US stock markets were down on Monday due to the tech sector downturn, and gold prices also retreated from their highs, while yields rose. Oil is also under pressure as OPEC+ failed to convince markets of their readiness to cut production volumes, and the prospect of falling demand is becoming increasingly clear.

On Tuesday, the market was set to focus on the U.S. ISM Non-Manufacturing PMI and JOLTS Job Openings, which showed high resilience amid the significant tightening of the Federal Reserve 's monetary policy. If both indicators show a slowdown, it will increase the chances that the Fed will start cutting rates sooner rather than later, and this could mount pressure on the dollar.

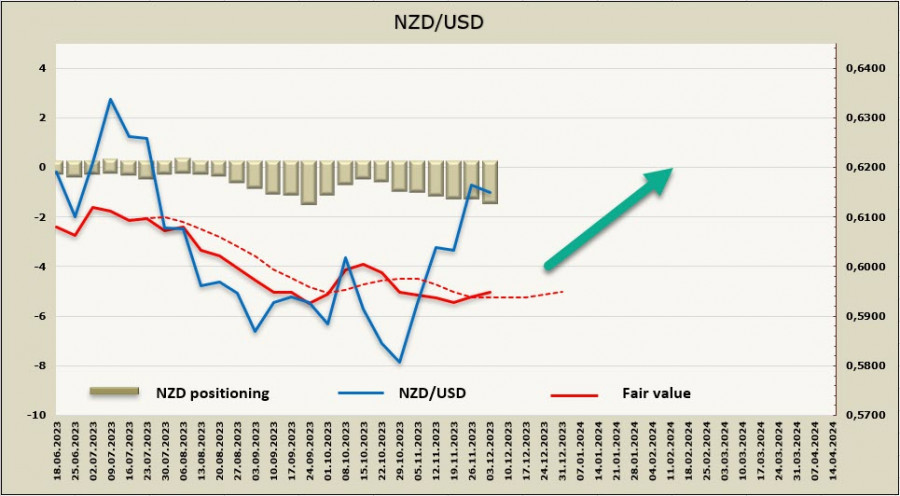

NZD/USD

As expected, the Reserve Bank of New Zealand left the Official Cash Rate (OCR) unchanged at 5.50%. However, to the surprise of the market, it raised the rate forecast from 5.59% to 5.69% and shifted the expected date for the start of the rate-cutting cycle to the first half of 2025. Some RBNZ officials pointed to a low tolerance for inflation, stating that it will take more time than previously forecasted to return to the target range of 1-3%.

In the long-term perspective, such a decision is favorable for kiwi bulls, as it implies a shift in yield differentials in favor of NZD throughout 2024, starting from the date of the first rate cut by the Fed, which the market is already expecting in March.

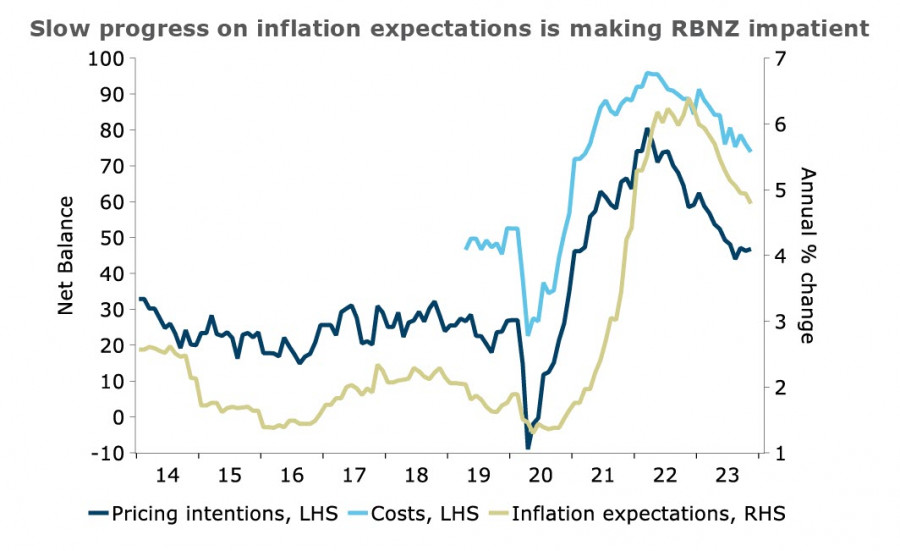

The ANZBO general inflation indicator continues to head downwards, but the movement is very slow, and the RBNZ has stated its readiness to continue hiking if progress in reducing inflation is insufficient.

In the end, for a sustainable decline in inflation, it is necessary to cool the labor market to create conditions for slowing wage growth, a trend that is stable but still clearly insufficient. Accordingly, the possibility of further rate hikes remains.

The net short NZD position increased by 184 million to -1.2 billion over the reporting week, bearish positioning, which is somewhat surprising against the backdrop of reduced expectations for the US dollar. Nevertheless, the price is trying to move up following general market trends.

The kiwi found resistance at the upper band of the 0.6210/30 channel, as we assumed in the previous review, but failed to overcome this area. The nearest support is at 0.6054, followed by the middle of the channel at 0.5950/70, but there's a low chance that the pair will fall to it. A more likely scenario is consolidation at current levels with another attempt to break above the channel's boundary. If successful, the next target will shift towards the local high at 0.6409.

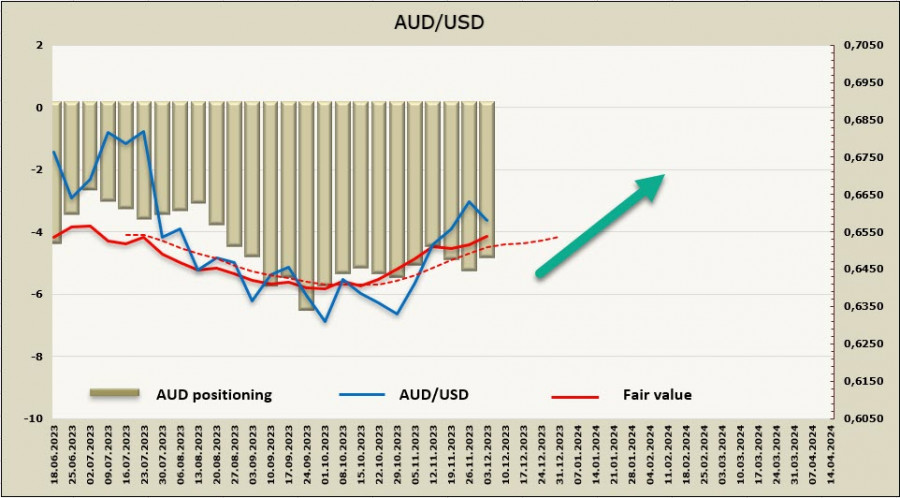

AUD/USD

As expected, the Reserve Bank of Australia left the interest rate unchanged at 4.35%. However, it is too early to say that the rate hike cycle is complete. Markets see the possibility of another increase in February, as internal price pressure remains strong. As noted in the accompanying statement, "...progress in bringing inflation back to the target range of 2 to 3 percent was looking slower than earlier forecast."

Until the end of the week, the aussie may trade with increased volatility as GDP data for the third quarter and the trade balance will be published. The unstable situation with risk demand will exert pressure on the AUD, while the US dollar's broad weakness provides support. It's currently uncertain which of the two trends will prove stronger.

The net short AUD position decreased by 376 million to 4.735 billion. Despite the ongoing decrease in the volume of short positions for 10 weeks, it is happening gradually, and the bearish bias remains intact. The current upward movement is considered corrective. The price, after some consideration, is again moving upward, making it possible for us to expect further growth.

AUD/USD failed to overcome the resistance area of 0.6690/6710 against the backdrop of a somewhat disappointing RBA decision. However, there is potential for further growth. It is assumed that the pair will not breach the support at 0.6525, and the corrective pullback to the downwside will end above this level. Afterward, another attempt to set a new high is expected. The target is 0.6690/6710, and if successful, the next target is 0.6890/6900.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/pUTGmC7

via IFTTT