Early in the European session, Gold (XAU/USD) is located below the 21 SMA below +1/8 Murray (2031) and is trading around 2,010.07, making a technical correction.

Yesterday in the American session, gold extended its advance to a new one-month high at about 2,032.05. Around this level, it found a strong rejection triggered a technical correction towards the 2,010 level.

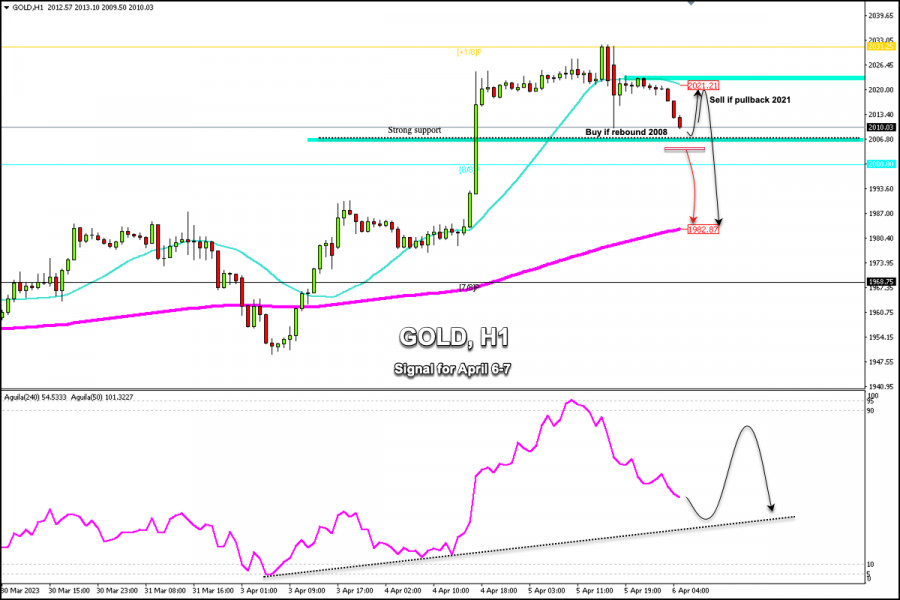

On the 1-hour chart, we can see that gold has made a strong technical correction after having reached the key level of 2,031 and is now showing signs of a probable technical rebound for the next few hours.

A price drop of $20 means that gold is showing signs of exhaustion. The metal is likely to resume its technical correction and could reach the psychological level of $2,000.

This corrective movement could be considered profit-taking due to the bullish movements we have seen in the last few days. Gold is expected to resume its bullish cycle in the next few hours, but for this, we could expect a rebound around 2,008 towards the 21 SMA zone located at 2,021.

The yield of 10-year Treasury bonds reached a low of 3.27%, last seen on September 8, 2022. It is likely that if the downward movement continues, it could favor the recovery of gold and its price could reach 2,031, +2/8 Murray at 2,062.50, and finally the one-year high of 2,075.

The outlook remains bullish for gold and it could resume its bullish cycle if it returns and trades above 2,031, then it could move towards the 2,065 zone (+2/8 Murray). Below the psychological $2,000 level, we could expect a strong technical correction and the instrument could reach 1,982 (200 EMA) and the 7/8 Murray line located at 1,968.

Our trading plan for the next few hours is to buy gold in case it rebounds around 2,008, with targets at 2,021. On the other hand, in case there is a pullback towards 2,021, that is where the daily pivot point is located, it could be seen as a signal to sell with targets at 1,982 (200 EMA).

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/YJ0ePBh

via IFTTT