As expected, the Bank of Canada left the interest rate unchanged at 5%, and it practically ruled out a rate cut at the next meeting in April. The accompanying statement was quite brief, possibly indicating that the Bank of Canada is clearly in a waiting mode before taking any action, and it cannot provide any new comments.

During the press conference, Bank of Canada Governor Tiff Macklem outlined several points that may shed some light on the central bank's future course of actions. Firstly, Macklem announced that there were no major surprises in the six weeks following the January meeting. Accordingly, the Bank shifted from the position of "possibly raising the rate" to "how long will we keep it at this level." Secondly, in response to the latest inflation data, Macklem said that the underlying inflationary pressure persists, and that "we want to see a downtrend in core inflation in the coming months." Since inflation indicators will be updated only once before the April meeting and three times before the June meeting, the markets came to the conclusion that it will happen at least until June, the rate will remain at the current level, which is clearly a bullish signal.

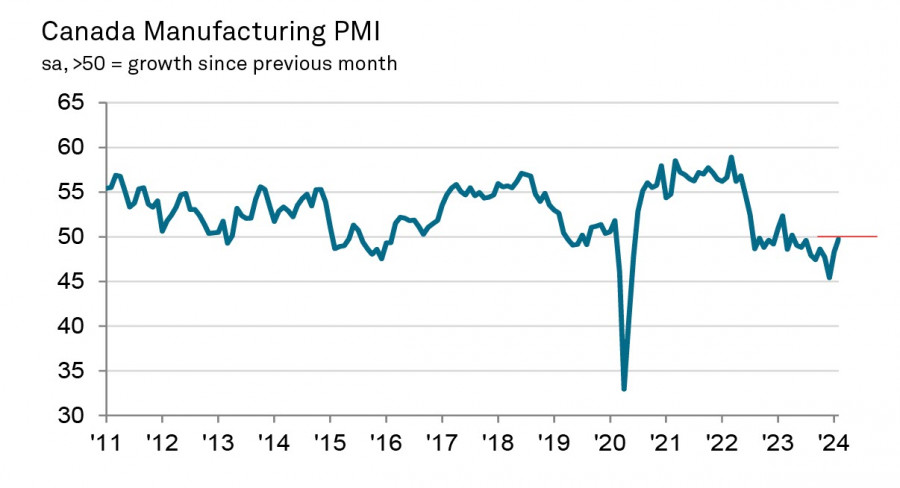

Canada's economy has adapted to high rates, with the manufacturing PMI reaching 49.7 in February, closely approaching the expansion point.

The decline in production and new orders has slowed, and companies are showing optimism – for the first time in three months, there is growth in employees. GDP in the fourth quarter has been revised upward to +0.2%, and now the main factor that could impact the Canadian dollar is the labor market report on Friday. The report will not only make an assessment of the strength of the labor market but also of inflation prospects – something crucial for the Bank of Canada. Therefore, the pair may show strong movement if the final figures differ from the forecasts.

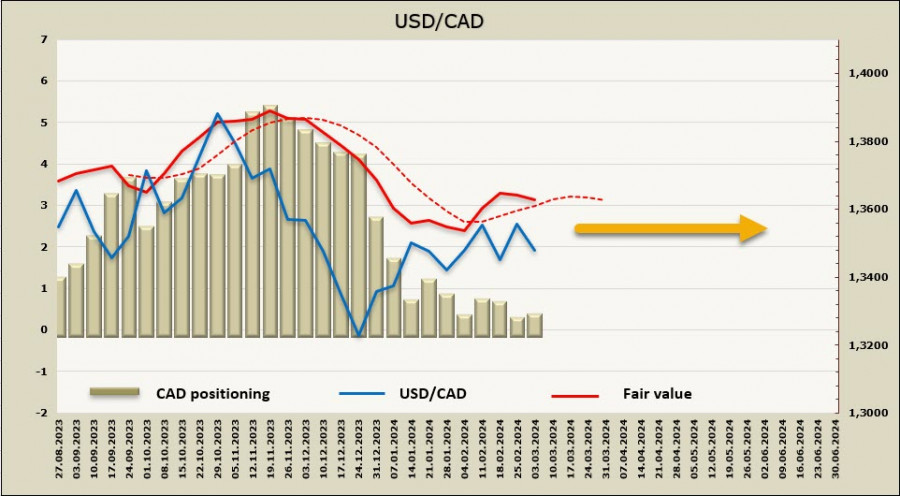

Positioning on the CAD is neutral with a slight bearish bias of -102 million, with a weekly change of -38 million. The price is above the long-term average, but there is a clear attempt at a bearish reversal.

The resistance at 1.3620, which we identified as the nearest target in the previous overview, remains unattainable. Signals of dollar weakness were too evident for the Canadian dollar to ignore, leading the pair lower towards the broad support area of 1.3350/90. The short-term momentum is clearly bearish and seems to be unfinished, which makes the decline the most likely scenario in the short term. However, the pair doesn't have any fundamental reasons to form a bearish trend at the moment, so we consider the decline to be technical and expect the pair to enter a sideways range after the end of the movement. The resistance level is at 1.3620, but the chances of returning to it have noticeably diminished.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/y3NAkBG

via IFTTT