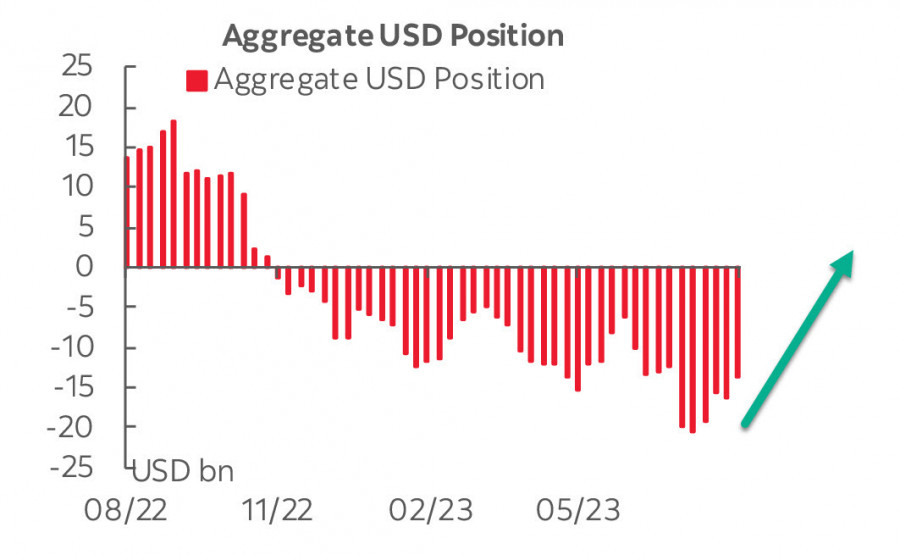

The value of the net short dollar position fell by $2 billion to -$14.3 billion over the reporting week, according to CFTC data. Most currencies had minor changes, except for the Japanese yen, which is rapidly being sold off.

Additionally, it's worth noting that futures for most commodity currencies, as well as for oil, copper, and gold, went through a bearish correction. This points to increasing concerns about a global recession. At the same time, it indicates that in the current conditions, the US dollar is still the market's main favorite, and also justifies the dollar appreciating in value.

Federal Reserve Chairman Jerome Powell's speech in Jackson Hole did not provide any new information. Powell stuck to his stance, reiterating the message that the US central bank is prepared to continue raising the funds rate if necessary, and that this policy will remain restrictive until there's compelling evidence that inflation is approaching the Bank's 2% inflation target.

Powell also remarked that the current restrictive policy will put downward pressure on economic activity, hiring and inflation. However, he warned that if the economy continues to grow above trend, it could put further progress on inflation at risk and could warrant further tightening of monetary policy. Overall, Powell's speech essentially reaffirmed that the Fed still relies on data and will act cautiously.

This week, the market will focus on the US non-farm employment figures, the US ISM Manufacturing Index, China's PMI, and eurozone inflation for August.

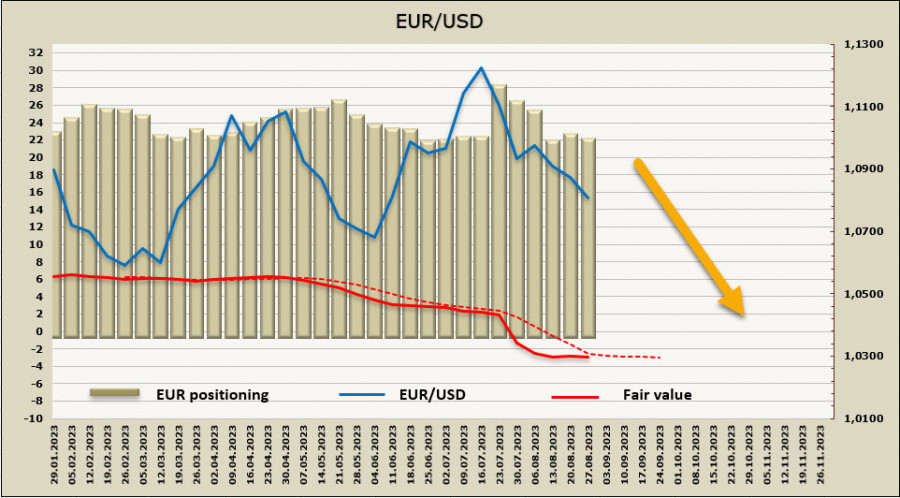

EUR/USD

European Central Bank President Christine Lagarde also spoke in Jackson Hole. Her speech mainly focused on structural changes affecting monetary policy, but without any hints of changing the current ECB strategy.

The eurozone inflation report for August will be released on Thursday, where it is expected that inflation will fall from 5.3% to 5.1%, and core inflation will drop from 5.5% to 5.3%. Since the ECB heavily relies on data, the data might lead to a surge in volatility if the figures significantly deviate from forecasts.

The net long position for the euro decreased by 0.3 billion over the reporting week, standing at 21.5 billion. Positioning remains firmly bullish. At the same time, the price is still below the long-term average, and there are almost no signs of an upward reversal.

A week earlier, we expected a test of the support level at 1.0830; the euro fell even lower to the channel's boundary at 1.0767. From a technical standpoint, an attempt to build a bullish correction seems likely, with the resistance area being at 1.1010/50. At the same time, the long-term trend is bearish, so the option of a shallower correction followed by an attempt to break down from the correction channel looks a bit more likely, in this case we can expect a move to the previous local low of 1.0634.

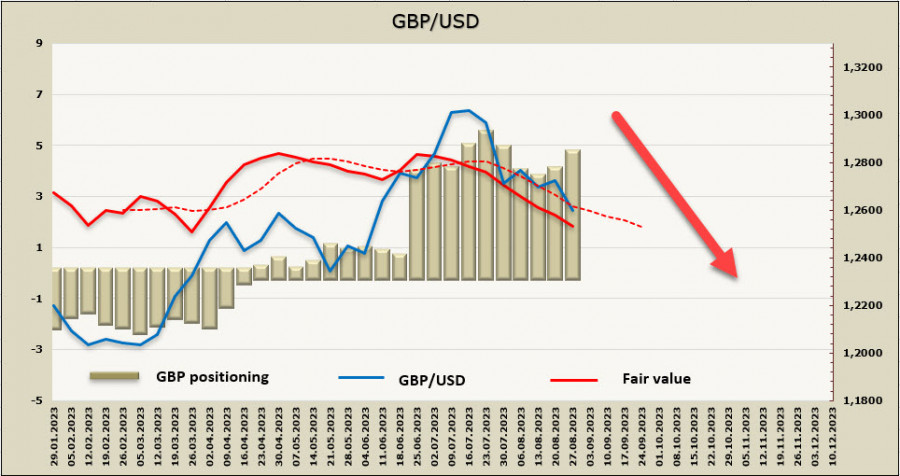

GBP/USD

GfK's long-running Consumer Confidence Index increased five points to -25 in August. All five measures were up in comparison to last month's announcement. Even though the overall figure remains sharply negative, hopes for an improvement in household finances are returning to the positive territory. The Major Purchase Index is up eight points, which is a good thing, as the advance is potentially better news for retailers. However, it simultaneously indicates that inflation deceleration remains uncertain, as a sharp rise in demand fuels price growth and contradicts the Bank of England's plans to reduce consumer demand.

Potentially, the situation favors the growth of the UK economy, but it also sustains fears that the BoE will raise rates to a higher level than the market currently expects. The pound has a chance to revive its growth as soon as the market re-evaluates interest rate forecasts.

The net long position for GBP increased by 0.6 billion to 4.7 billion over the reporting week. Speculative positioning is firmly bullish, but the price is also falling. The main reason for such an imbalance is the situation in the debt market, where UST yields have considerably stronger prospects than British bond yields.

In the previous review, we assumed that the likelihood of a bullish correction has increased, but the long-term trend remains bearish. As of Monday morning, this forecast remains valid. The almost uninterrupted decline that started in July increases the chances of a technical correction, but fundamental markers indicate that the pound will depreciate further.

If a correction develops, we see a resistance area at 1.2680/90, where sell-offs may resume. The long-term target shifts lower to the support area at 1.2290/2310.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/S9upvZj

via IFTTT