The U.S. dollar showed who's in charge after the release of strong U.S. labor market statistics. Job growth of 353,000 in January, a revision of the indicator upwards by a total of 128,000 in November–December, a decrease in unemployment to 3.7%, and an acceleration in average wages to 4.5% increased Treasury bond yields and put an end to the ambitious plans of GBP/USD bulls. No matter how strong the pound was, its opponent proved even stronger.

Thanks to the Bank of England's meeting, the pound had hopes of leading the race among the G10 currencies and realizing Goldman Sachs' ambitious forecast for GBP/USD to rise to 1.3. The assumption behind this is that the BoE will keep rates higher and longer than its counterparts. Bank of England Governor Andrew Bailey announced a change in priorities. If the central bank was previously concerned about how high to raise borrowing costs, now it's about how long to keep them elevated.

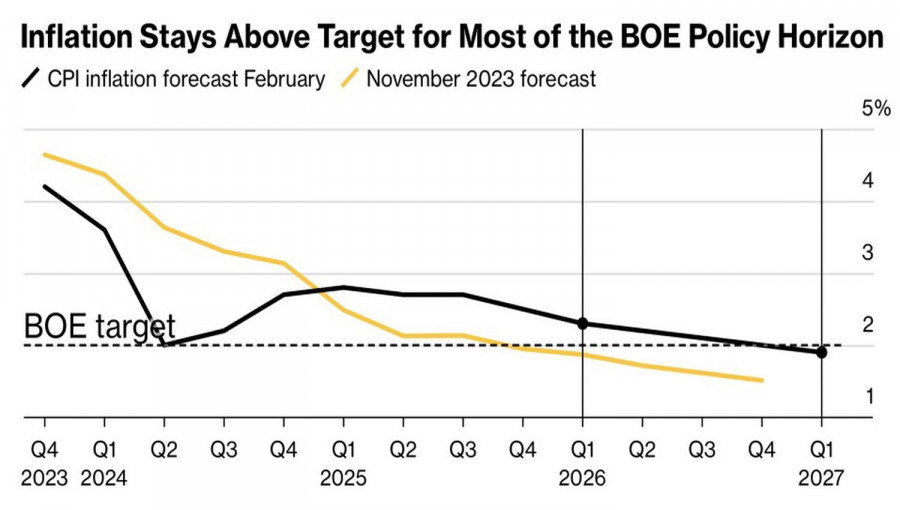

Judging by the most serious split within the MPC since 2008, the "hawks" have no intention of throwing in the towel. Two MPC members voted for an increase in the repo rate, one for a decrease. The accompanying statement no longer mention that there might be a need to further increase borrowing costs. In addition, inflation forecasts suggest that it may accelerate after reaching the 2% target as early as the second quarter. At the same time, the BoE raised GDP growth estimates. In such conditions, keeping rates at a plateau for a long time is appropriate.

Bank of England's Inflation Forecasts

After the Bank of England meeting, the short-term market reduced the scale of the expected monetary expansion in 2024. Earlier, it expected four acts with a 50% probability of a fifth. Now, it is confident in reducing the repo rate by only 100 basis points to 4.25%. The expected start of the monetary policy easing process shifted from May to June. It's no wonder that GBP/USD quotes rose. By that time, the Fed was expecting a sharp increase in the federal funds rate by 125 basis points. Derivatives did not rule out that monetary expansion would begin in March.

A strong U.S. employment report led to a change in these expectations. The scale of monetary policy easing in the current year, both for the Bank of England and the Federal Reserve, is estimated at 100 basis points. The start dates for this process in the United States have shifted to May. GBP/USD bulls no longer have such an advantage as the speed and magnitude of monetary stimulus, and they are forced to retreat. However, it should not be expected that there will be a mass exodus from them.

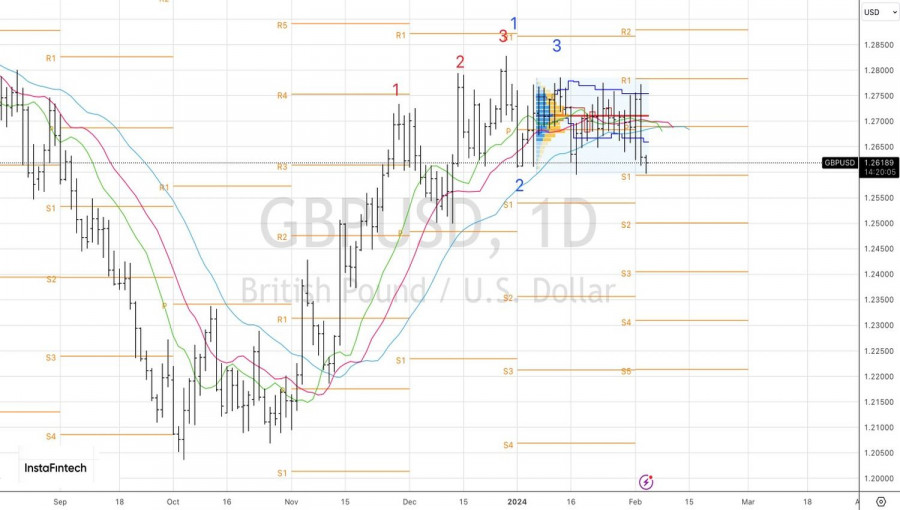

Technically, on the GBP/USD daily chart, after an unsuccessful play of the Spike and ledge pattern based on the 1-2-3 pattern, a false breakout pattern has emerged. If the market does not go where it is expected to go, it is more likely to go in the opposite direction. The initiative was taken by the "bears," creating grounds for selling the British pound against the U.S. dollar towards 1.249 and 1.240. A rebound from resistance at 1.265 or a breakdown of support at 1.260 could be the basis.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ujzZIFQ

via IFTTT