The topic of interest rates remains a key focus on the currency market. While the market has more or less understood the interest rates of the European Central Bank and the Federal Reserve (though there are still many questions about it), the Bank of England remains a real "wild card." To begin with, the British central bank has not released any statements regarding planned changes in monetary policy for 2024. We have certainly heard a few speeches from BoE Governor Andrew Bailey and some of his colleagues, in which they indicated an impending interest rate cut during the current year. However, a year is a long time, and the market needs a clear answer.

Based on the current level of inflation in the UK (higher than in the EU and the US), it could be assumed that the BoE would be the last to start lowering rates. For quite some time, even major banks did not provide any forecasts, but JP Morgan was the first to step forward. The brokerage now expects the BoE to start cutting interest rates in August, although earlier expectations were for the first interest rate cuts no earlier than the fourth quarter of 2024. By the end of 2024, JP Morgan expects the rate to drop by 75 basis points, which is much less than what is anticipated from the ECB and the Fed.

Forecasts for the ECB's rate cut range between 4 and 5 steps of 25 basis points each. Forecasts for the Fed's rate cut fall within the range of 5-7 steps of 0.25%. On the other hand, the BoE may cut rates only three times. This is what likely keeps the British pound from falling against the dollar. The market expects a more aggressive easing of policy from the FOMC than from the BoE, which maintains a strong demand for the pound.

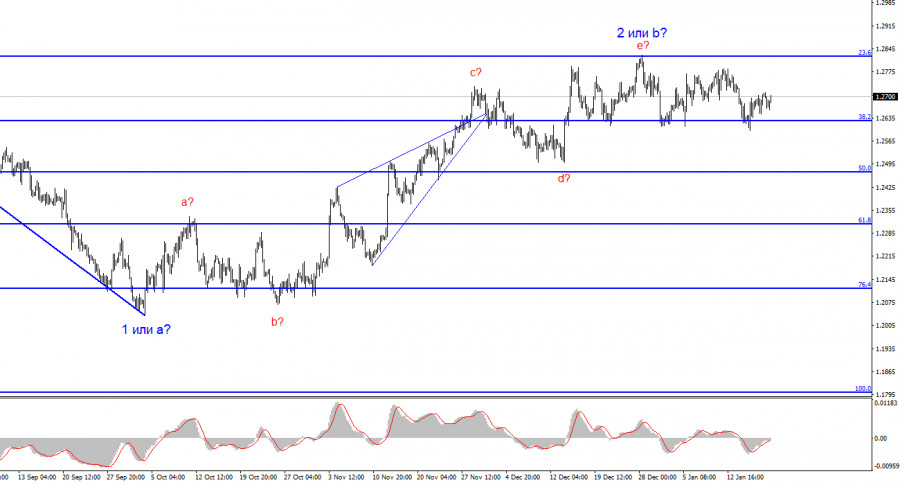

Unfortunately, this news background and market sentiment does not support the construction of wave 3 or C. In any case, it is not appropriate to talk about the dollar's prospects until a breakthrough above the 1.2627 level occurs. Wave 2 or B could become more complex several times, or we could see a complex corrective structure of a horizontal nature, which would only further complicate things for traders. In the past month, we have seen far from the most attractive movement, and I do not see any factors that could make the situation more favorable in the near future. It is much more pleasant to trade the euro at the moment.

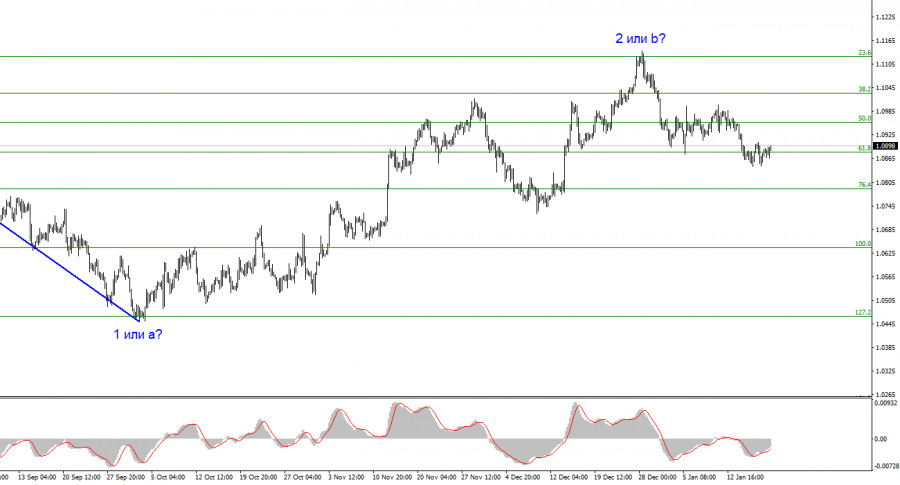

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. An unsuccessful attempt to break above the 1.1125 level, which corresponds to 23.6% Fibonacci, suggests that the market is prepared to sell.

The wave pattern for the GBP/USD pair suggests a decline. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. In fact, we are already seeing some signs of its end. However, I wouldn't rush to conclusions and short positions. I would wait for a successful attempt to break the 1.2627 level, afterwards it will be much easier to expect the pair to fall further.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/gsxQm5e

via IFTTT