Those times have passed when the Federal Reserve feared repeating the mistakes of its predecessors in the 1970s. Now, the central bank faces a different task: achieving a soft landing for the U.S. economy. According to its opinion, this is more important than returning the PCE to the 2% target. The idea is that as inflation decreases, high interest rates tighten monetary policy and cool the economy. Time will tell how accurate this is. For now, the EUR/USD cannot break above 1.1.

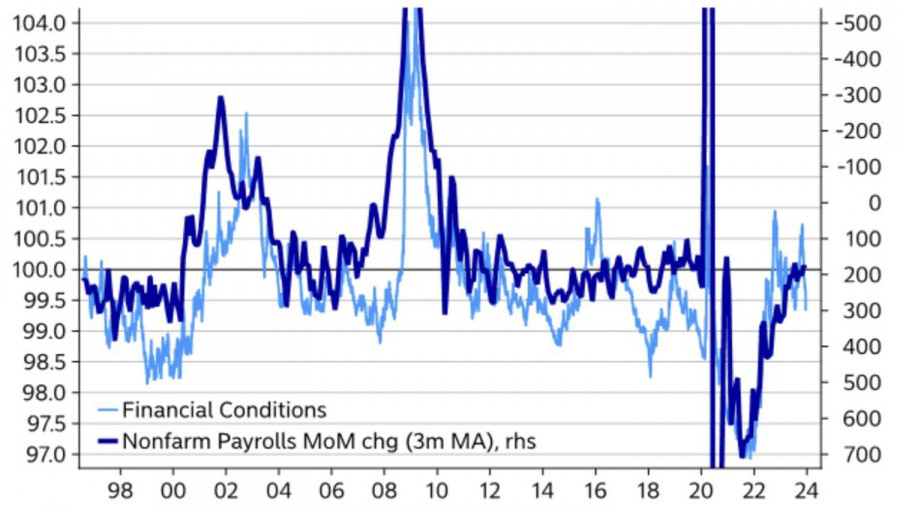

The Federal Reserve suddenly remembered its dual mandate. The central bank began to argue that a balanced approach should be taken to reduce price pressure and not take away jobs from Americans. However, the softer financial conditions are, the higher the probability of increased employment. Moreover, the slowdown in wage growth is due to immigration. Once its pace slows down, wages will accelerate again. Especially considering that strikes are pursuing exactly this goal.

Dynamics of Financial Conditions and Employment in the USA

Thus, if the labor market remains strong in the next few months and wage growth accelerates, it should not be surprising. The Federal Reserve should blame itself for this. Due to its dovish pivot, U.S. stock indices reached historic highs, Treasury bond yields sharply fell, the dollar weakened, and credit spreads narrowed. Financial conditions have become softer, which will undoubtedly have a positive impact on employment.

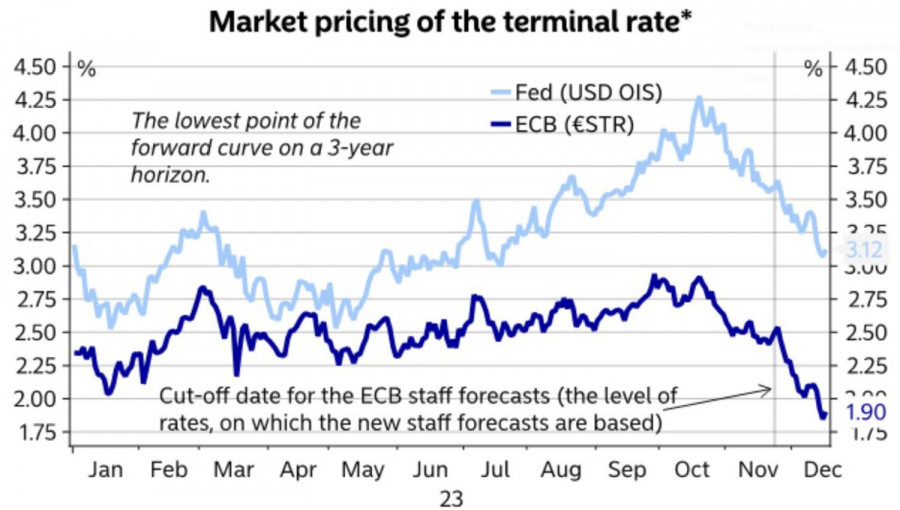

In my opinion, the Federal Reserve made a political mistake. The sooner it realizes this, the sooner it will return to "hawkish" rhetoric. However, until the releases of data on December labor market and inflation, the EUR/USD bulls are unlikely to come down to earth. Derivatives continue to expect a federal funds rate cut to 4% in 2024, putting pressure on the dollar. Moreover, FOMC officials' dovish speeches increased the chances of starting monetary expansion in March from 71% to 81%.

Dynamics of Market Expectations for the Fed and ECB Interest Rates

However, there would be no happiness if the misfortune helped. Bears on the main currency pair can take advantage of changing market sentiment and the inability of the euro to overcome the psychologically important level of $1.1. According to BNP Paribas, this is related to the weakness of the eurozone economy. Stock indices can collapse at any moment because Greed in the market often swaps places with Fear. As soon as bulls feel concerns about open longs, they will start unwinding them, locking in profits. This will end with a pullback of the S&P 500 and EUR/USD.

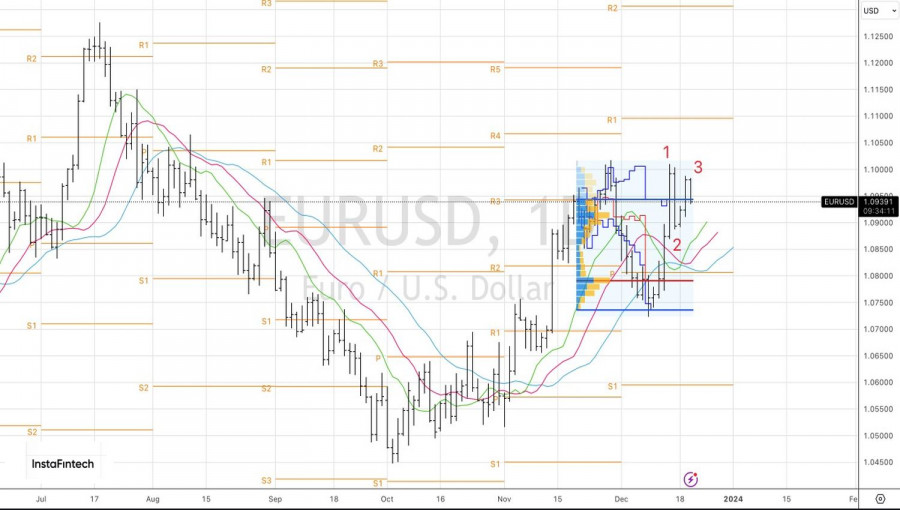

Technically, on the daily chart of the main currency pair, a combination of reversal patterns, Double Top and 1-2-3, has been formed. If bears manage to return EUR/USD quotes to the fair value range of 1.0735-1.0945, the initiative will again be in their hands. Thus, closing below 1.0945 will allow traders to return to selling the euro against the U.S. dollar. A conservative strategy involves opening short positions on a breakdown of support at 1.089.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/rCozv8N

via IFTTT