Over the weekend, we analyzed what Federal Reserve Chairman Jerome Powell and European Central Bank President Christine Lagarde conveyed to the market. Now, let's understand what to expect from both instruments based on their statements. Briefly, Powell indicated his readiness to raise the interest rate once more. Most likely, this will not happen before November, as there is no pressing need to rush this decision at the moment. Inflation in the US has risen for the first time in 14 months, but only by 0.2% annually. Perhaps the inflation report for August will highlight this issue, but until it's released, it's pointless to speculate.

On the contrary, Lagarde implied that the ECB is close to its peak rate and is likely to transition to one rate hike over two meetings. Hence, the central bank might leave the rate unchanged in September. And even though the ECB might raise the rate more times than the Fed, there's a noticeable shift away from Lagarde's hawkish tone while maintaining Powell's hawkish stance.

Based on this, I conclude that the most logical course of events would be for the dollar to strengthen against the euro and pound. I want to stress that just because this seems apparent doesn't mean the market will sell the euro and pound to buy dollars consistently for a month. We might well see an upward corrective wave. But looking at the overall market situation, I expect both instruments to fall further.

In addition, the Bank of England, which currently holds the lead in terms of monetary tightening. In reality, the BoE is also nearing the end of its tightening cycle, but hasn't indicated as much. Inflation in the UK is objectively the highest, so any hawkish rhetoric from a member of the Governing Council might stall the pound's decline. However, overall, I believe that the pound sterling has exhausted its growth potential.

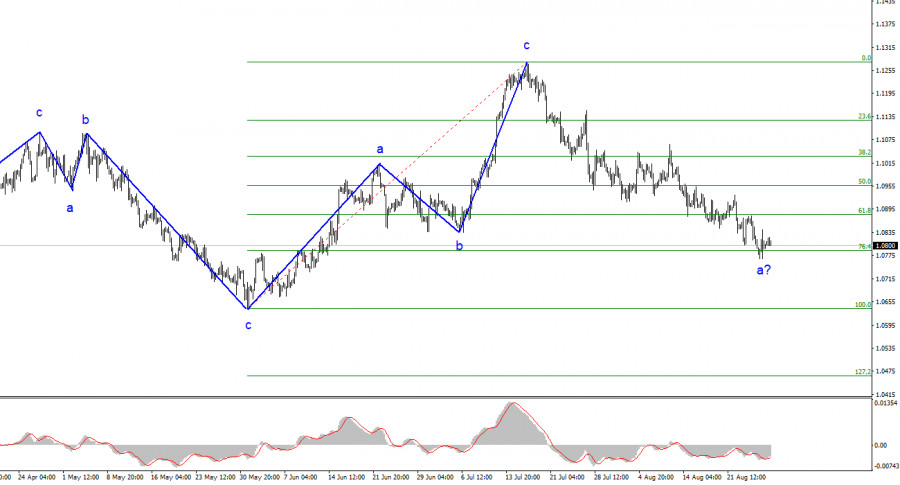

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range are quite realistic, and with these targets in mind, I advise selling the instrument. The a-b-c structure appears complete and convincing. Therefore, I advise selling the instrument with targets set around the 1.0788 and 1.0637 marks. I believe that the construction of a downtrend segment will continue, but a corrective wave might start soon.

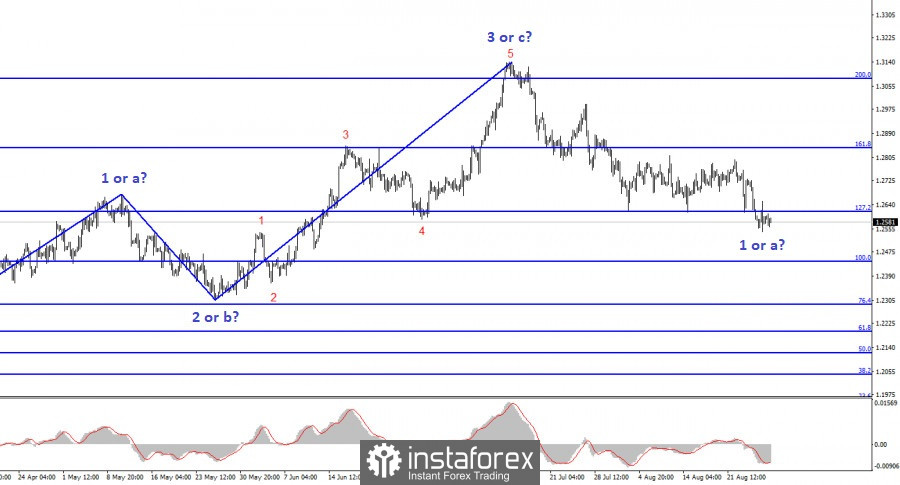

The wave pattern of the GBP/USD pair suggests a decline within the downtrend segment. There is a risk of ending the current downward wave if it is wave "d" and not "1". In that case, wave 5 could start from current levels. However, in my opinion, we are currently witnessing the construction of the first wave as part of a new downward segment of the trend. A successful attempt to break through the 1.2618 mark, corresponding to 127.2% Fibonacci, indicates the market's readiness for new short positions. I advise selling with targets set around the 1.2443 mark.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/46DK1a0

via IFTTT