"When the facts change, I change my mind. What do you do, sir?" That's how European Central Bank board member Isabel Schnabel responded to Reuters when asked why she talked about raising deposit rates just a month ago, but now deems the resumption of the ECB's monetary policy tightening cycle an extremely unlikely event. After the hawkish comments, the yield on German 10-year bonds dropped to 2.28%, the lowest level since July. The futures market began predicting a 150 bps reduction in borrowing costs in 2024, and the EUR/USD tested the 1.08 level.

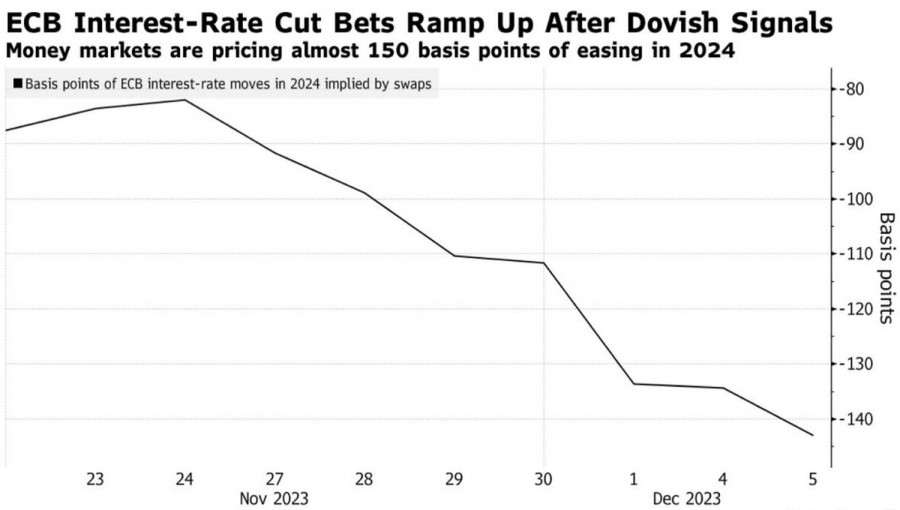

Dynamics of market expectations for the ECB deposit rate

When centrist Francois Villeroy de Galhau mentioned the end of the monetary tightening cycle, the EUR/USD bulls came back down to earth. Now, with a hawk like Schnabel echoing him, the risks of the euro falling to $1.07 and below are growing rapidly. Just three weeks ago, the chances of easing the ECB's monetary policy in the first quarter were zero, and derivatives signaled a 75 bps deposit rate cut in 2024. Now they are confident that the process will start in March, and borrowing costs will drop by 150 bps to 2.5%.

On the contrary, regarding the timing and magnitude of the Fed's monetary expansion, investors have begun to have doubts. The stock market euphoria in November was more associated with expectations of a significant easing of monetary policy. Now, on Forex, you can often hear the opinion that the S&P 500 rally has gone too far.

Dynamics of the S&P 500 and market expectations for the Fed rate

The report on U.S. non-farm payrolls for November should become an indicator of market sentiment. Bloomberg experts forecast job growth of 200,000. If this happens, there will be no need to talk about a slowdown in the U.S. economy. The Fed will have a strong reason to stick to the plan of keeping borrowing costs flat at 5.5%, raising the yield on Treasury bonds, damaging stock indices and global risk appetite, and allowing the USD index to rise from the ashes.

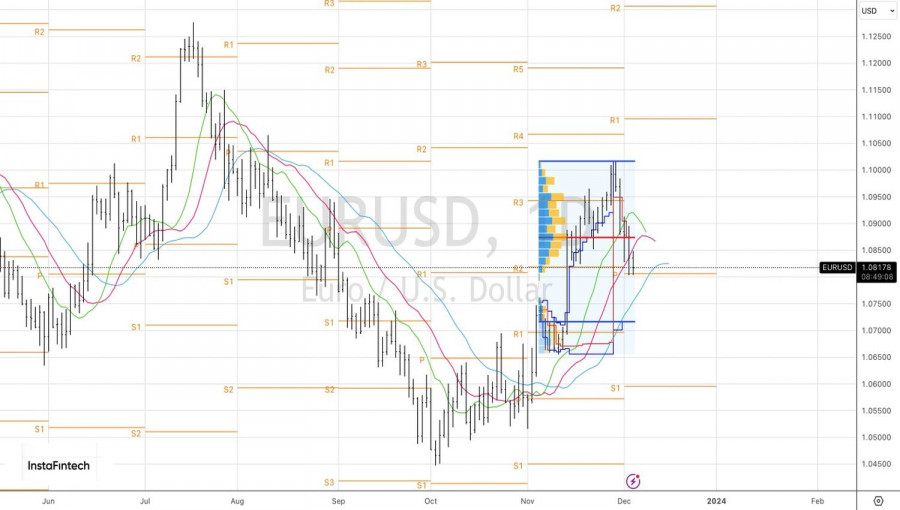

Thus, the pressure on the euro is exerted by the increasing probability of the ECB's early dovish pivot, expected scales of monetary expansion, and the readiness of the U.S. stock market to undergo a correction in case of positive data on U.S. non-farm payrolls. These factors reduce the chances of consolidating the main currency pair in the trading range and increase the likelihood of its decline towards 1.07, and possibly 1.06.

Technically, on the daily chart, the inability of the main currency pair to hold above the fair value of 1.0875 indicates the weakness of the bulls. A breakdown of support at 1.0805–1.0815 will allow increasing the short positions in the euro against the U.S. dollar, formed from the level of 1.094. The pivot levels at 1.0715 and 1.065 serve as targets for the downward movement.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/jw18nIg

via IFTTT