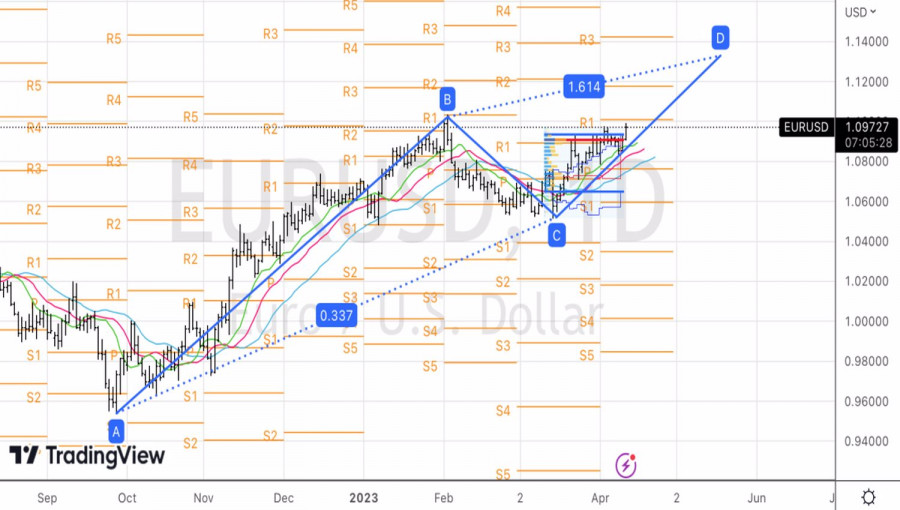

As expected, a faster decrease in the pace of consumer price growth in the US in March than experts from Bloomberg had predicted became a catalyst for the EURUSD rally. The main currency pair came within arm's reach of the psychologically important level of 1.1, thanks to the strengthening of investors' belief that the increase in the federal funds rate in May will be the last in the cycle of tightening the Federal Reserve's monetary policy. If it happens at all.

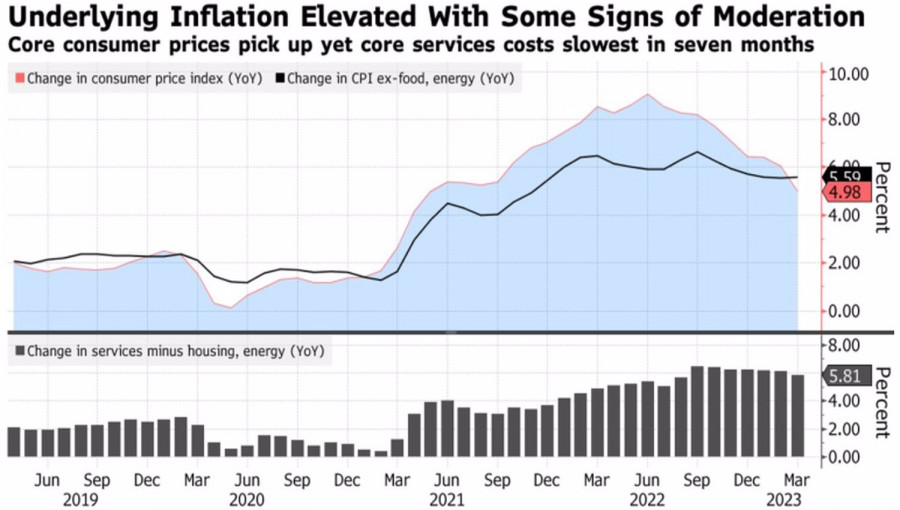

For the first time in over two years, consumer prices in the US are growing slower than the core inflation. In March, CPI slowed down from 6% to 5% due to the effect of a high base. A year ago, the surge in energy prices triggered the inflation acceleration mechanism. In June 2022, it reached its peak, and comparing with those times allows us to claim that in the coming months, the pace of consumer price growth will drop to 4% and below.

US inflation dynamics

Undoubtedly, the recovery of the service sector after the pandemic and the still strong labor market will put obstacles in this process. However, disinflationary phenomena in the US real estate market, economic slowdown, and the resolution of supply chain issues suggest that the peak of inflation has been left behind. The indicator is steadily moving towards the 2% target, which means it's time for the Fed to wrap up its work. According to Philadelphia Fed President Patrick Harker, the peak borrowing cost is slightly above 5%.

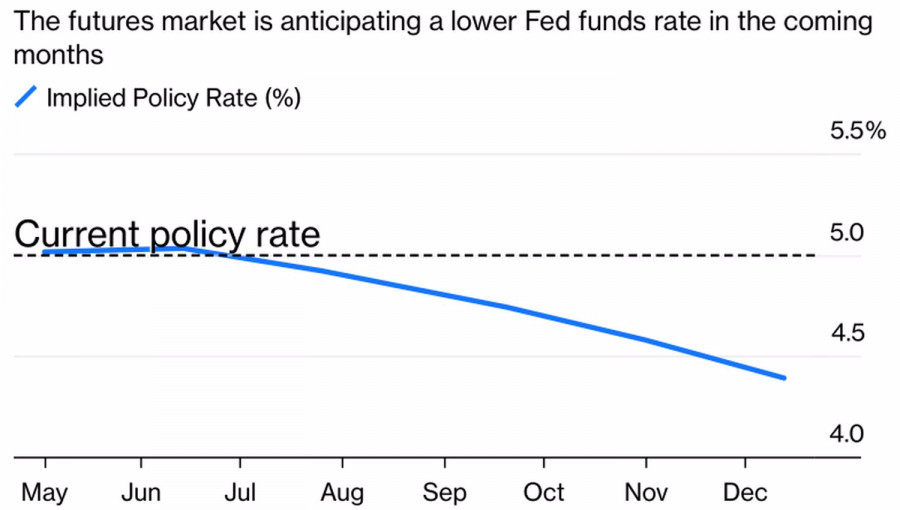

Following the release of US inflation data for March, Treasury bond yields fell, the US dollar weakened, and the chances of a 25 basis point increase in the federal funds rate in May dropped from 72% to 66%. Such an outcome is most likely, while investors are looking for clues about the Federal Reserve's future actions in the minutes of its March meeting.

For now, derivatives are clinging to the idea of a dovish pivot. They predict that borrowing costs in the US will fall by 40-50 basis points by the end of the current year.

Dynamics of expectations for the Fed rate

In my opinion, the Fed may abandon its idea of holding the rate at a plateau for an extended period of time in only one case. If the US economy begins to wither before our eyes. The approach of a recession used to not bother Jerome Powell and his colleagues. However, times have changed now. The IMF believes that inflation will slow down due to sluggish GDP growth.

Thus, the worse the macro statistics for the United States turn out, the more chances there are for the Fed to ease its monetary policy as early as 2023. If the US economy gets a second wind, the dollar may return to the game.

Technically, on the daily chart, EURUSD bulls have taken another step forward in the recovery of the upward trend. In accordance with the target at 161.8% for the harmonic trading pattern AB=CD, its initial target level is 1.133. The recommendation is to buy euros on pullbacks and on the breakouts of important pivot levels.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/SBY4Hjo

via IFTTT