New – is the well-forgotten old. Determination was in style when central banks raised rates. Their currencies received support from it. The slowdown in inflation would seem to make central banks more cautious. They seemed to think they could sit back and relax. But by the end of 2023, determination may come back into style. Financial markets demand that the European Central Bank loosen its monetary policy as soon as possible. If ECB President Christine Lagarde and her colleagues respond, EUR/USD will take a low blow.

When inflation slows down faster than expected, you inevitably wonder whether interest rates should fall faster too. The US Personal Consumption Expenditure Index has plummeted to 3%, consumer prices in the eurozone to 2.4%, and in Germany, even to 2.3%.

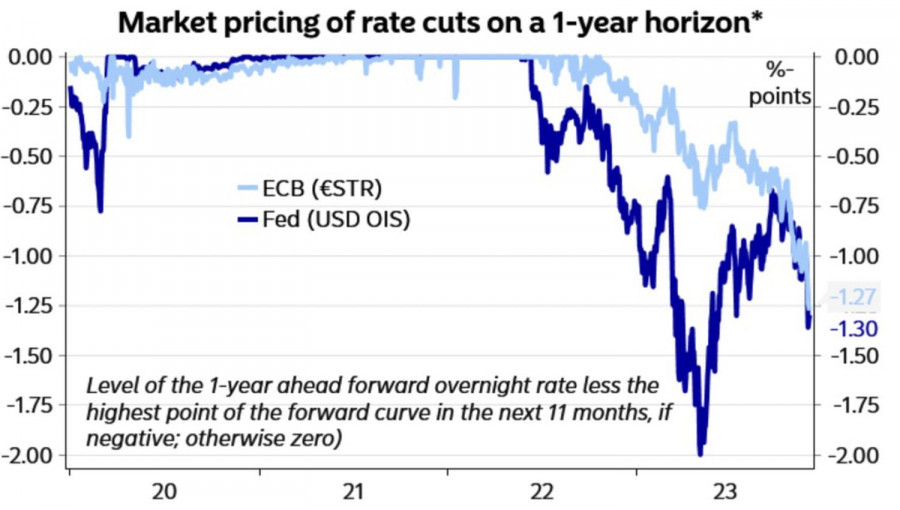

All this is happening against the backdrop of a barely standing economy of the currency bloc. France's GDP unexpectedly contracted in the third quarter, and Germany was hit by the Constitutional Court's decision on the illegality of the government's use of special funds. Now Berlin is forced to figure out how to plug the hole in the budget, which risks seriously slowing GDP in 2024-2025. It's not surprising that markets are factoring in expectations of a 125 bps deposit rate cut by the ECB next year.

Market expectations for the Fed and ECB interest rates

It's surprising that similar forecasts are being made for the Federal Reserve. Inflation in the United States is decreasing more slowly than in the eurozone, due to significant fiscal stimuli during the pandemic, a stronger labor market, and less impact from the energy crisis. The U.S. economy looks significantly stronger than the European one. In the third quarter, it expanded by 5.2%. In the fourth, the leading indicator from the Fed Bank of Atlanta signals growth of 2.1%. This is significantly higher than the Bloomberg expert consensus estimate of 0.9%.

Bulls on EUR/USD seized on Christopher Waller's comments about a possible rate cut if the deflationary process continues at the same pace. However, in a strong economy, the chances of such an outcome are lower than in a weak one. Moreover, the subsequent speech by New York Fed President John Williams about the prolonged maintenance of borrowing costs on a plateau indicates that not everyone agrees with this.

In the end, no one has canceled financial conditions. The fact that they are getting weaker complicates the Fed's fight against inflation. Fed Chair Jerome Powell will have an excellent opportunity to corner the markets. A dip in stock markets will push EUR/USD even lower.

US and eurozone financial conditions

On the other hand, the Fed's decisions will still depend on incoming data. And reports on US employment for November are of much greater interest to investors than FOMC officials' assumptions.

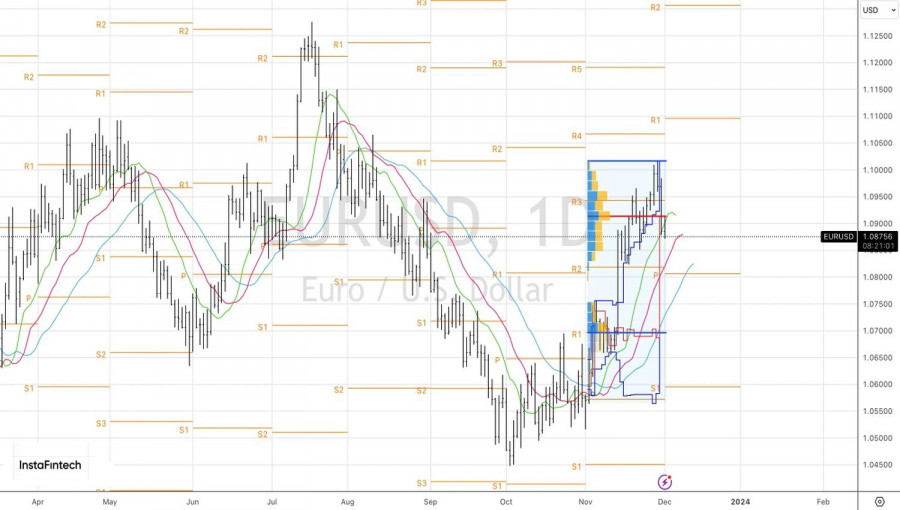

Technically, returning below the fair value at 1.0915 is a bearish sign. If buyers fail to bring the pair back above this level in the next few days, EUR/USD may continue to fall towards 1.08. We maintain the shorts formed from 1.094.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/yIlOHLv

via IFTTT