Despite the fact that the first FOMC meeting in 2024 is behind us and has clarified everything, we continue to receive new information related to the Federal Reserve's rates. Initially, the market believed that rates would start to fall in March, with enough voices in favor of this in the Fed, as well as among major banks and analysts. I mentioned at that time that such an abundance of diverse information only confuses market players who cannot clearly understand what to expect from the US central bank.

It all ended with Federal Reserve Chief Jerome Powell explicitly saying that a March rate cut is not likely. Investors are now pricing in a roughly 15% chance of a rate cut in March, per CME's FedWatch Tool, but this did not reduce disagreements in the market. For instance, on Monday, Chicago Fed President Austan Goolsbee said that he does not consider a long pause in rate cuts necessary. Goolsbee signaled he does not take the strong U.S. job growth as a reason for waiting to cut interest rates, but rather as a comfort that the labor market is not ready to crack.

Goolsbee noted that a strong labor market is undoubtedly good news, but one should not judge based on just one month. If the next payroll reports are also strong, concerns about labor market weakening will become less pronounced, which is good for the economy. At the same time, the Fed may have to reconsider its position on non-inflationary growth due to increased labor productivity.

If we omit all the less important details, the main point is that Goolsbee believes that the FOMC should not delay the rate cut because of a strong labor market. It's a good thing that there are not many adherents of similar thoughts at the Fed, as I expect the US currency to rise. For this to happen, the Fed's rate needs to stay at its peak for as long as possible, and the FOMC members' rhetoric should remain hawkish. This is not only my personal wish; it is an objective necessity, as inflation in the US has hardly decreased in recent months, and the economy continues to grow. Therefore, the Fed indeed has the opportunity to keep the rate at its peak almost painlessly for the economy.

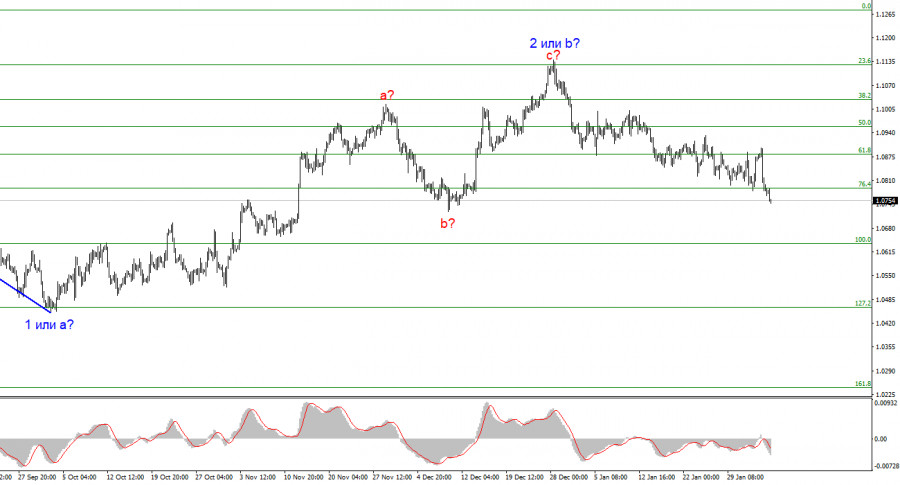

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

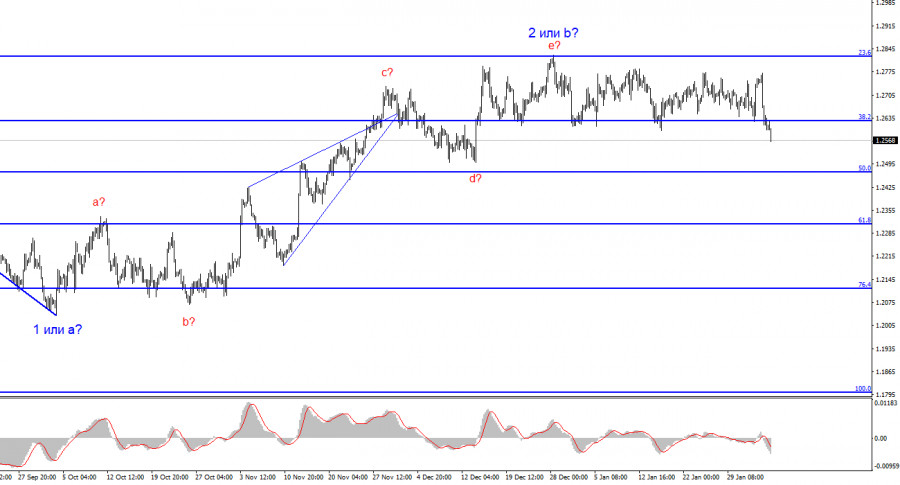

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways movement. I would wait for a successful attempt to break through the 1.2627 level, as this will serve as a sell signal, which, hopefully, everyone managed to open. Take note that after a daily decline, the instrument may pull back up, but I only expect it to fall further.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/pD8kKyI

via IFTTT