to the opposite levels of 1.0918 and 1.0947.

Sell signal

Scenario #1: You can go short on the euro after EUR/USD reaches the 1.0891 level (the red line on the chart). The target will be placed at 1.0864 where I recommend exiting the market and immediately buying the euro in the opposite direction. We reckon a 20-25 point move in the opposite direction from the level. The instrument will again come under selling pressure in case of a failed attempt to consolidate at daily highs. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just starting its decline from it.

Scenario #2: Another option to open short positions today is the situation of two consecutive tests of 1.0918 while the MACD indicator is in the overbought area. This will limit the pair's upside potential and cause a reverse market turnaround downwards. If so, EUR/USD is expected to decline to the opposite levels of 1.0891 and 1.0864.

What's on the chart

The thin green line is the key level at which you can open long positions on the EUR/USD pair.

The thick green line is the target level since the price is unlikely to move above this level.

The thin red line is the level at which you can open short positions on the EUR/USD pair.

The thick red line is the target level since the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid trading during sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/6g47uoV

via IFTTT