Over the past two years, there have been many false dawns in the financial markets, with Deutsche Bank counting as many as six instances. When investors accustomed to cheap money bet on a dovish pivot by the Federal Reserve, they were repeatedly forced to endure losses. However, this time, everything seems to be going according to plan. There is plenty of evidence that the Federal Reserve will start lowering interest rates in 2024. Nevertheless, this doesn't help the bulls for EUR/USD.

The problem is that Europe has decided to take the initiative. Usually, central banks move in a pack, led by the Federal Reserve. But the rapid slowdown in inflation in the eurozone and the weakness of its economy force the ECB to outpace the leader. The Federal Reserve, with its strong economy, can afford to sit on the sidelines. The European Central Bank cannot. The deposit rate needs to be lowered. Even the head of the Bank of France, Francois Villeroy de Galhau, stated that the issue of easing monetary policy would be on the Governing Council's agenda in 2024.

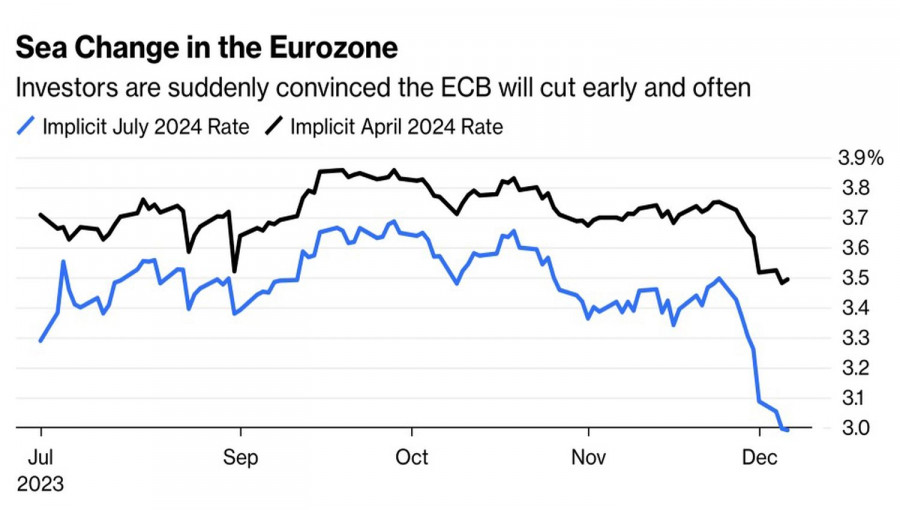

The futures market predicts that the first act of ECB monetary expansion will take place either in March or April, and the deposit rate will fall by 150 basis points to 2.5% by the end of next year. Reuters experts consider these estimates too aggressive. Specialists place bets at 100 basis points, in increments of 25 each quarter.

Dynamics of Market Forecasts for the ECB Rate

The current spike in inflation is unique. It is driven by fiscal stimulus and supply shocks. The decline in prices in European economies, most affected by the armed conflict in Ukraine and the associated energy crisis, proves this. The fact that gas storage facilities are filled to 98.6% in Spain, 94% in Germany, 93.3% in France, and 92.4% in Italy, with low demand, indicates that prices may drop from the current €39 per megawatt-hour to €32. Inflation will continue to slow down, and the specter of deflation will loom over the eurozone.

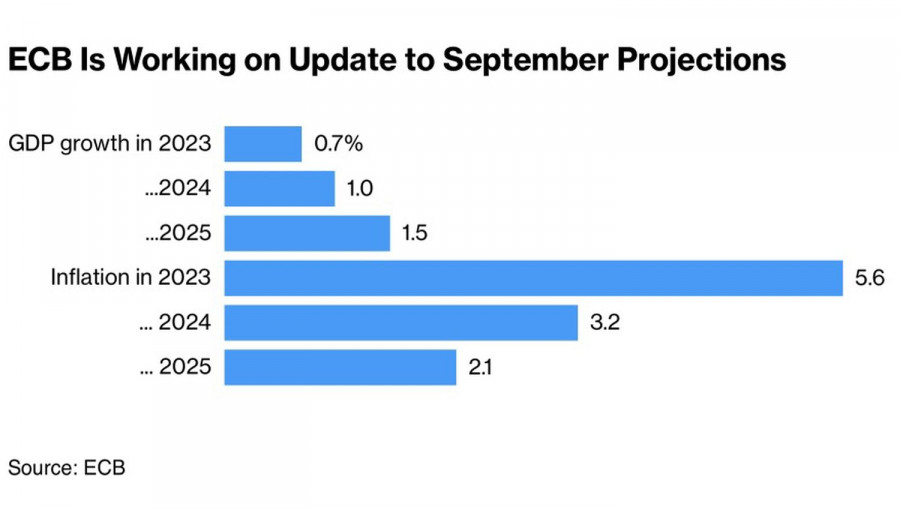

An important point is that goods prices in the eurozone have been falling for the past three months, while service inflation has already returned to the 2% target. In the ECB's latest forecasts, it is stated that CPI will reach the target only in 2025. However, December's estimate may significantly drop below. It may show inflation at the 2% level as early as 2024.

ECB Forecasts for Inflation and GDP

Thus, pressure on EUR/USD is created by two factors. Firstly, the ECB may be a pioneer on the road to monetary expansion, which is bad for the euro. Secondly, markets understand that they have rushed ahead of themselves. A drop in stock indices will increase demand for the U.S. dollar as a safe-haven asset. However, if the November U.S. employment statistics disappoint significantly, the markets will feel vindicated, and the USD index will weaken.

Technically, on the daily chart, EUR/USD is attempting a bullish counterattack to bring the pair's quotes back into the trading range of 1.08–1.1. If successful, the idea of consolidation with euro purchases from the lower boundary of the trading channel will become relevant. If not, rebound from 1.08 will allow for an increase in short positions.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/4JUxPu2

via IFTTT