The Federal Reserve wants to lower rates amid a strong economy, while the European Central Bank is not in a hurry to ease monetary policy despite the eurozone barely standing on its feet. A paradox! Nevertheless, the recent cycle of monetary restriction was unique. Inflation was rising too quickly, and rates were increasing at the most aggressive pace in decades. It seems that their reduction will also puzzle investors. It's no wonder that EUR/USD is experiencing turbulence.

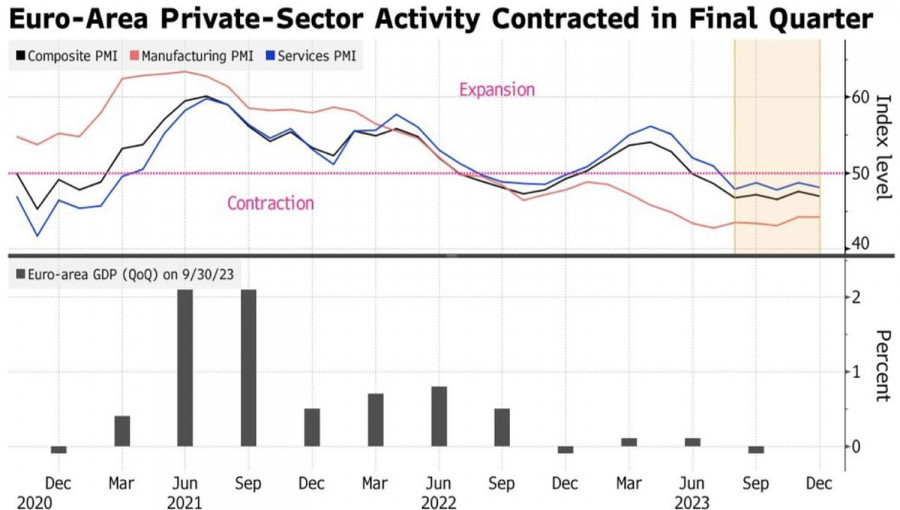

After two days of rapid growth, the bulls on the main currency pair decided to take profits. The reason was disappointing statistics on business activity in the eurozone for November. The index has been below the critical mark of 50 for the seventh month, indicating a recession. The economy is in decline, and the European Central Bank cannot muster the courage to talk about easing monetary policy.

Dynamics of Business Activity in the Eurozone

According to the head of the Bank of France, Francois Villeroy de Galhau, the cycle of monetary restriction is complete. Unless something extraordinary happens, the deposit rate will no longer rise. However, this does not mean a rapid reduction in borrowing costs. The ECB will be guided by incoming data, not the calendar.

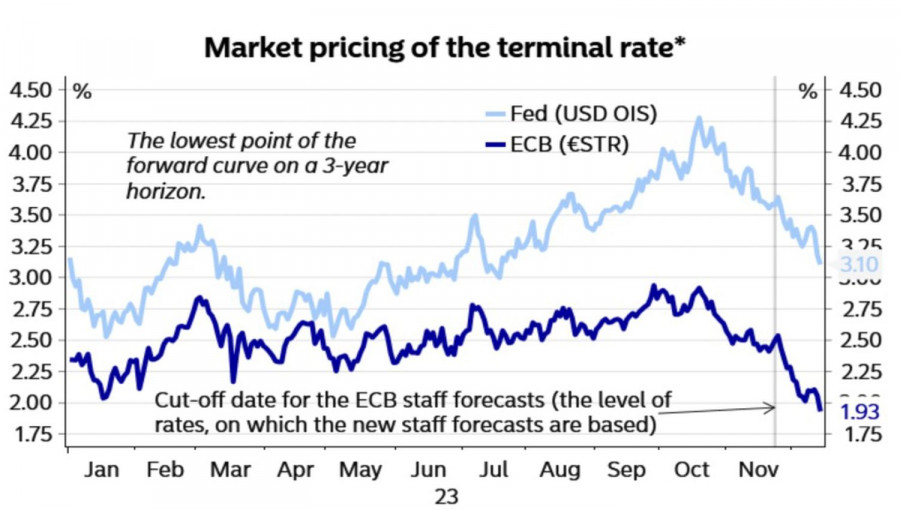

The head of the Bank of Estonia, Madis Muller, noted that deflation in the eurozone is spreading faster than expected. This is happening because the transmission of monetary policy to the economy is happening sooner than forecasted, making it effective. However, market views on the deposit rate change in 2024 are overly optimistic.

Dynamics of Market Expectations for ECB and Fed Rates

Market expectations see a weak economy and rapidly declining inflation to the 2% target, while they are told something entirely different: discussing monetary expansion is premature. This confusion is compounded by the narrative of the Federal Reserve. Washington, unlike Frankfurt, signals a reduction in borrowing costs to ensure a soft landing for the already robust U.S. economy.

This usually does not happen. Rates are raised to cool economic activity and lowered to heat it up. The Federal Reserve is doing something beyond the commonly accepted measures. Again, confusion arises, forcing investors to look towards the U.S. dollar.

What's next? Market expectations for a 150 bps rate hike in federal funds in 2024 are clearly exaggerated, twice as much as the Fed predicts. And, for now, the central bank's position seems more justified. When investors finally realize this, profit-taking on S&P 500 longs will accelerate the decline in the main currency pair.

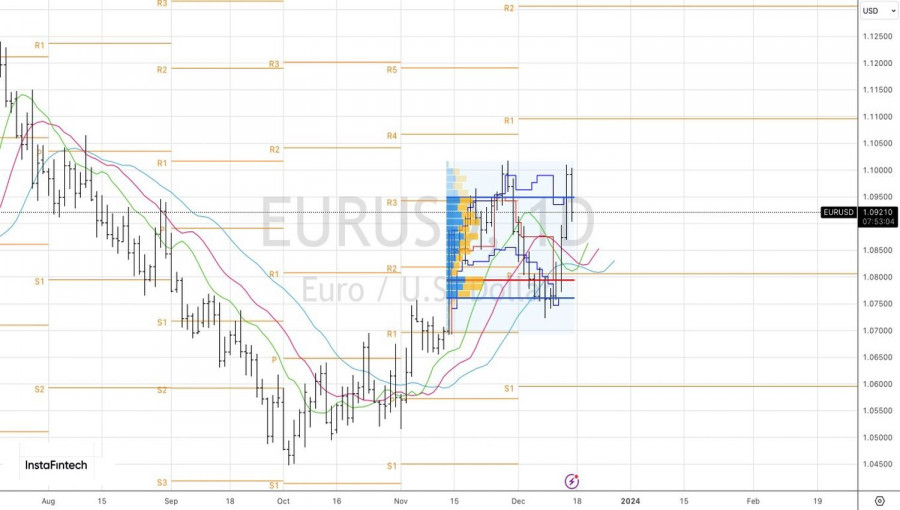

Technically, on the daily chart, a Double Top pattern has formed on EUR/USD. The return of the euro to the fair value range of $1.076–1.094 indicates the weakness of the bulls. As long as the pair is trading below 1.094, it should be sold. A return above the critical level will be a reason to buy.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/u9LJbfl

via IFTTT