Traders this week found themselves dealing with high expectations from central banks. Initially, they were anticipating a more hawkish stance from Jerome Powell (although it is clear that any further rate hike by the Fed might be the last one). Subsequently, they were expecting something similar from Christine Lagarde (who, on the contrary, spoke about a pause rather than further tightening). As the ECB started signaling a clear slowdown in the pace of monetary policy tightening, which typically precedes the end of the cycle, demand for the euro sharply declined. This moment should have happened several months ago.

Consequently, the euro should continue its downward trend. It is important to note that the euro has been rising almost consistently while the Fed and the ECB raised rates. This should have led to some currency parity, but the euro has experienced a strong surge over the past ten months. We see this as unjust, considering that the economic statistics in the US are much better than in Europe, and the interest rate is higher. So, there should be a moment of correction. Why not now?

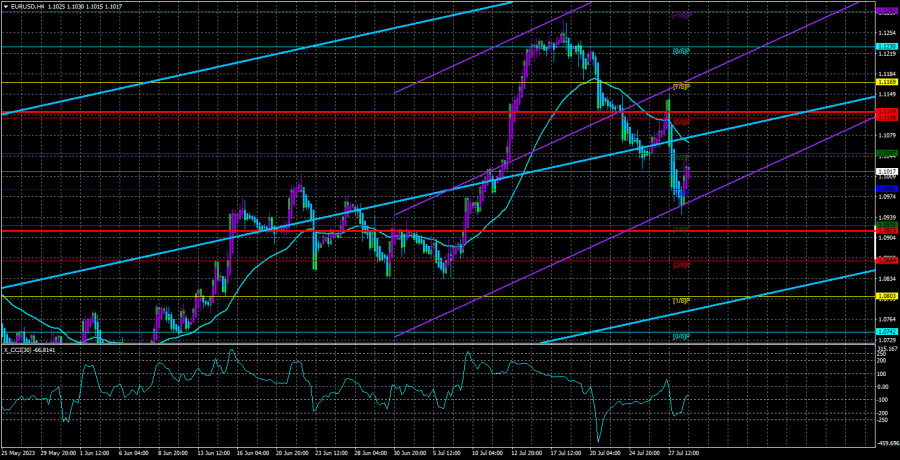

On the 4-hour timeframe, the pair remains below the moving average line. It still needs to be determined if the upward trend has concluded on the daily chart, as the price has only retraced by 230 points from its annual highs. Although the critical line has been breached, similar breaches occurred during the current upward trend, and each time, the euro saw further growth.

Macroeconomic statistics remain in the background.

The upcoming week will witness many macroeconomic publications, some of which are quite important. However, traders still need to show substantial interest in the macroeconomic background. In recent months, strong US statistics have had little impact on the dollar. Nevertheless, let's focus on the most interesting events in the European Union.

On Monday, two crucial reports will be published: GDP for the second quarter and inflation for July. According to official forecasts, the European economy may have grown by 0.2-0.3% in the second quarter. If these predictions come true, the euro may find support, as the last two quarters have been weak, if not dismal. Despite the EU's economy projecting higher growth, the reality is less impressive. However, given the context of tightening monetary policy, even this growth level can be seen as positive.

The inflation report may indicate a decrease to 5.2–5.3% from the current 5.5%. Core inflation may also decrease to 5.4%. Although this slowdown may not be considered significant enough to prompt the ECB to tighten its rhetoric after Lagarde's talk about a pause, inflation in the EU is still declining, and the same is happening in America. Moreover, in the US, inflation is nearly reaching 2%. Thus, each moderate slowdown will suggest that the ECB will ease its tightening pace. This information is unlikely to support the euro.

On Tuesday, the EU will release the Manufacturing PMI for July and the unemployment rate. The Manufacturing PMI is the second estimate and is expected to be similar to the first one. The unemployment rate for the EU is considered a secondary indicator. The Services PMI will be released as a second estimate on Thursday, followed by Retail Sales on Friday. These reports are not considered the most critical. Therefore, the most important information will come on Monday. At least until the 1.0860 level, the pair should fall in any case.

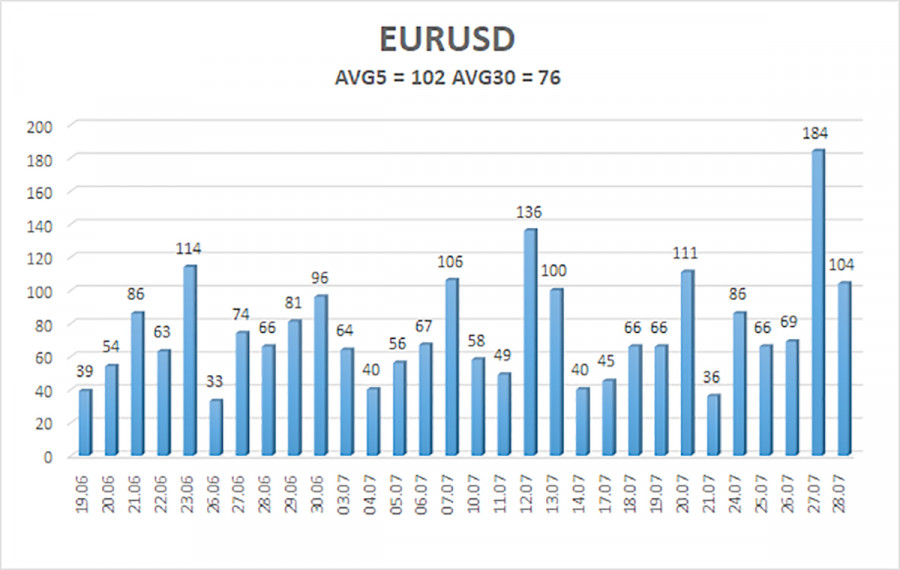

The average volatility of the EUR/USD currency pair for the last five trading days as of July 30 is 102 points, classified as "high." However, this level of volatility was primarily driven by trading on Thursday. Over the next few days, it may decrease. Consequently, we expect the pair to move between the levels of 1.0915 and 1.1119 on Monday. A downward reversal of the Heiken Ashi indicator will indicate a resumption of the downtrend.

Nearest support levels:

S1 - 1.0986

S2 - 1.0925

S3 - 1.0864

Nearest resistance levels:

R1 - 1.1047

R2 - 1.1108

R3 - 1.1169

Trading recommendations:

Currently, the EUR/USD pair is trading below the moving average but is experiencing a correction. Traders can now contemplate taking new short positions, aiming for 1.0925 and 1.0915, provided the Heiken Ashi indicator shows a downward reversal. On the other hand, long positions will be meaningful only if the price remains consistently above the moving average line, targeting 1.1108 and 1.1169.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both point in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade in the next 24 hours, based on the current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an approaching trend reversal in the opposite direction.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/U9fp0HK

via IFTTT