Long-term perspective.

The EUR/USD currency pair showed a downward movement again during the current week. The European currency has been falling for two consecutive weeks, practically every day. It is worth reminding ourselves that the euro has been rising like a rocket for about two months, raising questions about the reasons behind its behavior. We have repeatedly stated that there are simply no grounds for a strong strengthening of the euro currency. We also warned that sooner or later, the debts would have to be "repaid," which we are currently witnessing.

Last week, the fundamental and macroeconomic backgrounds were quite weak. For two weeks in a row, we have been observing a series of statements by representatives of the ECB and the Fed, but there is very little truly important information. There is no information capable of influencing the pair's movement at the moment. From all the statements made by officials of the European and American central banks, we can draw the following conclusions. The ECB will continue to tighten its monetary policy, but probably not more than in the next two meetings. The Fed has most likely completed its tightening cycle, but one or two rate hikes can still be expected in 2023. The difference between these central banks and their policies lies in the fact that the Federal Reserve is practically unlimited in its ability to raise rates. Of course, it cannot increase them to 10%, but that is not necessary. Inflation in the United States has already dropped to 4.9%, and the additional 1-2 rate hikes are reserved in case inflation stops decreasing or starts to rise. The ECB does not have such opportunities because each subsequent rate hike is a blow to an economy that is already on the brink of recession.

Thus, we can draw only one conclusion: the current rise of the dollar is completely fair and logical. Even if we remove all the fundamental factors, the pair should occasionally correct itself. And you cannot remove fundamental factors from the equation.

COT Analysis.

On Friday, a new COT report for May 23rd was released. In the last nine months, the COT reports have fully reflected what is happening in the market. As can be seen from the above illustration, the net position of large players (the second indicator) began to rise in September 2022. At approximately the same time, the European currency started to rise. Currently, the net position of non-commercial traders (bullish) remains very high and continues to grow, just like the European currency itself.

We have already drawn traders' attention to the fact that the relatively high value of the "net position" suggests the impending end of the upward trend. This is indicated by the first indicator, where the red and green lines have significantly diverged, which often precedes the end of a trend. The European currency attempted to start falling a few months ago, but what we saw was just a simple and not very strong correction. During the last reporting week, the number of buy contracts for the "non-commercial" group decreased by 8.6 thousand, while the number of shorts increased by 4.7 thousand. Consequently, the net position decreased by 13.3 thousand contracts. The number of buy contracts is higher than the number of sell contracts by 174 thousand among non-commercial traders, and this is a very large gap. The difference is more than threefold. The correction has started, and it may not be just a correction but the beginning of a new downward trend. At the moment, even without the COT reports, it is clear that the pair should fall.

Fundamental event analysis

During the current week, there were practically no important publications in the European Union. The manufacturing activity index continued its free fall below the "waterline," while the services sector index continued to grow. Essentially, these were all the reports published in the EU this week. As we can see, there is essentially nothing to analyze, and the downward movement of the pair was not related to macroeconomic statistics from across the ocean. The problem for the European currency is that the market has already fully priced in all the growth factors, with some factors even being priced in multiple times. It is simply impossible to find new reasons to buy the euro at the moment. Of course, the market can buy without reason, but such behavior is more characteristic of the cryptocurrency market rather than the foreign exchange market. Therefore, we believe that the decline should continue in any case.

Trading plan for the week of May 29th to June 2nd:

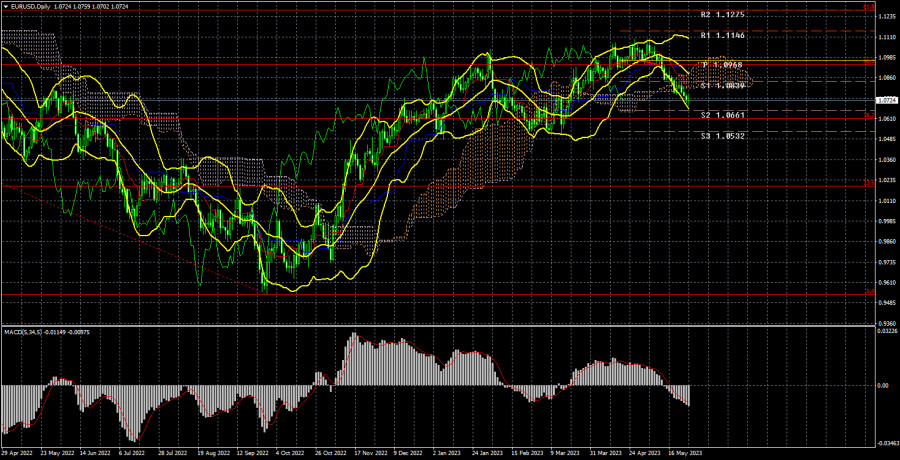

- During the 24-hour timeframe, the pair started a downward movement that we have been waiting for a long time. Buying is no longer relevant as the price has settled below all the lines of the Ichimoku indicator. Moreover, the fundamental and macroeconomic backgrounds do not support the euro currency, so it is very difficult to expect further growth without a significant correction. Formally, trading on the upside can be considered if the price reverses above the Kijun-sen line, but we still believe that such growth would be illogical. Therefore, we cannot be confident in it.

- As for selling the euro/dollar pair, in the 24-hour timeframe, positions could be opened after surpassing the Kijun-sen line, as we mentioned in previous articles. The Senkou Span B line has been crossed, and the next target is the 1.05-1.06 area, which is just a little further to go. The euro remains overbought, so a decline is the most likely scenario. The cancellation of this scenario would occur if the price settles above the critical line.

Explanations for the illustrations:

Support and resistance levels, Fibonacci levels - these are the targets when opening buy or sell positions. Take Profit levels can be placed near them.

Ichimoku indicators (default settings), Bollinger Bands (default settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/5CPrV7L

via IFTTT