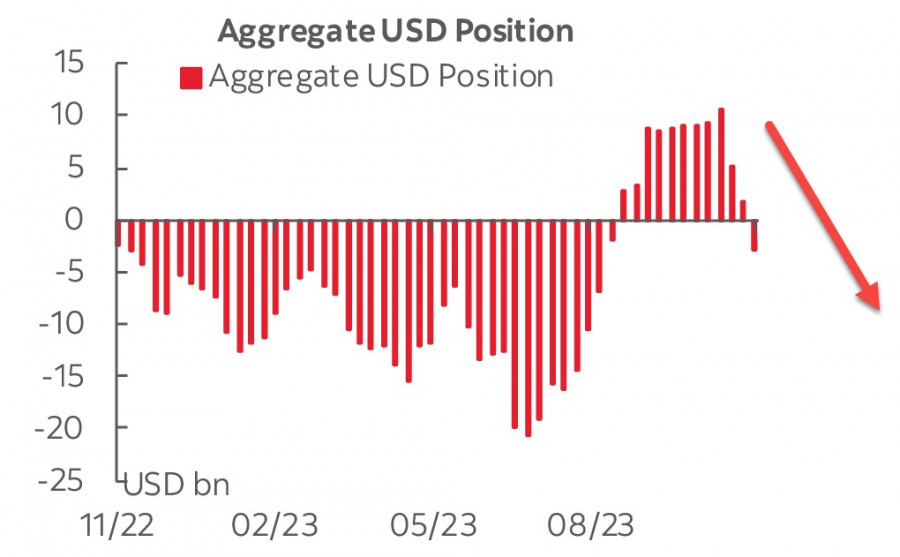

The dollar has been in a bullish position for a total of 11 weeks. According to the latest CFTC report, it lost another 4.8 billion, forming a net short position of -3.1 billion.

The dollar was sold against all major currencies without exception. Oil lost another 1.4 billion, with a bullish excess of 10.3 billion. The dynamics are negative, reflecting a reaction to the expectations of global slowdown. In turn, gold added 2.3 billion, and the net long position increased to 39.5 billion. This is a factor in favor of defensive assets and further dollar selling.

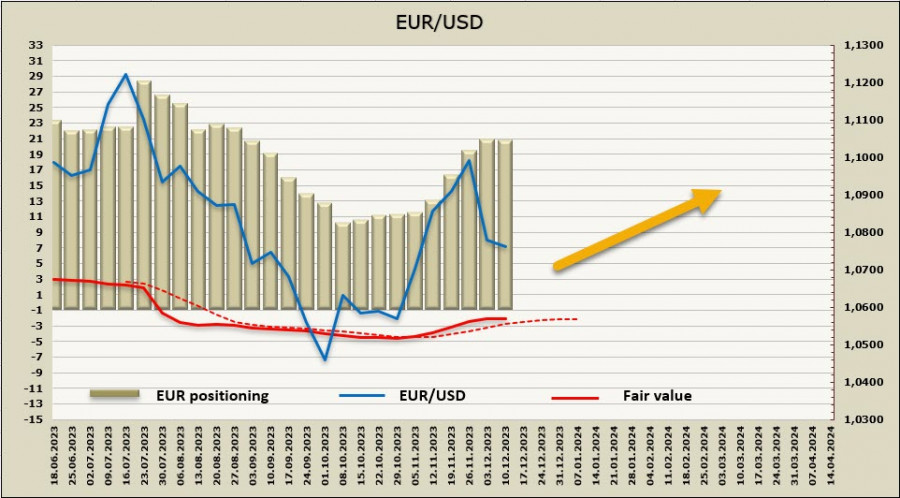

EUR/USD

On Thursday, the European Central Bank will hold a meeting on credit and monetary policy. There's a low chance of another rate hike, as inflation in the eurozone is slowing faster than forecasted. Moreover, there is a possibility that the ECB will signal that the current cycle is complete, and investors will turn their attention on the rate cut cycle in 2024 and the conclusion of the PEPP reinvestment program. An official decision on this matter is expected only in January.

Markets are beginning to shift towards a more aggressive interest rate cut, with an expected decrease of 140 points by the end of next year. There is a 70% probability that the rate cut will start as early as the first quarter. If this forecast receives any confirmation during the ECB meeting, the rally in EUR/USD may be forgotten, and the pair will start to fall while maintaining yield spreads in favor of the dollar.

The net long EUR position increased by 0.9 billion to 20.6 billion in the reporting week, with firm bullish bias. However, the price lost momentum due to short-term yield changes in favor of USD, although it remains above the long-term average. This makes it possible for us to expect sustained growth, but the momentum has weakened.

EUR/USD failed to stay above the support at 1.0820/30, correcting towards the 50% retracement level from the October/November growth, where it may find local support. The expected continuation of the rise, anticipated a week earlier, was hindered by lower eurozone inflation and the latest labor market data from the US. The nearest support is at 1.0666, followed by 1.0630/40, but a further decline is unlikely. It is assumed that after consolidation, euro bulls will attempt to resume the upward movement, with 1.0940/60 as the target.

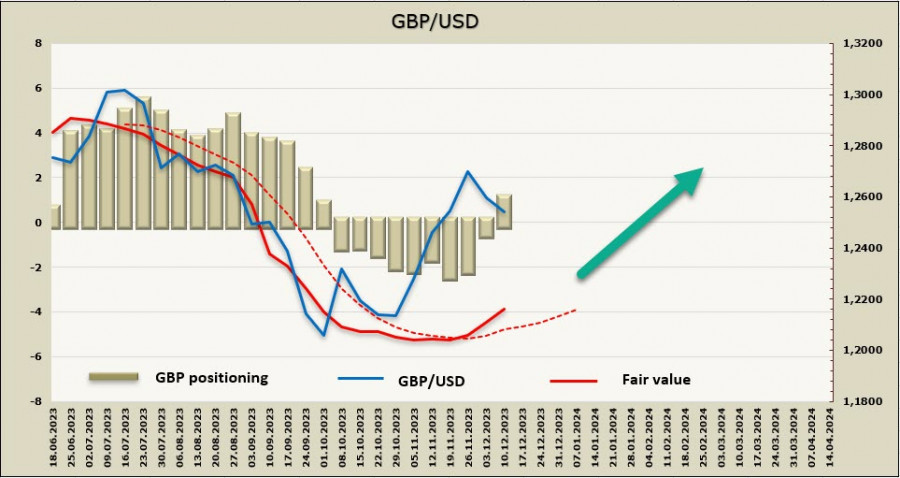

GBP/USD

The Bank of England will hold its meeting on credit and monetary policy on Thursday. It is expected that the interest rate will remain unchanged at 5.25%, and the tone of the accompanying commentary will not change significantly. However, unanimity is not expected, and DanskeBank predicts a split vote in favor of such a decision at 6-3, meaning at least 3 members of the Committee will maintain a hawkish stance and vote for a rate hike, increasing the chances of surprises after the meeting.

Economic data released after the last meeting in November paints a mixed picture. As expected, the base effect led to a noticeable decrease in inflation in October, and inflation in the services sector also shows signs of weakening. PMI data turned out better than forecasts, and GDP dynamics in the third quarter stabilized near the zero mark. The employment report shows signs of slowing wage growth, and hiring activity has also noticeably declined.

The market's reaction to the BoE meeting outcomes will likely be restrained.

The weekly change in the pound is +1.5 billion, forming a long position of 0.9 billion. The positioning is neutral, but the dynamics favor the pound for the third consecutive week. The price is rising, providing grounds to expect sustained growth.

The pound continues to trade in a bullish channel, with a muted reaction to non-farms, and by the current moment, half of Friday's decline has already been played out. Support comes from the lower band of the channel at 1.2440/60, and it is possible that the pair may fall, considering the latest data from the United States. However, it seems like the pair could rise towards the upper band of the channel at 1.2810/40. The interim target is the local high at 1.2730.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/67iTsCo

via IFTTT