Another central bank meeting will take place in the upcoming week - that of the Bank of England. The BoE is the most hawkish central bank for one simple reason. Inflation in the United Kingdom is at 4%, which is twice the target level. I want to remind you that throughout the past year, inflation in Britain was much higher, and back in September, BoE Governor Andrew Bailey's forecast of inflation below 5% by the end of the year seemed unrealistic. However, Bailey turned out to be correct, so his words are likely to be trustworthy.

Unfortunately, Bailey rarely speaks and gives interviews, so we hardly receive important information from the BoE. Currently, the market expects the start of monetary easing no earlier than the autumn of 2024. But everything will depend on the state of the economy, which has been stagnating for a year and a half, and on the pace of inflation slowdown, which has been pleasing recently.

It is clear that the BoE interest rate will not change next week. Therefore, the market is already focusing its attention on other topics. One of them is the results of the vote on the interest rate among the members of the Monetary Policy Committee. This time, only two officials may vote for an increase, and seven are likely to vote to keep the rate unchanged. If this turns out to be the case, I will be able to conclude that the BoE's hawkish stance is softening.

This is bad news for a Brit, but good news for me. The pound has been moving horizontally for 5-6 weeks, which doesn' make me happy. The wave analysis suggests the construction of a bearish wave with significant downward potential for the instrument. However, instead of a decline, we see almost nothing. Therefore, I believe that any changes in sentiment within the Monetary Policy Committee are already a reason to expect the end of the sideways movement.

It is also necessary to pay close attention to Bailey's speech if it takes place this time. At the moment, it is not scheduled on the calendar. Certainly, a statement from the central bank explaining its decisions will be announced, but it is much more interesting to listen to the BoE governor. In any case, the upcoming week will not be dull, as in addition to the two meetings, there will be several important reports. The first week of the new month is the time when U.S. labor market data is published.

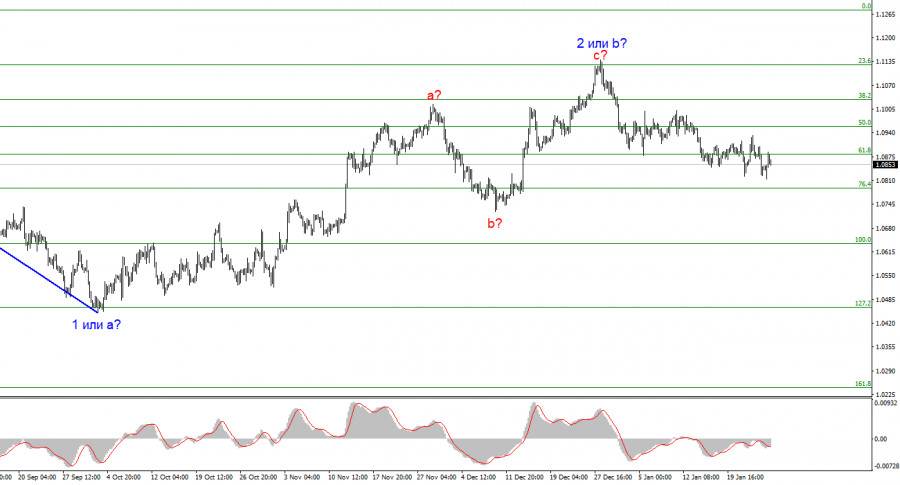

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci retracement, suggests that the market is prepared to sell over a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

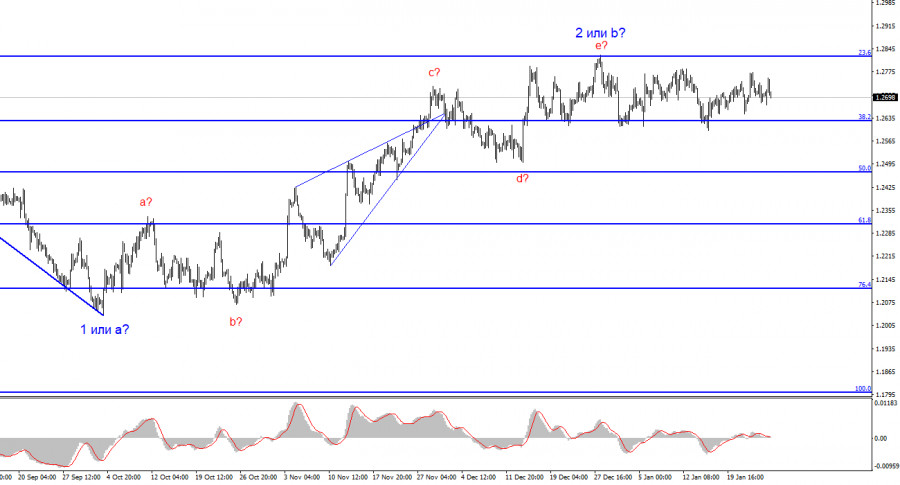

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. However, since we are currently observing a flat pattern, I wouldn't rush to short positions at this time. Since the movement has been horizontal for a month now, I would wait for a successful attempt to break below the 1.2627 level in order to grow more confident about the instrument's decline.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/GRQ6PSa

via IFTTT