The 10-year U.S. treasury yield has climbed above 4.55%, a 16-year high. This is likely due to the Federal Reserve officials' signal that interest rates will not drop anytime soon. Currently, markets are pricing in a 77-point rate cut by the Fed in 2024, compared to 117 points at the beginning of September. On the other hand, the likelihood of another rate hike by January has increased from 40% to 50% at the beginning of the month.

The increase in the U.S. Treasury yields have pushed the EUR/USD pair below 1.06 since mid-March, and the USD/JPY pair is approaching highs from October 2022. The euro mounts pressure due to cautious comments from European Central Bank President Christine Lagarde, which are increasingly less hawkish.

The key focus is on the U.S. Conference Board Consumer Confidence Index. After improving in the summer, consumer confidence declined in August, and the market also expects September's figures to edge down. If the forecast holds true, it would indirectly suggest a reduction in inflationary risks, which could contribute to further demand for risk assets and a shallow correction in the dollar, at least.

The U.S. dollar looks confident at the start of the week. The markets believe that the Fed maintained a hawkish stance, especially in comparison to the dovish outcomes of meetings by the Bank of England, the Swiss National Bank, and the Bank of Japan, as well as signs of weakness in the eurozone economy. This suggests further positive dynamics for the dollar.

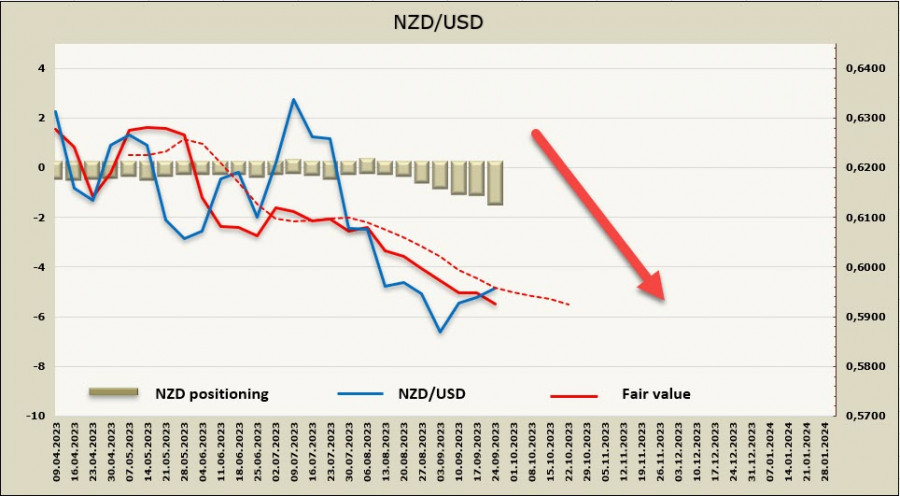

NZD/USD

New Zealand's economy grew 0.9% in the second quarter, lifting the country out of recession. While economic recovery alone doesn't provide a clear understanding of how inflation will change, it increases the likelihood that the Reserve Bank of New Zealand's October meeting will have a more hawkish bias, and another rate hike may occur by the end of the year.

Despite rising oil prices, which generally supports commodity currencies, the situation looks slightly different for New Zealand. Surging gasoline prices increase inflationary risks and put the burden primarily on households. In terms of agriculture prices, which is the main export sector of the economy, recovery has not been as swift as desired following the August slump.

This week's Global Dairy Trade auction alleviated some previous concerns about worsening conditions in the second half of the year. Prices rose by 4.6%, compensating for about half of the price decline in August. However, exports are still facing declining profitability. According to the updated RBNZ forecast, the current account surplus will decrease to 5.7% by the end of 2025, which is still quite high.

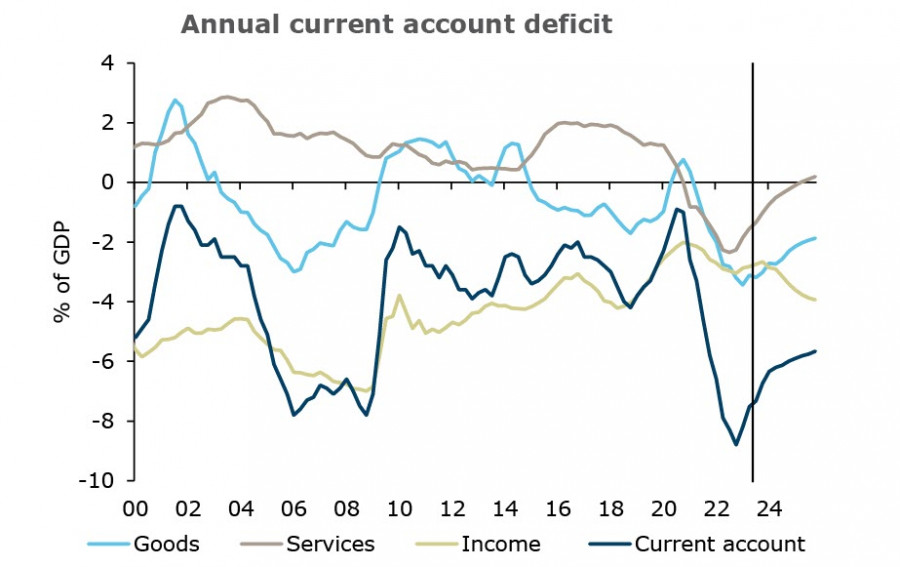

The current account deficit is a weak spot for New Zealand's economy. Tightening monetary and fiscal policies play a significant role in limiting import demand, but export risks are also skewed to the downside. The primary income deficit is increasing, reaching 2.8% of GDP by the end of the second quarter and expected to continue growing. Yield spreads are favoring the dollar, which is weighing on the NZD/USD exchange rate.

The net short NZD position rose by $400 million to -$1.263 billion over the reporting week, and the price is firmly decreasing.

Last week, we took note of a growing probability of a bullish correction, although the long-term trend for NZD/USD remains bearish. The kiwi has stopped declining, but it seems that it hasn't recovered enough. The kiwi failed to reach the previous local high of 0.6009, let alone the mid-channel area of 0.6030/50. We expect the kiwi to resume its downward movement in the near future, with the nearest target being the lower band of the channel at 0.5800/20, though there aren't many reasons for a more significant drop at the moment.

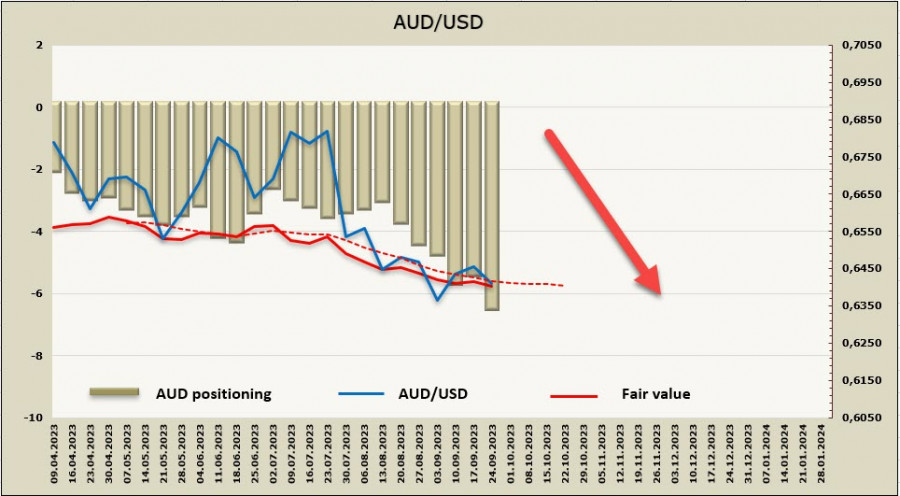

AUD/USD:

The CPI indicator, which will be released on Wednesday, is expected to show an increase in annual inflation from 4.9% to 5.2%, with fuel prices being the key driver of growth. The NAB Bank forecasts inflation to reach 1.1% in the third quarter, which is higher than the Reserve Bank of Australia's projection of 0.9%. Of course, the monthly index, even if it increases to the projected 5.2% year-on-year, will not provide a complete picture, but it can support the aussie until the release of the full Consumer Price Index on October 25th.

The sharp increase in average wages poses a risk in driving inflation higher, but there are other factors that can offset this such as overall labor market weakness and a slowdown in consumption growth. Overall, the picture is more or less in line with the RBA's objectives – inflation, albeit slowly, is decreasing.

However, market forecasts suggest another rate hike by the end of the year. High interest rates contribute to economic slowdown and also reduces household real incomes, which is necessary to combat high inflation. The AUD exchange rate will remain under pressure until the RBA's rate hike cycle ends, and there are very few reasons that could support a bullish pivot.

Investors have increasingly turned bearish on the AUD. The net short AUD position rose by $1.146 billion to -$6.257 billion over the reporting week, and the price remains below the long-term average and is headed downwards.

We believe that the consolidation period just above the lower band of the channel is coming to an end. The nearest target is the local low of 0.6358, and succeeding targets are 0.6280/6300. The factors supporting commodity currencies are not strong enough to counter the rise in U.S. yields against the backdrop of economic stability, creating conditions for the dollar's broad strength across the currency market.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/mz8d9Q2

via IFTTT