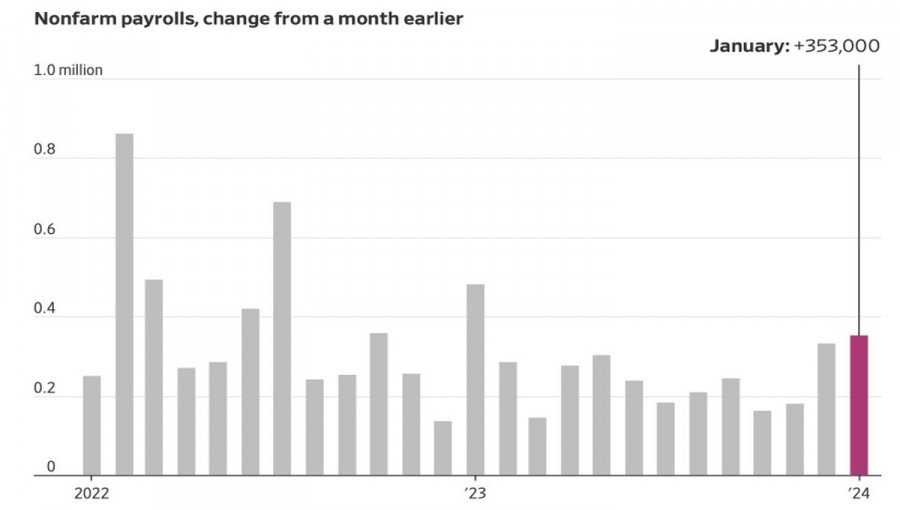

The more the U.S. economy is anticipated to slow down, the more frequently it delivers pleasant surprises. Employment growth of 353,000, a decrease in unemployment to 3.7%, and an acceleration in average wages from 4.1% to 4.5% signify only one thing. There can be no talk of any cracks in the economy. Thus, the "bears" on EUR/USD can continue to exploit American exceptionalism and lead the quotes of the main currency pair downward.

It's interesting to wonder if Jerome Powell knew that the report would be so strong when he ruled out March as a possible month to start the Fed's monetary expansion. The statistics are indeed impressive. Average hourly earnings increased by 0.6% MoM, although none of the Bloomberg experts predicted an increase in the indicator by more than 0.4%. Against a backdrop of strong employment, this raises the risks of inflation acceleration. The situation is starting to eerily resemble the 1970s.

Employment Dynamics in the United States

Back then, rapid inflation decline allowed the Fed to declare its victory and make a dovish pivot. Moreover, there were rumors in the market that the Central Bank yielded to the ruling power to ensure its victory in the elections. In late December 2023, the Fed also discussed a rate cut on federal funds in three FOMC meetings in 2024. Meanwhile, Donald Trump's Republican team criticizes Powell, who allegedly plans to support Democrats by easing monetary policy.

For investors, something else is important: instead of a soft landing, the U.S. economy seems to be taking off. If so, events from half a century ago could easily repeat. We are talking about a repeat inflation acceleration, resumption of the cycle of tightening the Fed's monetary policy, and subsequent recession.

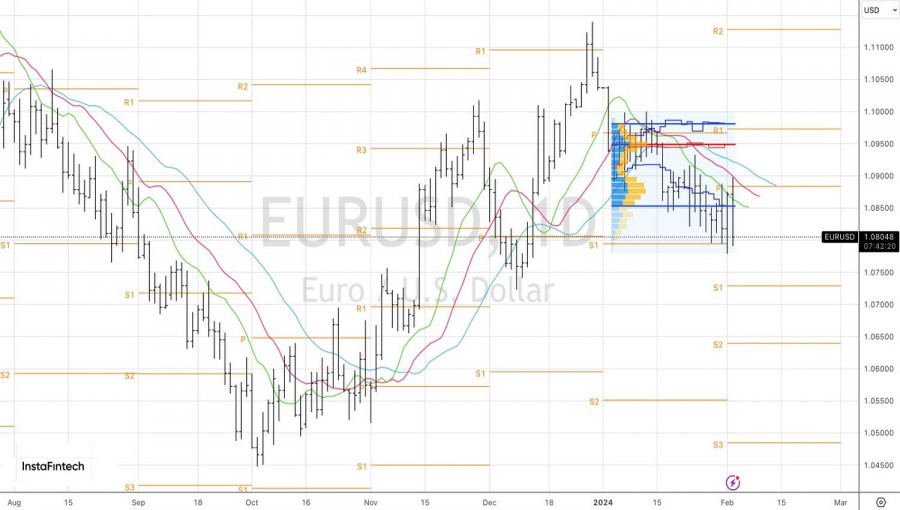

In any case, after such an impressive employment report, the chances of a rate cut on federal funds in March have dropped from 37% to less than 20%. The probability of starting monetary expansion in May has decreased to 71%, and the expected scale of monetary policy easing has dropped from 125 bps to 100 bps. It's no wonder that EUR/USD collapsed below 1.08. According to Deutsche Bank, if the risks of a drop in borrowing costs in March fall to zero, the euro will trade near $1.066. Is everything heading in that direction?

In any case, two strong reports on the U.S. labor market in a row help EUR/USD determine the direction of further movement. Thanks to the first of them, the dollar managed to close January in the green zone for the first time in four months. The U.S. dollar will likely strengthen its leadership in the race of the Big Ten monetary units in February.

Technically, the fluctuations of EUR/USD in a narrow trading range of 1.080–1.085 will likely end. The formation of a bearish bar with a wide trading range, provided the week closes below the pivot level at 1.079, indicates growing risks of a downward movement. In such conditions, it makes sense to move away from the false breakout strategy and focus on selling the euro towards $1.073 and $1.064.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/q3Ud9mW

via IFTTT