FOMC rates in 2024 perhaps raise the least number of questions and don't exactly provide a good amount of support to the US dollar. According to the market consensus, the Federal Reserve is expected to be the first to cut interest rates in 2024, which exerts significant pressure on the dollar. Only recently have we started to receive signals from the ECB that it will begin cutting rates in late spring or early summer, which has exerted some pressure on the euro. As we can see, the British pound is hardly moving, as the market expects the Bank of England to start the easing process no earlier than the end of the summer.

On Friday, Raphael Bostic, the President of the Atlanta Fed, spoke, and he often delivers specific statements, so his remarks are quite interesting. However, this time he was not being specific. Bostic said he was open to changing his stance on rates. It is quite difficult to understand what he means by this. Will Bostic's position be more dovish or more hawkish? I tend to think it will be more hawkish. I believe that the Federal Reserve has no reason to rush with rate cuts, despite the rather weak GDP forecasts for the fourth quarter in the United States.

In my opinion, the Fed can afford to remain entirely focused on inflation, paying only minimal attention to economic growth. It's quite simple: the United States has economic growth, unlike the European Union or the United Kingdom. Bostic affirms that his views will be informed by incoming data. He also made a clear hint at his stance, stating that he wants to ensure a stable movement of inflation toward 2% before advocating for a rate cut. With this statement, he indicated that his current position is more hawkish, emphasizing a patient approach to monetary easing.

Theoretically, this could support the dollar, but it's unlikely to have a significant impact on the pound. It would require several more FOMC members to also signal that they won't rush to make a decision on rate cuts. However, there are no speeches scheduled in the near future, as the first meeting of 2024 is only about a week and a half away. This means that members of the Federal Open Market Committee won't have the opportunity to provide comments leading up to the meeting. The market can only wait and speculate in anticipation of the first Fed meeting.

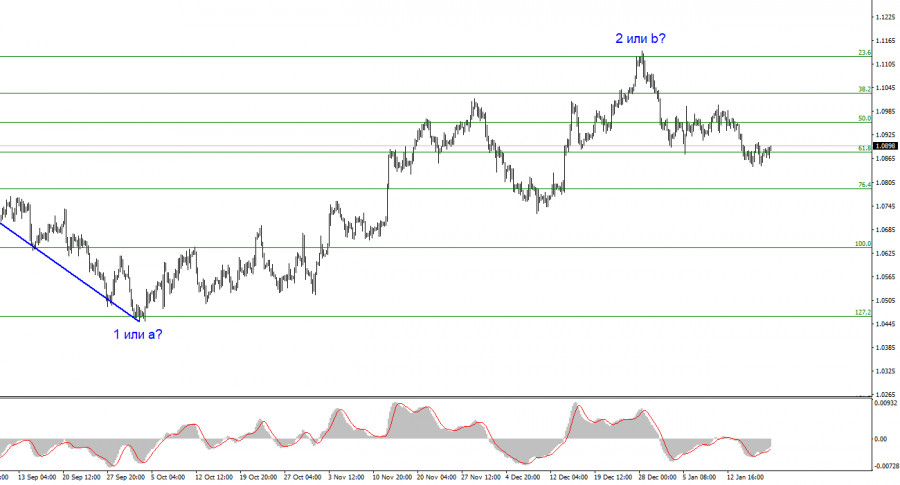

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. An unsuccessful attempt to break above the 1.1125 level, which corresponds to 23.6% Fibonacci, suggests that the market is prepared to sell.

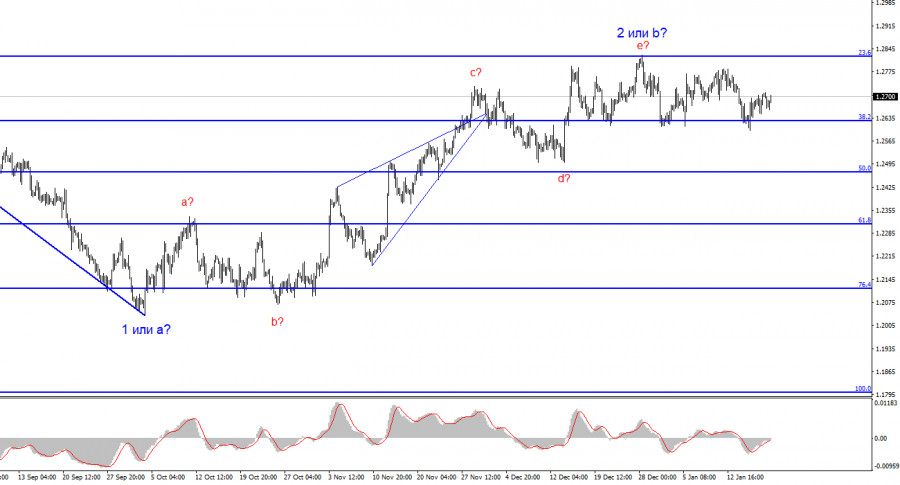

The wave pattern for the GBP/USD pair suggests a decline. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. In fact, we are already seeing some signs of its end. However, I wouldn't rush to conclusions and short positions. I would wait for a successful attempt to break the 1.2627 level, afterwards it will be much easier to expect the pair to fall further.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/XpEt63W

via IFTTT