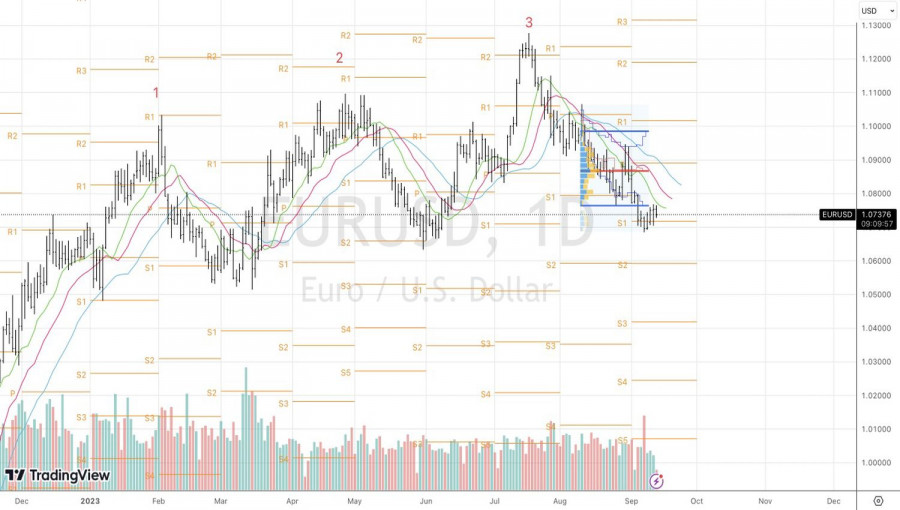

Europe continues to receive bad news, but the market is becoming increasingly convinced of the ECB's readiness to raise the deposit rate to 4% as early as September. This sets a positive tone for EUR/USD and allows the pair to remain above the 1.072 red line. The bulls are ready for an attack, but first, they need to pass the test of the release of U.S. inflation data for August.

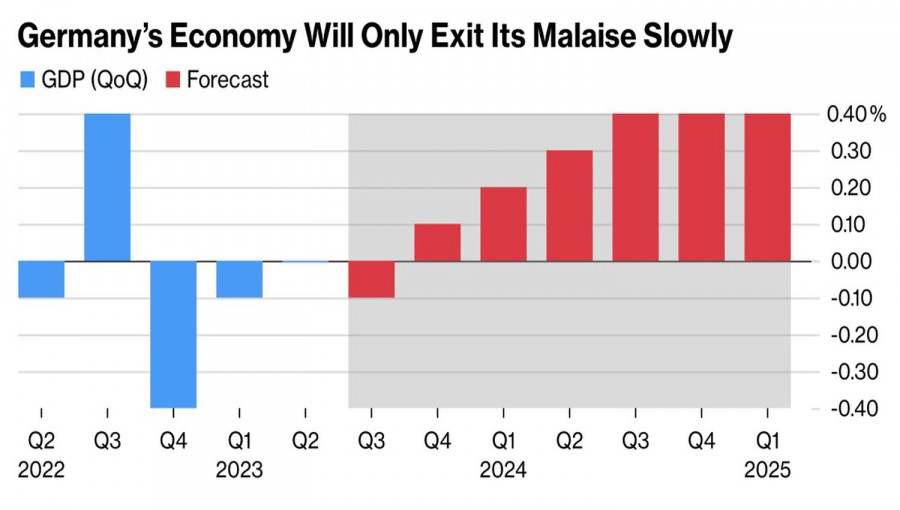

According to Bloomberg's insider information, the German government will lower its GDP growth forecast to -0.3% in 2023. This will align its assessment of the German economy with the views of the IMF and the European Commission. The International Monetary Fund believes that Germany's Gross Domestic Product (GDP) will decline by 0.3% this year. The European Commission looks even more pessimistic with its estimate at -0.4%.

Germany's Economic Performance

The leading economy of the eurozone is dragging down the entire currency block. In July, industrial production in Germany decreased by 1.1%, worse than what Bloomberg experts had predicted. As a result, the indicator lost all its second-quarter gains. The economy appears very weak, but the ECB is likely to turn a blind eye to this in September.

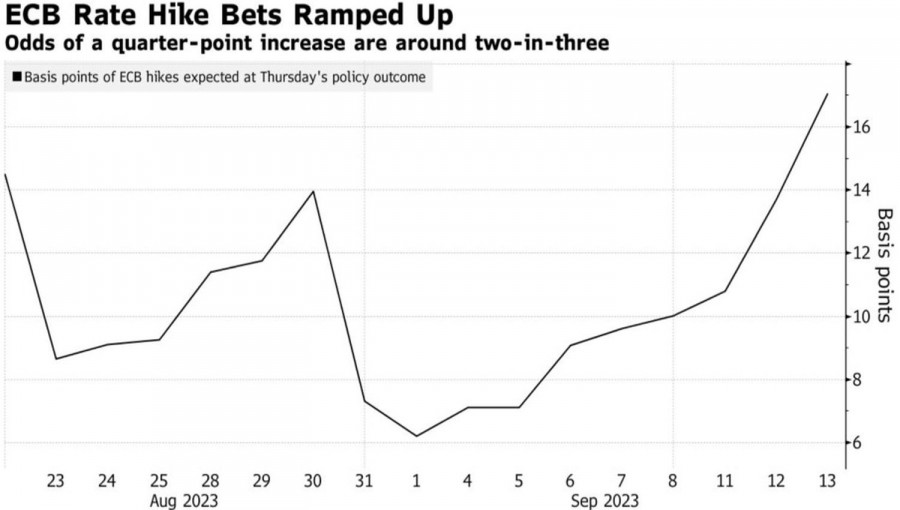

Markets have fundamentally changed their opinion on the verdict of the Governing Council. Just at the beginning of autumn, they were giving only a 20% probability of a 25 bps deposit rate hike to 4% at the September 14 meeting. On the eve of the meeting, this figure increased to 68%, partly due to hawkish comments from European Central Bank Governing Council member Klaas Knot. Knot stated that investors underestimated the chances of tightening the ECB's monetary policy.

Dynamics of the expected ECB rate change in September

The continuation of the monetary restriction cycle outweighs the factor of the eurozone's economic weakness and inspires EUR/USD bulls to attack. However, euro buyers are not rushing events, fearing unpleasant surprises from U.S. inflation. Bloomberg experts predict a slowdown in the core inflation indicator in August from 4.7% to 4.3%, which is bad news for the U.S. dollar.

If the actual data matches these numbers or falls even lower, the chances of a federal funds rate hike to 5.75% in 2023 will drop from the current 45%. This will lead to a drop in yields on Treasury bonds and push U.S. stock indices up. As a result, global risk appetite will improve, and the safe-haven asset like the U.S. dollar will come under selling pressure.

Therefore, EUR/USD bulls are waiting for a signal to start their attack. It can come from both U.S. inflation data and the ECB. However, in both cases, unpleasant surprises are possible.

Technically, on the daily chart of EUR/USD, there was a rebound from the lower boundary of the fair value range of 1.0765-1.098. This indicates the weakness of the bulls and allows selling the pair on a break below the support levels at 1.071 and 1.069. Buying the euro makes sense if it returns to $1.0765 with a subsequent successful breach of this level.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/URb3IM5

via IFTTT