The CFTC report published on Friday showed that long-term investors are bullish on the dollar. The weekly change was +3.6 billion, and the net short dollar position decreased to -6.9 billion. Among the major world currencies, only the yen has refrained from selling off, while all other currencies saw weekly changes in favor of the dollar.

The US inflation data for August will be published on Wednesday. Rising oil prices may lead to a 0.5% m/m increase in overall inflation, which could fuel another Federal Reserve interest rate hike. However, slowing wage growth could have a positive impact on consumer price growth in the services sector. At the moment, the markets are convinced that the Fed will take a break at the next meeting, the likelihood of a rate hike is only 7%, and the key meeting in this cycle will be in November, which is still far off.

We believe that the US dollar is still the main favorite of the foreign exchange market, and investors will continue to buy because the market is convinced of the strength of the US economy. Although the greenback retreated from its previous highs on Monday, the other currencies look weaker. A possible rate hike by the European Central Bank is unlikely to strengthen the euro's position because weak economic data reduce the chances of decisive action by the ECB, and any sign of weakness on the part of the bank will be perceived by markets as another confirmation of the dollar's strength.

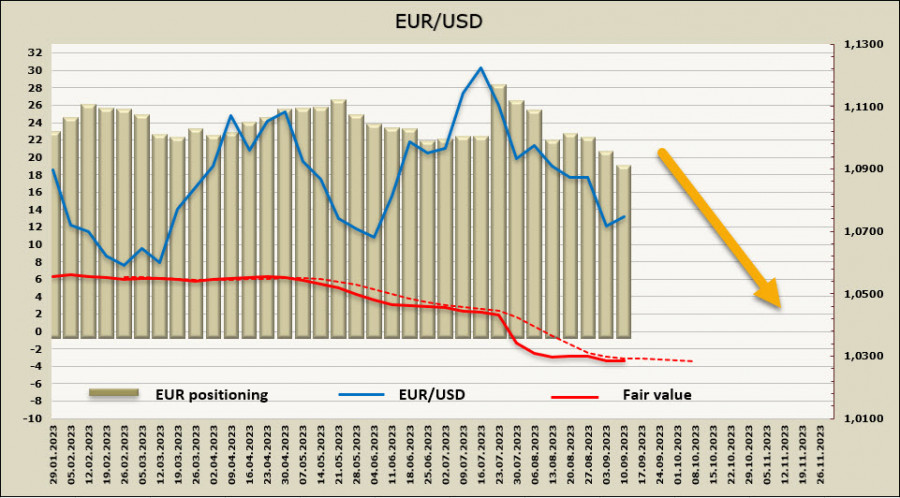

EUR/USD

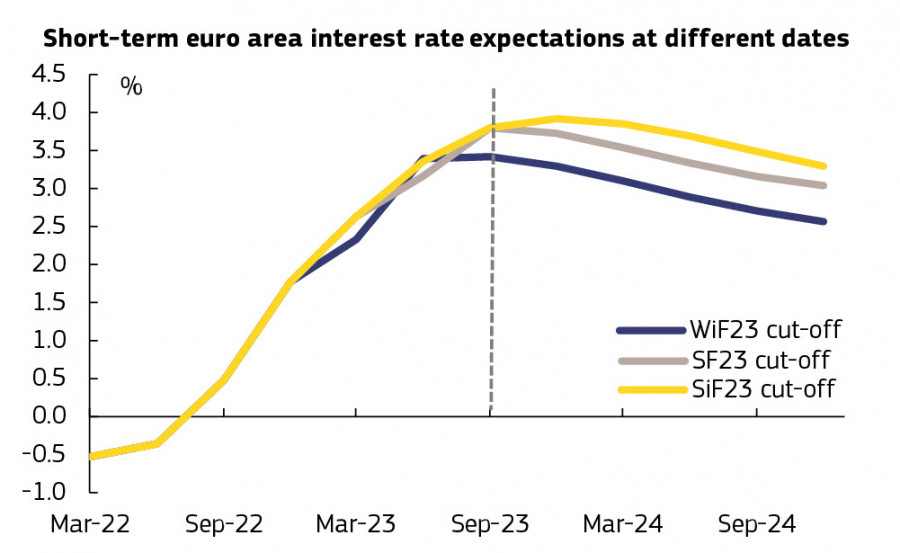

The ECB will hold its meeting on Thursday, where a final rate hike of 0.25% is expected. The markets still do not have a consensus on whether this hike will happen next Thursday or if the ECB will take a pause until the next meeting.

The high wage growth rates in the eurozone favor a rate hike. In the second quarter, wage growth was 5.6% y/y, even higher than the 5.4% in the previous quarter and exceeding the ECB's estimate of 5.3%, which was presented in June. Accordingly, the threat to core inflation remains high, and it is expected to fall to 3% in the second half of 2024.

ECB officials are sending mixed signals, and there is no unified position. Some hint at the need to take a pause, while others focus on high core inflation and urge not to stop. The European Commission has lowered its economic growth forecast for the eurozone by 0.3% for 2023 and 2024 to 0.8% and 1.4%, respectively. The inflation forecast for the current year has been reduced to 5.6%, but it has been raised to 2.9% for the following year. The European Commission believes that the ECB will raise rates by 0.25% on Thursday, claiming that the market is leaning toward this opinion.

The European Commission holds a pessimistic view of the prospects for eurozone economic growth, which does not contribute to euro demand.

The value of the net long euro position fell by 1.6 billion to 18.2 billion during the reporting week. Net positioning continues to be bullish, and the trend favors selling the euro. The price is below the long-term average, which supports further euro depreciation, but the dynamics are neutral.

EUR/USD, as we suggested a week ago, broke below the lower band of the channel at 1.0764 and headed towards the local low of 1.0634. Traders will likely test the low; the question is whether the euro will break this support on the first attempt, or if a second wave will be needed. In case the euro continues to correct higher, we can expect a retracement to the resistance zone of 1.0790/0810. We consider this scenario less likely, as we believe that the euro will fall further, with the support zone of 1.0605/35 as the target.

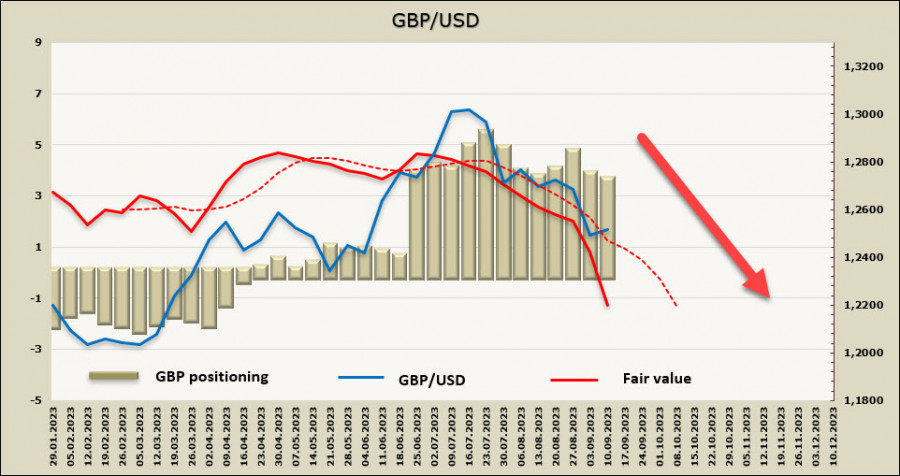

GBP/USD

The pound has slightly recovered from its decline following hawkish comments from the Bank of England. Speaking in Canada, Monetary Policy Committee member Catherine Mann signaled she's likely to support further rate hikes as she sees persistent inflation harder to fight than a downturn. She also said it is a "risky bet", but it's better to make a mistake that can be corrected later, and this implies a call for further rate hikes.

The labor market report for August was set to be published on Tuesday, with investors focused on the average earnings growth rate. It is expected that the 3-month measure will remain at 7.8%. Any deviation from the forecast could change rate expectations, potentially leading to increased volatility for the pound.

The value of the net long pound position fell by 0.2 billion to 3.6 billion during the reporting week. Despite a fairly deep sell-off in recent weeks, net positioning continues to be bullish, which does not prevent the price from falling.

As expected, the pound successfully tested the support at 1.2545. There are almost no reasons for an upward reversal, and any potential corrective rise is limited by the resistance zone of 1.2545/65. We expect the bearish sentiment to persist. The goal is an update of the local low and a move below 1.2440, with the next target being 1.2290/2310. Here, the pound may find strong support. From a technical perspective, falling below this area would suggest the end of the long-term uptrend.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/MohkxsJ

via IFTTT