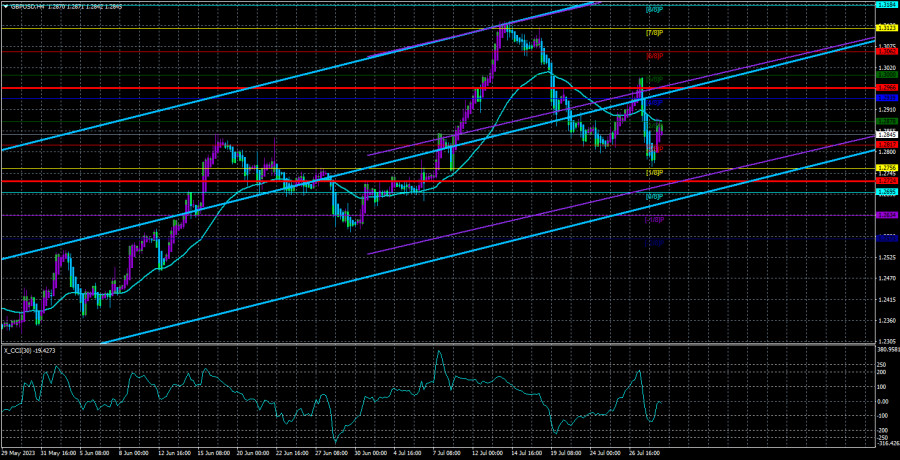

The GBP/USD currency pair also slightly corrected on Friday following its decline on Thursday. However, the pair remains below the moving average, indicating short-term bearish prospects. As mentioned earlier, no strong signals suggest the end of the upward trend in the long run. The price has settled below the critical line in the 24-hour timeframe, but we have seen many such occurrences in the last 5–6 months. This implies that the downward movement may persist for some time, with the target being the Senkou Span B line at 1.2573.

Nevertheless, the most significant event of the week will be the Bank of England meeting. While the outcome is predictable, it isn't easy to anticipate the statements from Andrew Bailey. The Bank of England may raise the interest rate by 0.25% and signal the tightening cycle's impending conclusion. If this occurs, it logically implies that the pound should start losing market support. High market expectations regarding the BOE rate primarily drove the recent growth in the British currency. If the market realizes that the rate will continue rising for a while, there will be no reason left to buy the pound.

Toward the end of the year, when the Fed might start indicating a willingness to ease monetary policy, the dollar may face pressure again. However, if the pair fails to correct by even 500–600 points by that time, it will be necessary to acknowledge again that there is no logic in these movements. On the one hand, it doesn't matter, as we have a trend to trade on. Nevertheless, the lack of correlation between fundamental and macroeconomic backgrounds and the pair's movements must be clarified.

The Bank of England meeting stands as the pivotal event of the week. Next week in the UK, business activity indices for July will be published in the final assessment, along with the Bank of England meeting. The decision on the interest rate is already known - a 0.25% increase. However, this decision has slightly less certainty compared to similar ones from the Fed and the ECB. The Bank of England has shown in the previous meeting that it can make unexpected decisions, so a surprise at the July meeting cannot be ruled out.

If the rate is raised as expected by 0.25% and Andrew Bailey doesn't make any significant statements, then the pound is unlikely to gain market support (except perhaps momentarily). However, if the BOE Governor indicates that the bank is ready to continue tightening until inflation approaches the target level, the market will have new reasons for active pound purchases.

In the US, there will also be significant publications and events. First, the FOMC meeting is already behind us, so the "silent mode" for the monetary committee members is over. Second, on Friday, there will be reports on Non-Farm Payrolls and unemployment, which are always crucial. Third, the ISM indices for services and manufacturing will be published, which are much more significant than the standard S&P indices. Fourth, ADP, JOLTs, and initial jobless claims reports will be released. As we can see, plenty of important publications will be in the US alone. Adding the Bank of England meeting to the mix, a volatile week awaits us.

Considering that the dollar has recently taken the lead, we expect its growth to continue. We don't anticipate Andrew Bailey adopting a more hawkish rhetoric; instead, he might slightly ease it. US labor market data from month to month have shown high values (considering the current Fed rate), and there is no reason to assume that they will disappoint in July. However, we must remember that expectations are one thing, and reality is another. Any of the reports or events can bring surprises.

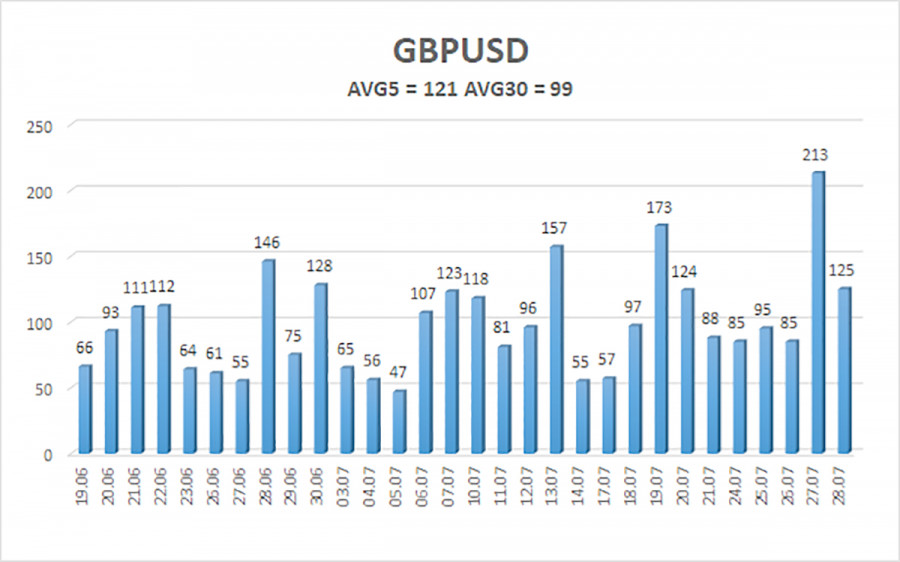

The average GBP/USD pair volatility for the last five trading days as of July 30 is 121 points, considered "high" for the pound/dollar pair. On Monday, July 31, we expect movement within the range limited by 1.2724 and 1.2966. A reversal of the Heiken Ashi indicator downwards will signal the resumption of the downtrend.

Nearest support levels:

S1 - 1.2817

S2 - 1.2756

S3 - 1.2695

Nearest resistance levels:

R1 - 1.2878

R2 - 1.2939

R3 - 1.3000

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair has returned below the moving average. Currently, short positions are advisable, targeting 1.2756 and 1.2724 in case the price bounces back from the moving average line. Long positions can be considered if the price remains above the moving average, with targets at 1.2939 and 1.2966.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. It indicates a strong trend if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move in the next few days, based on current volatility indicators.

CCI indicator - its entry into the overbought area (below -250) or oversold area (above +250) indicates an upcoming trend reversal in the opposite direction.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/kMmJFjd

via IFTTT