The first day of the week turned out to be unusually dull, while the US observed a holiday. The British currency barely moved, maintaining the possibility of building the presumed wave 3 or C. However, one cannot be satisfied with just a probability. The instrument must decline to maintain the integrity of the wave pattern, and my readers could make profitable trades. Unfortunately, the British pound clearly has problems with movements lately.

Bank of England Governor Andrew Bailey spoke to the Parliament's Treasury Committee. Despite the seriousness of the statements made, the market did not find any reasons to reduce demand for the pound. Undoubtedly, the market needs time to digest such information, but so far, the market reaction does not satisfy me in any way.

Bailey said on Tuesday that markets expect a rate cut this year, and they have a reason to do so. He mentioned that there has been a lot of emphasis on the recession rather than on strong employment. "We are having to walk a narrow path on monetary policy," Bailey said. He adds that the recession is modest by historical standards and is probably over.

The fact that the BoE will start lowering rates in 2024 is already obvious to everyone. Bailey then said that the Consumer Price Index does not necessarily have to fall to the target level for the central bank to start easing policy. He noted that some inflation components are decreasing very reluctantly, but the central bank looks to the future with optimism and hopes for a faster slowdown.

In fact, there is nothing new in the statement "we don't necessarily wait until inflation has hit the 2% target before it starts lowering rates." However, Bailey openly stated for the first time that the central bank is considering the possibility of easing. In other words, the tone of his statements is beginning to sound more dovish. In my opinion, this is a significant reason for the pound to finally start declining. However, it will all depend on market participants, who, it seems, refuse to believe that the BoE may start lowering the rate in the first half of the year.

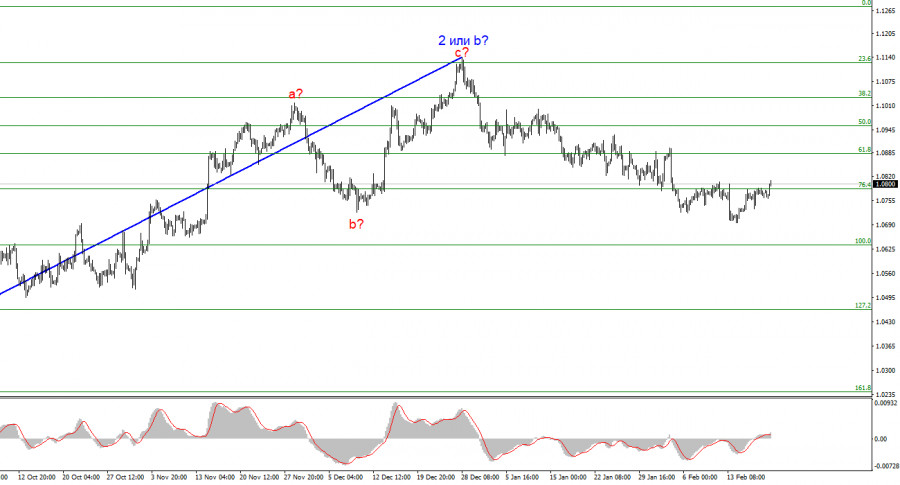

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I am currently considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

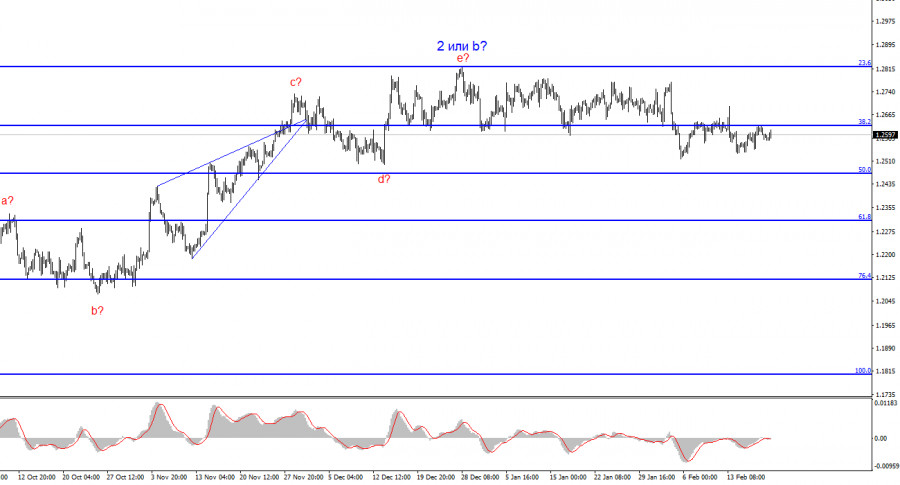

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. A successful attempt to break through the 1.2627 level acted as a sell signal. Another signal was formed, in the form of an unsuccessful attempt to break this level from below. Now I am quite confident about the instrument's decline, at least to the 1.2468 level, which would already be a significant achievement for the dollar, as the demand for it remains very low.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/L4F9a3J

via IFTTT