The results of the Federal Reserve's meeting will be known on Wednesday evening, and the results of the European Central Bank's meeting will be announced on Thursday. As usual, the markets have a number of questions for the central banks, but they are not concerned with the Banks' current decisions, but their future course of actions for the remaining part of the year. There are quite a few concerns regarding monetary policy in the second half of the year. Let's take a closer look at them.

European Central Bank: Klaas Knot, the head of the Dutch central bank, announced last week that tightening of monetary policy after July is not a decided decision. In other words, the ECB may decide to take a pause in September or adopt the approach of the Federal Reserve with one rate hike in two meetings. Undoubtedly, such an approach will be considered dovish, although in fact, it can be seen as "moderately hawkish." However, it might put pressure on the euro. Therefore, ECB President Christine Lagarde's speech will be crucial for the euro's fate. If the ECB president confirms that the rate hike in September is an open question, and the central bank is considering a pause, demand for the euro may decrease.

Fed: The majority of market participants currently lean towards the idea that the central bank will announce the last rate hike in the current monetary policy cycle. If that is indeed the case, the US dollar may come under pressure because the end of rate hikes is the first step towards rate cuts. Undoubtedly, sooner or later, the ECB will take the same step, and the correlation of the monetary policies of the two central banks is important to us. Therefore, the US dollar may not start a new phase of decline. However, it could significantly decrease in the short term.

If Fed Chair Jerome Powell allows for another rate hike this year, the market might interpret this statement as a signal for an increased demand for the US dollar. However, regardless of the rhetoric from both central bank presidents, we are approaching a moment when both central banks will conclude their tightening policies. Personally, I believe that the market has already priced in around 80% of all rate hikes in the European Union and the United States. This suggests that the market has no compelling reasons to maintain a high demand for the single currency. Nevertheless, wave analysis sometimes shows what is happening in the market more accurately than fundamentals.

I would also like to add that, with regards to the British pound, it is better to consider not only the level of 1.2840 but also an area around this level, about 20-30 pips in each direction. A move away from this area will indicate the direction of the instrument.

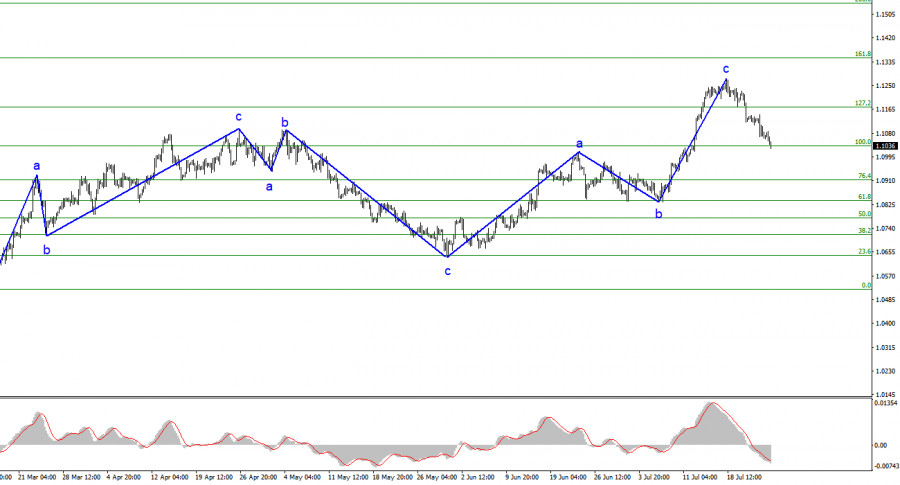

Based on the analysis conducted, I come to the conclusion that the formation of an upward wave set is completed. I still consider targets around 1.0500-1.0600 as quite realistic, and I advise selling the instrument with these targets in mind. The a-b-c structure looks comprehensive and convincing, and closing below the 1.1172 mark indirectly confirms the formation of a downtrend. Therefore, I continue to recommend selling the instrument with targets located around the level of 1.1034, but in reality, the decline should be much stronger if all three waves are constructed.

The wave pattern of the GBP/USD pair suggests a decline in the coming weeks. As the attempt to break through the 1.3084 mark (downwards) was successful, you could open short positions, as I mentioned in my recent reviews. The market has successfully breached the 1.2840 mark, indicating that the pair may fall. However, market sentiment may change on Wednesday if Powell's stance is not aggressive enough. The current wave has dropped below the peak of wave 3 in 5, which indicates the formation of a downtrend. I expect the pound to fall further.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/pYxj38B

via IFTTT