Forecast :

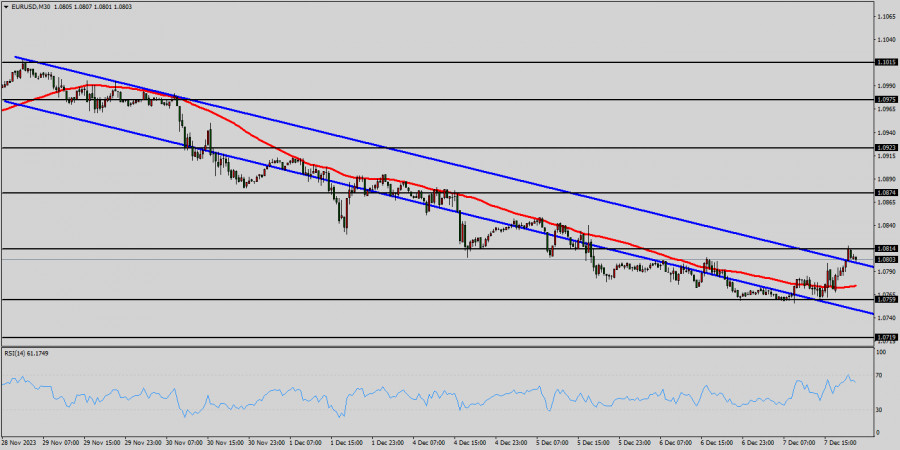

The EUR/USD pair has broken below its 100 EMA at 1.0814, which, combined with the RSI below 60, keeps sellers optimistic about further losses.

Sellers need to break below support at 1.0759, the December low to extend the bearish move towards 1.0719, the 50 Ema, and the lower band of the rising channel to bring 1.0700 into target.

The EUR/USD pair gained traction and rose toward 1.0820 in the American session on Thursday, reaching two-day highs. The US Dollar stays on the back foot and helps the pair push higher amid lower Treasury yields, ahead of Friday's NFP (tomorrow).

Intraday bias in the EUR/USD pair stays on the downside for the moment, as fall from 1.0814 short term top is in progress. Sustained break of 100 EMA (now at 1.0800) will pave the way to retest 1.0759 support.

Signal :

Sell below the first resistance of 1.0814 with the targets of 1.0759, 1.0719 and 1.0700. On the upside, above 1.0814 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 1.0814 resistance holds, in case of recovery.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/tSQBUrh

via IFTTT