Analysis of Wednesday trades

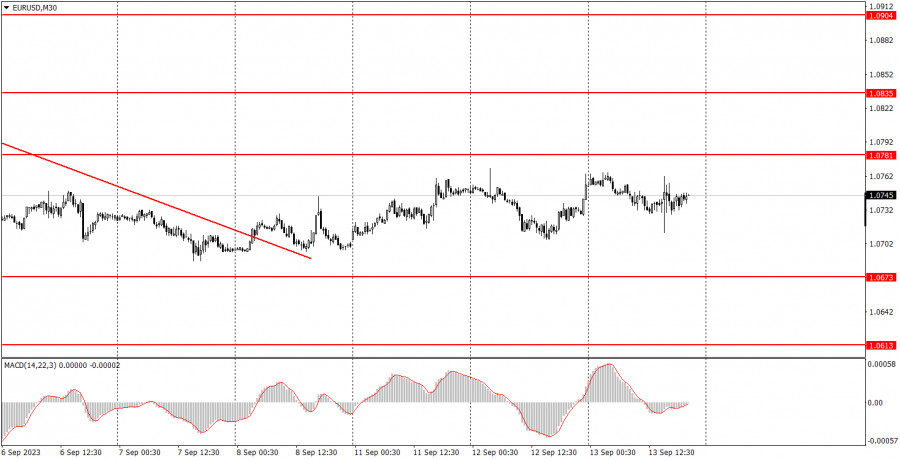

EUR/USD 30M chart

The EUR/USD currency pair continued its lackluster and chaotic movement on Wednesday, similar to recent days. Despite the release of a crucial U.S. inflation report, volatility remained at 53 pips. Essentially, there's little to discuss. The pair is trying hard to adjust upwards, but it is struggling. Traders see no compelling reason to buy the euro. A resumption of the euro's decline seems inevitable given the current conditions.

The U.S. inflation data was unusually mixed. Core inflation rose to 3.7%, surpassing expectations, while the base rate dropped to 4.3%, in line with forecasts. The market struggled to interpret this conflicting data, resulting in no discernible rise or fall of the currency pair. How the Federal Reserve might respond to this report remains unclear, given the simultaneous rise and drop in inflation rates.

EUR/USD 5M chart

On the 5-minute chart on Wednesday, the market movement was quite telling. Throughout the day, the pair consistently traded around the 1.0733 level, revisiting it approximately ten times. Any bounce from this level might have been an invitation to open long positions. However, it was only after the inflation report's release that the price managed to ascend by 17 points. This was a crucial period when beginners should have stayed on the sidelines, as the market's movements could have been erratic. In the end, while beginners might have entered into long positions, they neither encountered losses nor gained profits.

Trading ideas on Thursday:

On the 30-minute chart, minimal correction persists. Despite breaching the trend line, the European currency still lacks robust bullish indicators. In the medium term, we anticipate the euro's further decline against any macroeconomic and fundamental backdrop. However, given this week's strong economic indicators, a slight upward correction is plausible. On the 5-minute chart tomorrow, the key levels are 1.0517-1.0533, 1.0607-1.0613, 1.0673, 1.0733, 1.0767-1.0781, 1.0835, 1.0871, 1.0901-1.0904, 1.0936, and 1.0971-1.0981. If the market moves 15 points in the predicted direction, consider adjusting the Stop Loss to a break-even position. Key events for Thursday in the EU include the European Central Bank (ECB) meeting announcement and a press conference with Christine Lagarde. In the U.S., we await the release of the producer price index, retail sales, and unemployment claims. Given the significance of these events, we're hopeful for a volatility exceeding 50 points tomorrow.

Basic rules of a trading system:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, post which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trend line or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/MYBr7gH

via IFTTT