Analysis of macroeconomic reports:

Thursday will present a balanced slate of macroeconomic events. The highlight will be the European Central Bank meeting results, specifically any adjustments to the key interest rate. Opinions on this event are split. Approximately half the experts predict a 0.25% rate hike, which would be viewed as a "hawkish" move. The other half anticipate the rate to remain unchanged, seen as a "dovish" stance. In the former scenario, we could witness a rise in the euro, while in the latter, a decline. However, we strongly advise novice traders against attempting to predict the ECB's decision and the currency pair's movement tomorrow.

In the US, three secondary reports will be released: retail sales, unemployment claims, and the producer price index. The market may well overlook all three reports, especially if their figures closely align with predictions. Both Germany and the UK have no significant releases scheduled for Thursday.

Analysis of fundamental events

Among Thursday's fundamental events, the standout is a press conference with Christine Lagarde, discussing the results of the ECB meeting. During the ECB President's remarks, critical insights, especially about the regulator's future rate plans, may be unveiled. It's worth noting that signals over the past two months frequently indicate a readiness to halt the tightening of monetary policy—a situation that's unfavorable for the euro. Consequently, if Lagarde suggests a pause or an end to the current cycle tomorrow, it could trigger a significant decline in the euro.

General conclusion:

On Thursday, beginning traders should pay attention to the ECB meeting and Christine Lagarde's speech. Other events of the day are of minor importance. Even if they make some impact, the first two events would still overweight them.

Basic rules of a trading system:

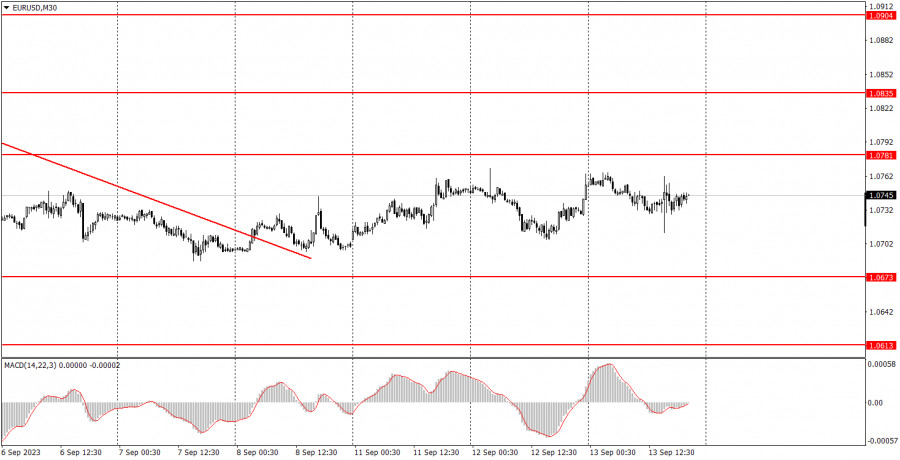

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, post which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trend line or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/tAVbDQR

via IFTTT