Long-term perspective.

The GBP/USD currency pair also showed a downward movement during the current week, but once again, it was much weaker than the EUR/USD pair. Thus, the pound continues to demonstrate a persistent unwillingness to decline, although it has more reasons to do so compared to the euro. The British pound has grown stronger than the euro over the past 2.5 months and the past 9 months and its corrections have been weaker. The state of the British economy is much worse than the American one. The Bank of England has raised interest rates 12 times but has failed to achieve a significant slowdown in inflation. Therefore, from our point of view, everything indicates that the pound should fall. Over the past 2 weeks, the pair has lost only 350 points. It is not a small amount, but it is not significant either.

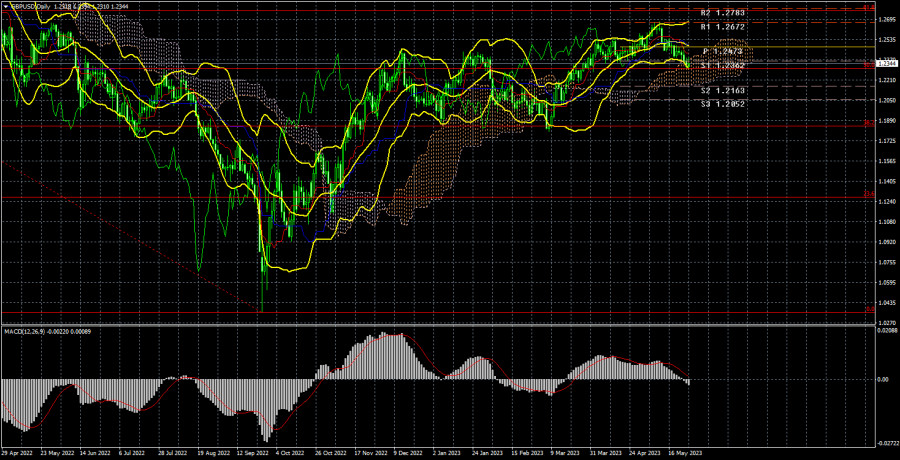

The most crucial thing now is the breakthrough of the important critical line on the 24-hour timeframe, which allows for further decline towards the Senkou Span B line. However, even reaching the lower boundary of the Ichimoku cloud will not be considered a sufficient decline. We expect to see the pound reach at least the 38.2% Fibonacci level at 1.1840, but given the market's current reluctance to sell, there are significant doubts about this.

Last week, Bank of England Governor Andrew Bailey spoke twice. Both of his speeches in Parliament can be considered "moderately hawkish" as the head of the BOE continued to insist on the need for tightening monetary policy. At the same time, his words can also be interpreted in another direction, as Mr. Bailey expects a significant decline in inflation in the remaining part of 2023. If inflation falls rapidly and significantly, the regulator will have no grounds for further rate hikes. Therefore, Bailey's statements are a "double-edged sword."

We believe that the pound should decline regardless of Bailey's statements. The macroeconomic statistics remain disappointing, and the BOE has almost exhausted its potential for tightening monetary policy. The market has already priced in all the factors supporting the pound's growth two or three times.

COT analysis.

According to the latest report on the British pound, the "non-commercial" group closed 8.1 thousand buy contracts and 7.1 thousand sell contracts. Thus, the net position of non-commercial traders decreased by 1 thousand contracts but continues to grow overall. The net position indicator has been steadily increasing over the past 9-10 months, but the sentiment of major players has remained bearish (although now it can be said to be bullish, purely formally). The British pound has been rising against the dollar for a long time (in the medium-term perspective), but it had few reasons to do so. We believe that a prolonged and protracted decline of the pound has now begun, although COT reports allow for further strengthening of the British currency. However, it is challenging to say on what basis the market can continue buying.

Both major currency pairs are currently moving roughly the same, but the net position for the euro is positive, suggesting the completion of an uptrend, while for the pound, it is neutral. The British currency has risen by a total of 2300 points, which is a significant amount, and without a strong downward correction, the continuation of the rise would be entirely illogical (even if we disregard the lack of fundamental support). The "Non-commercial" group currently holds a total of 57.6 thousand contracts for selling and 69.2 thousand contracts for buying. We remain skeptical about the long-term growth of the British currency and expect it to decline, but we cannot command the market.

Fundamental events analysis.

In the UK this week, there were several important publications. Naturally, the inflation report takes the first place, which has simply "blown the minds" of traders and analysts. The main consumer price indicator decreased by 1.4% on an annual basis. It seemed like we finally saw what Andrew Bailey was talking about. But it's not that simple! In monthly terms, inflation accelerated by 1.2%, which is even higher than the most pessimistic forecasts. At the same time, core inflation increased from 6.2% to 6.8% on an annual basis, although forecasts predicted a decrease to 6.1%. In monthly terms, core inflation also rose by 1.3%, which is higher than any forecast. So how should these figures be interpreted? Is inflation falling or not?

In addition to inflation, business activity indices were published. All three indices declined in May, with the manufacturing sector being particularly concerning. Retail sales increased by 0.5% in April, slightly above the forecasts, but on an annual basis, they decreased by 3%, which is worse than the forecasts. It cannot be said unequivocally that the statistics from the UK were strong.

Trading plan for the week of May 29 - June 2:

- The GBP/USD pair started to decline last week, which may be another simple pullback. The price has settled below the critical line, so the decline may continue with the target being the Senkou Span B line, which is located at the level of 1.2165. We believe that small sell positions with support from deals on the 4-hour timeframe are reasonable now. The overall potential for the pair to decline is significant, around 400-500 points.

- As for buying, after a rise of 2300 points without a strong correction, further upward movement is highly doubtful. It should also be remembered that there is a lack of fundamental support for the pound. Therefore, long positions are not currently relevant. Formally, they will become relevant in case of a new consolidation above the critical line, but even in that case, they should be approached with caution.

Explanations for the illustrations:

Support and resistance levels, Fibonacci levels - levels that serve as targets when opening buying or selling positions. Take Profit levels can be placed around them.

Ichimoku indicators (default settings), Bollinger Bands (default settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the size of the net position for each category of traders.

Indicator 2 on the COT charts - the size of the net position for the "Non-commercial" group.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/8aCfmZF

via IFTTT