Analysis and tips on how to trade GBP/USD

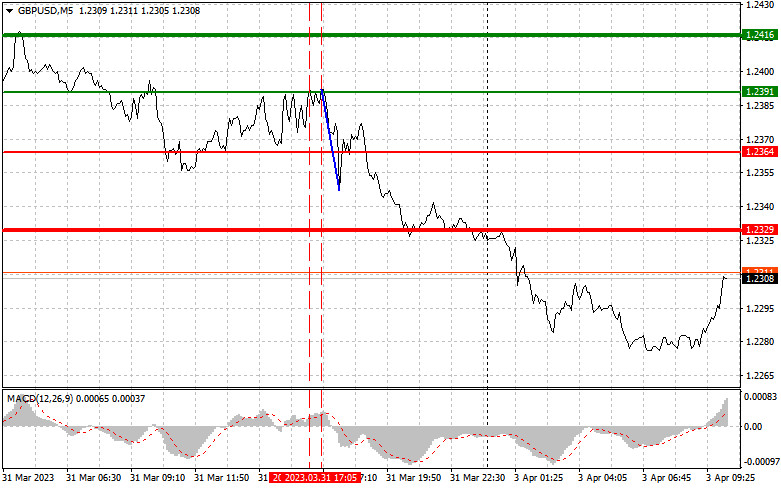

The price tested the 1.2391 mark when the MACD was slightly above zero. No buy signal followed. The price once again tests this mark shortly after. The MACD was in the overbought zone at that moment, which generated a sell signal, in line with Scenario 2. As a result, the pair lost more than 40 pips.

The pair remained near monthly highs after the release of an upbeat UK GDP report for the 4 quarter. Meanwhile, strong macro statistics in the US exerted pressure on the pair and triggered a sell-off at the end of last week. The UK will deliver data on the manufacturing PMI today. So, the pair is likely to be under pressure. In the North American session, the ISM manufacturing PMI will be published in the US. The pair may recover after the release.

Signal to buy:

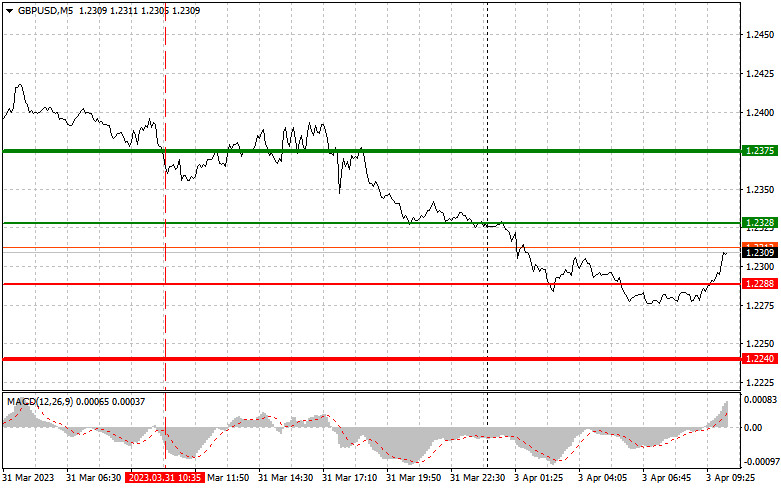

Scenario 1: we buy today when the price reaches the mark of 1.2328 (green line of the chart), targeting 1.2375 (thick green line), where we close long positions and sell the pound, allowing a correction of 30-35 pips. The pair may rise today if data in the UK comes upbeat. Important! Before buying the instrument, make sure the MACD is above zero and just starts moving up from this level.

Scenario 2: we also buy when the price tests the mark of 1.2288 twice, with the MACD being in the oversold zone at that moment. This will limit the pair's downside potential and lead to a bullish reversal in the market. The quote may go either to 12328 or 1.2375.

Signal to sell

Scenario 1: we sell today after the price tests the mark of 1.2288 (red line on the chart), which will cause a rapid fall in value. The target is seen at 1.2240 where we exit the market and buy the instrument, allowing a correction of 20-25 pips in the opposite direction. The pair may feel pressure if macro reports in the UK come disappointing. Important! Before selling the instrument, make sure the MACD is below zero and just starts moving down from this level.

Scenario 2: we also sell when the price tests the mark of 1.2328 twice, with the MACD being in the overbought zone at that moment. This will limit the pair's upside potential and lead to a bearish reversal in the market. The quote may then go either to 1.2288 or 1.2240.

Indicators on charts:

A thin green line indicates a buy entry point.

A thick green line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to grow above this level.

A thin red line indicates a sell entry point.

A thick red line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to fall below this level.

MACD. When entering the market, it is important to pay attention to the overbought and oversold zones.

Remember that novice forex traders should be very careful when deciding to enter the market. Before the release of important fundamentals, you should stay out of the market in order to avoid sharp fluctuations in the rate. If you decide to trade during news releases, make sure always to place a stop-loss order to minimize losses. Without it, you may quickly lose your entire deposit, especially if you do not use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/A0dmgOh

via IFTTT