When it comes time to slow down, the driver doesn't necessarily have to inform their passengers. Slowing inflation and cooling labor markets are pushing central banks to ease monetary policy. However, they are not in a hurry to talk about it, fearing that the markets will hinder them from reaching the inflation target due to weakened financial conditions. The expectation that the Bank of England will lower rates more slowly than the Federal Reserve leaves hopes for a recovery in the GBP/USD upward trend.

After the growth of U.S. employment by 199,000, a decrease in unemployment to 3.7%, and an acceleration of wage growth to 0.4% MoM in November, it seemed that the U.S. dollar should show its competitors where the wintering grounds are. The rally in Treasury yields and the reduced probability of easing Federal Reserve monetary policy in March from 70% to 44% created a favorable environment for the GBPUSD peak. In reality, it's not that simple. Due to the rise in U.S. stock indices, the pair managed to climb back above 1.255.

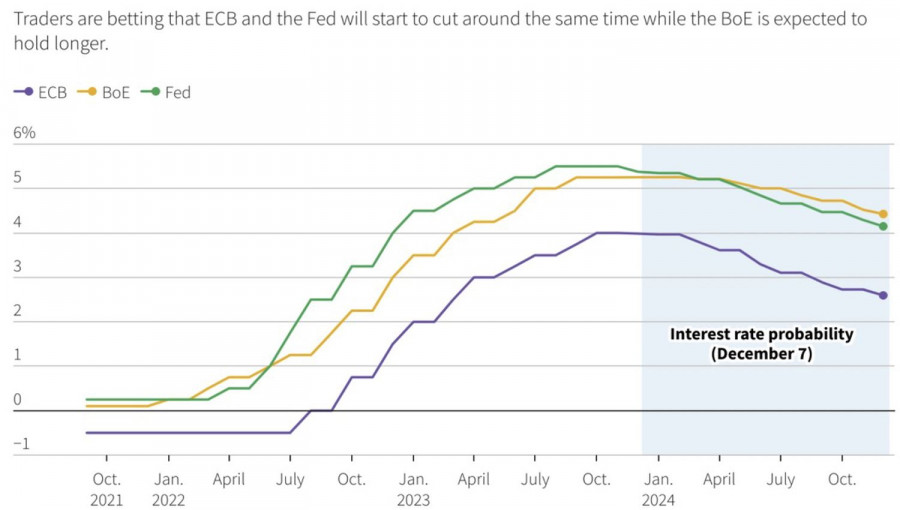

Central Bank Interest Rate Dynamics

The reasons for the pound's stability should be sought in lower expectations of a repo rate cut than the federal funds rate in 2024, as well as in market greed. Investors are confident that the Federal Reserve will ease monetary policy next year, even if the U.S. economy experiences a soft landing. The logic is, if inflation has reached the 2% target, why keep the cost of borrowing so high?

Investors believe that the Federal Reserve will take four steps towards monetary expansion next year, resulting in a 100 bps drop in the federal funds rate to 4.5%. For the Bank of England, these figures look like 75 bps and 4.5%. The British regulator's slowness is excellent news for GBP/USD.

The reasons for such estimates should be found in the slower inflation slowdown in the UK than in the U.S. Consumer prices in Britain fell by 4.6%, while in the United States, it was 3.2%. The 6.6% inflation in services does not allow the Bank of England to consider easing monetary policy. At the same time, the wage growth rate of 7.7% is significantly higher than that in the United States, theoretically heating up the CPI. In August–October, Bloomberg experts forecast a slowdown in the indicator to 7.4%. However, it will continue to grow faster than inflation, boosting people's purchasing power and promoting the acceleration of both the economy and prices.

Thus, the Bank of England can be envied. It doesn't have to fight the financial markets as hard as the Federal Reserve and the ECB do. Maintaining the repo rate at a plateau is the most likely scenario. And the markets are buying into this mantra, unlike the similar mantra of the Federal Reserve, which is selling very sluggishly.

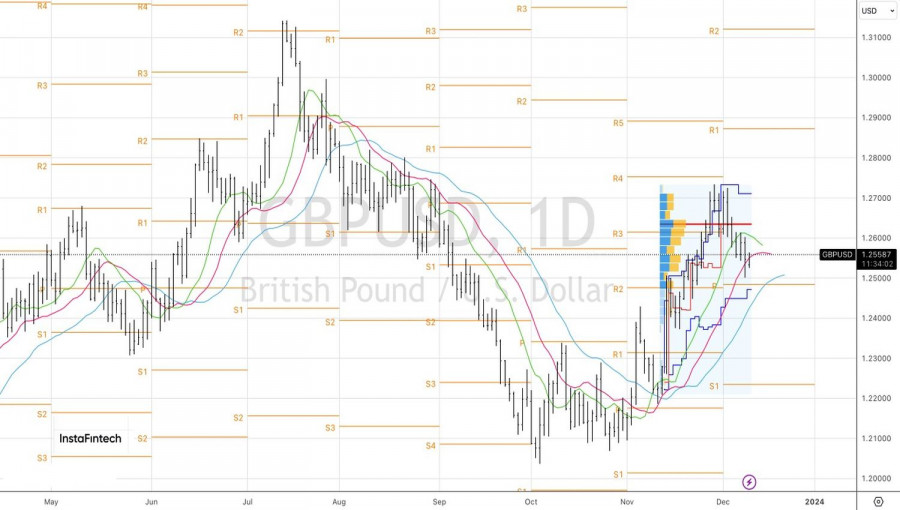

Technically, on the GBP/USD daily chart, for the bulls to restore the upward trend, they need to storm the resistance at 1.2615. Here is both the pivot level and the moving average. A successful test is a reason to buy. On the contrary, selling the pair should be considered if it falls below 1.253.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/9STY7q8

via IFTTT