The market continues to distance itself from the idea that the FOMC will start to lower interest rates in March. As of today, markets are currently pricing in a 8.5% chance of a rate cut in March, according to CME's FedWatch Tool. The probability of a rate cut in May is 35%, which is also relatively low. I mentioned earlier in the year that it's not advisable to expect the monetary easing cycle to start so soon, as inflation in the US is still far from the target, reluctantly decreasing over the past six months, and the state of the economy allows the central bank to keep the rate elevated for a few more quarters. So why "jump ahead " in this case?

I believe the first cut will not happen before June, but analysts from ANZ shocked all dollar skeptics with its forecast. ANZ expects the FOMC to cut rates from July 2024, and the total rate cut may be only 200 basis points. Analysts at ANZ believe that easing policy should not be expected before July, but even these timelines may change if inflation continues to stagnate, as it has in the last 7-8 months. The inflation backdrop must improve compared to current rates for the FOMC to decide on the first cut in July.

Therefore, the most hawkish scenario available today becomes even more hawkish. In 2024, ANZ analysts expect only four rounds of easing, totaling 100 basis points. The easing process could end in June 2025.

In my opinion, this should support the dollar. This logical chain is unlikely to work with the pound, as it has been trading according to its own rules for a long time. I don't see the GBP/USD instrument sticking to any logic. In my opinion, the "spring is tightening," and it can now jump in any direction. I would prefer it to tumble rather than harm the market.

As for the EUR/USD instrument, there is logic in its movements. And since analysts in the market have already started talking about July as the month of the first easing, the dollar cannot ignore this information, leading to a new growth that is fully supported by the current wave analysis.

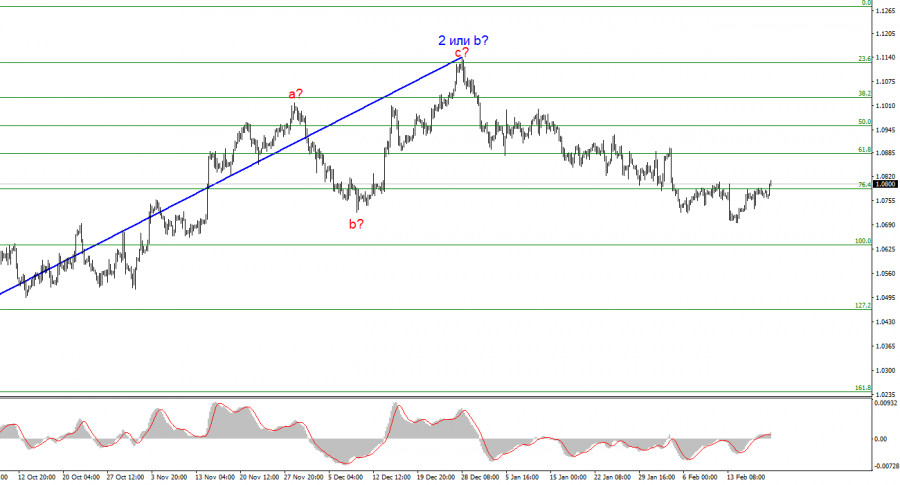

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I am currently considering selling.

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. A successful attempt to break through the 1.2627 level acted as a sell signal. Another signal was formed, in the form of an unsuccessful attempt to break this level from below. Now I am quite confident about the instrument's decline, at least to the 1.2468 level, which would already be a significant achievement for the dollar, as the demand for it remains very low.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/2PapSHm

via IFTTT