Monday has been a dull day, to say the least: there is low market activity, no news, and no events. The level of 1.0786 is very important for the euro. If the pair breaches this level, this would mean that the market is ready to buy and form a bullish corrective wave. However, I don't think the EUR/USD pair will be able to break through this mark, so I expect quotes to fall further. There are several reasons for this.

Firstly, this week will see very few economic events. Based on this, we can assume that the market sentiment will not change in the next four days. And four days are enough for the instrument to go down another hundred points.

Secondly, the Bundesbank said that the German economy is now likely in a recession. In my opinion, "likely" means that the recession has undoubtedly begun; otherwise, the Bundesbank would have tried to avoid using the word "recession". Perhaps the recession will be mild and short-lived, but it will depend on the European Central Bank, which is expected to start lowering rates this year, positively affecting the entire EU economy. However, rates may not start to decline until the summer, and by that time, the German and EU economies may have shrunk by a few tenths of a percent.

Thirdly, the economic condition of the European Union remains noticeably worse than that of the United States. In my opinion, this is a significant reason for the market to continue reducing demand for the euro and increasing demand for the dollar. This week, business activity indices for the services and manufacturing sectors of the EU and the US will be released. And most likely, the indices will remain where they are now: above 50 for the US and below 50 for the European Union.

Fourthly, signals from the Federal Reserve are increasingly indicating that monetary easing in 2024 will be much weaker than expected. The more market participants receive signals of the central bank's soft intentions, the stronger the demand for the US currency may increase. In any case, I expect the continuation of the downtrend in wave 3 or C.

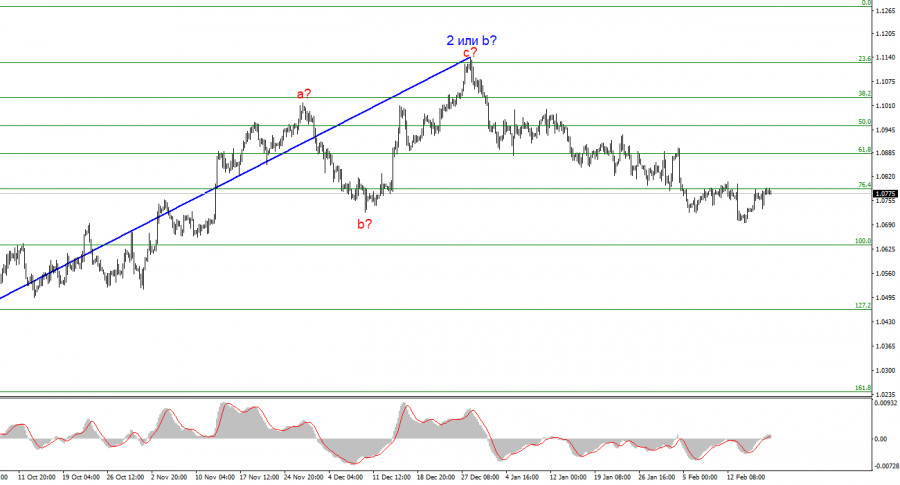

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I am currently considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

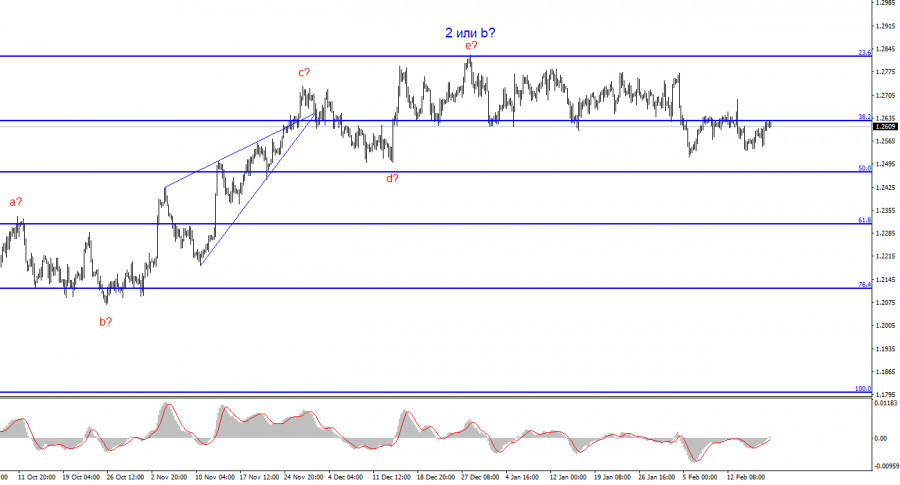

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. A successful attempt to break through the 1.2627 level acted as a sell signal. Another signal was formed, in the form of an unsuccessful attempt to break this level from below. Now I am quite confident about the instrument's decline, at least to the 1.2468 level, which would already be a significant achievement for the dollar, as the demand for it remains very low.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/OpboeQi

via IFTTT