The first FOMC meeting of 2024 has concluded, and it probably ended not as we would have liked. At the beginning of the review, I want to highlight a few theses from Federal Reserve Chair Jerome Powell's speech that deserve special attention. Here they are:

- Rates will not be lowered until there is confidence that inflation will return to the target.

- This year, it would be appropriate to begin policy easing if the economy develops as expected.

- If necessary, the Fed is ready to maintain the peak rate for a longer period.

- Weakening labor market conditions may lead the FOMC to begin rate cuts earlier.

I don't know how everyone interpreted Powell's entire speech, but for me, the above theses contradict each other. Powell voiced many interesting things, but the market was primarily interested in when the Fed deems it necessary to switch to easing policy. Obviously, if the US economy collapses by 3%, the Fed will seriously consider easing financial conditions.

Obviously, if tomorrow the labor market starts showing negative values, and unemployment jumps by a couple of percent, the Fed will start trimming rates. Clearly, if inflation remains above the target for longer, the Fed may keep rates lower for longer. All of this was clear even without Powell's speech.

The Fed chair only outlined several possible scenarios for the market, but the market itself is excellent at doing that. The market needed specific information, forecasts, plans, not just a list of all possible scenarios. Personally, I believe that the first FOMC meeting this year was simply useless for market participants and my readers.

Recall that in early January, the probability of a rate cut in March, according to the CME FedWatch tool, was 80%. Then it dropped to 56%, then to 40%, and after the FOMC meeting, it is only 35%. Therefore, the market is abandoning its weighted average opinion on the start of the easing process already at the next meeting. However, this was clear to me earlier. And after Powell's speech, it is not clear when the Fed will start lowering rates. Buyers did not get support, sellers did not experience a wave of optimism, and they were not convinced.

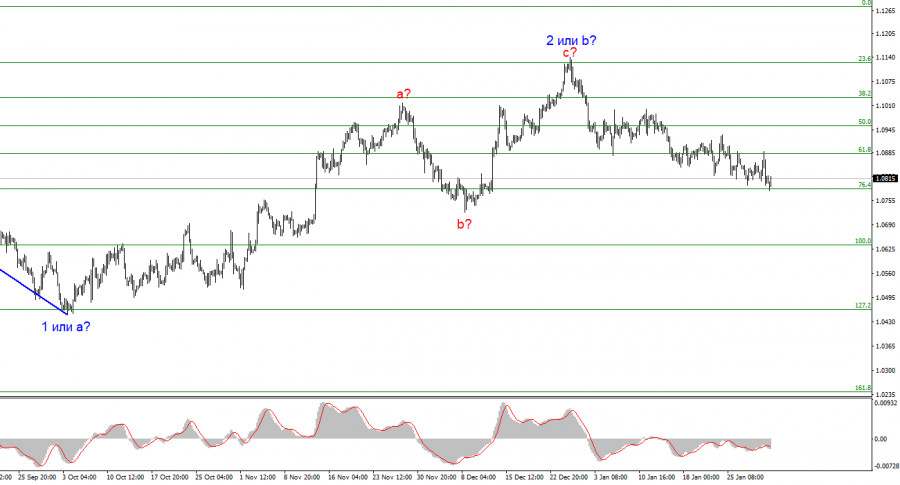

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

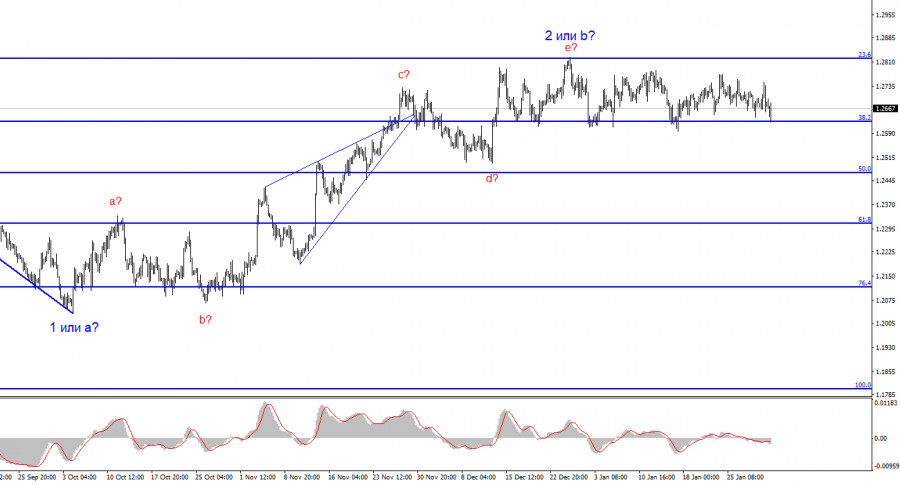

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. However, since we are currently observing horizontal movement, I wouldn't rush to short positions at this time. I would wait for a successful attempt to break through the 1.2627 level in order to grow more confident about the instrument's decline.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/wMQCGhr

via IFTTT