Demand for the U.S. currency has slightly increased at the end of the week. However, there are a few factors that still play against the greenback. First, the pound sterling has remained near its peak values, only slightly retreating on Thursday. The euro fell more, which can be explained by the eurozone inflation report. It turns out that the dollar has strengthened its positions slightly at the end of the week, but globally, it does not have a significant impact. Corrective waves 2 or b for both instruments were supposed to complete their formation a couple of weeks ago. At least, that's what I expected, as there were few reasons for the market to continue buying euros and pounds. There's nothing terrible about the fact that waves 2 or b are getting more complicated; these waves can have a length of up to 100% of the first wave. But still, it would be very desirable to avoid another extension.

On Friday, Federal Reserve Chairman Jerome Powell gave a speech. At a time when the Fed cannot decide whether to raise interest rates again, it was difficult to expect an answer to this question from Powell. The Fed is in confusion and contemplation. None of the FOMC members wants to make a mistake and raise the rate too high. But at the same time, many FOMC members fear that the current rate may not be enough to bring inflation back to the target level in a timely manner. The inflation indicator itself has been fluctuating in recent months. There is no stability.

The most important thing Powell said is, "It's still too early to talk about easing monetary policy." Powell acknowledged that the central bank has not yet completed the tightening process, fears a new acceleration of inflation, and keeps the option of another rate hike in case inflation gets out of control. However, there was little specificity in Powell's words. He simply indicated to the market that the situation is precarious, and the Fed will continue to make decisions based on incoming data. His speech cannot be considered either hawkish or dovish. Nevertheless, demand for the dollar slightly decreased after his speech.

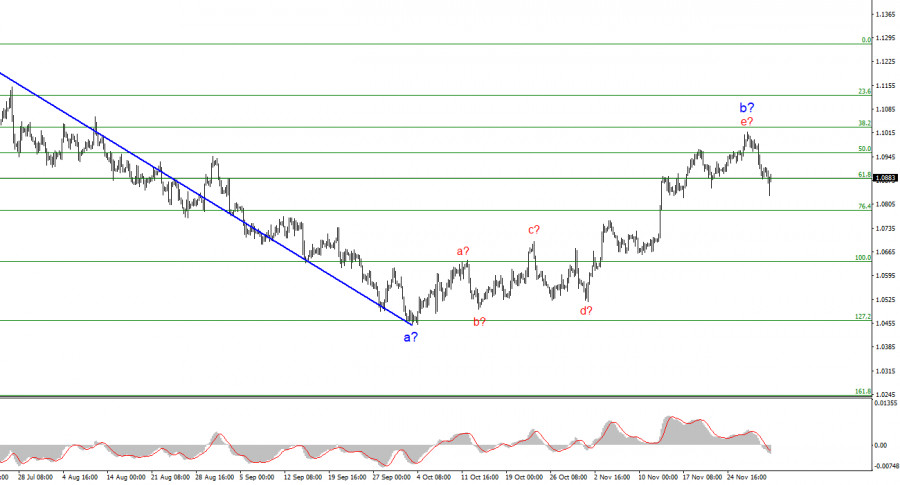

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to breach this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. But be cautious with short positions, as wave 2 or b may take a more extended form. A successful attempt to break the 1.0851 level could signal a decline in the instrument.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend. The most that we can count on is a correction. At this time, I can recommend selling the instrument with targets below the 1.2068 mark because wave 2 or b will eventually end and at any time, and it could happen at any moment. The longer it takes, the stronger the fall. The narrowing triangle is a harbinger to the end of the movement.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/10FismB

via IFTTT