If 2022 was the year when something broke in Bitcoin, then 2023 is the year of recovery after the trauma. Since the beginning of January, BTC/USD quotes have grown by almost 160%, trading above 40,000 since the start of December. From the levels of the March bottom, the token has rebounded by more than twice in less than nine months. On average, starting from 2014, Bitcoin's value doubling occurred in 9 months and 21 days. What's even more remarkable is that it usually fell by 27% before doubling its price. This did not happen in 2023. The rally was swift, and this is just the beginning of the cycle.

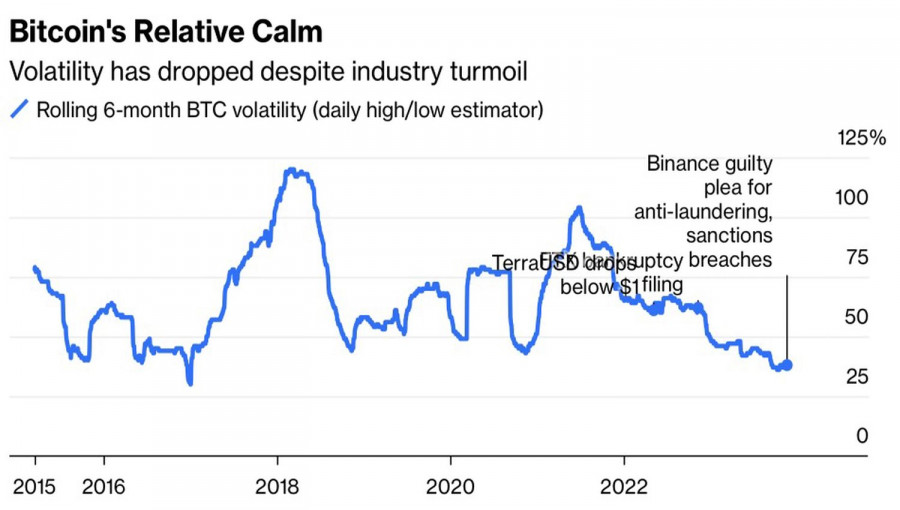

Bitcoin's market capitalization has increased from $871 billion at the end of 2022 to $1.7 trillion, and its share in the cryptocurrency market structure has jumped from 38% to 50%. Trading volumes on both the spot and futures markets have also increased, from $2.9 trillion in January to $3.6 trillion in December. Interest in the token is rising, and its volatility is decreasing, comparable to the volatility of quotes for American technology companies' stocks.

Bitcoin Volatility Dynamics

The cryptocurrency sector leader is maturing and regaining lost trust. However, does this mean that Bitcoin is ready to take a place in the portfolios of large institutional investors? The increased likelihood of approval by the Securities and Exchange Commission (SEC) of applications by BlackRock and 12 other companies to create ETFs with the token as the underlying asset suggests so. If the verdict is positive, it will strengthen confidence in the crypto industry and accelerate the capital influx. What could be a better reason to continue the BTC/USD rally?

In fact, the news of the SEC's approval of applications is presumably already largely reflected in the quotes, especially in combination with investors' hopes for a dovish pivot by the Federal Reserve. These factors formed the basis of Bitcoin's rapid rally in October–December. However, JP Morgan believes that investors expect new ETFs to increase the market capitalization by 10% from the current $1.7 trillion. If this does not happen, mass sell-offs will begin.

At the same time, Bitcoin has other strong points. The expected halving in 2024 will increase miner costs, limit supply, theoretically leading to price growth. Simultaneously, the weakness of the U.S. dollar against major world currencies due to the Fed's intention to make a dovish pivot will support risky assets, both American stock indices and cryptocurrencies. Moreover, there is a daring idea in the market that only Bitcoin can resist the strength of the dollar. Fiat currencies, including the euro, British pound, and Japanese yen, have so far failed to do so.

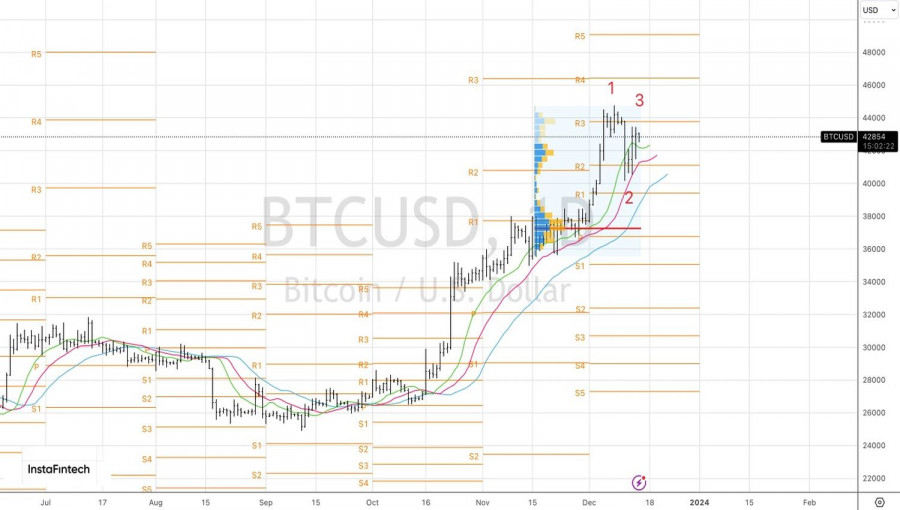

Technically, a reversal pattern 1-2-3 is forming on the BTC/USD daily chart. However, for its activation, a drop in quotes below the pivot level of 41,000 is required. In such a scenario, we will sell Bitcoin in the short term. On the contrary, its rise above resistance at 43,750 will be the basis for opening new or increasing previously formed long positions from 37,750. The upward trend looks stable, and its potential is far from being fully revealed.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/aS0DNAO

via IFTTT