"Buy on rumors, sell on facts"? Over the past few days, the EUR/USD quotes have fallen due to expectations on the Personal Consumption Expenditure (PCE) indices, which is the Federal Reserve's preferred inflation measure. Their actual values for February slightly differed from Bloomberg's forecasts, except for the fact that the monthly PCE didn't accelerate from 0.3% to 0.4%, as it remained at the same level. It seemed like it was time to close short positions, but the euro bulls weren't in a rush to attack.

The question "how much?" is not only important when buying a product or service. The pair's fate depends on how many times the European Central Bank and the Fed will cut rates. Goldman Sachs expects three rate cuts in 2024, four cuts in 2025, plus one in 2026. The Wall Street brokerage now expects five ECB cuts in the year. Both will begin in June, but the different scales of actions increase the risks of the euro falling to parity against the US dollar.

Such forecasts don't seem surprising given the inflation dynamics in the euro area and the dovish rhetoric of the ECB Governing Council officials. Indeed, French consumer prices slowed from 3.2% to 2.4% in March, while Italian prices slightly accelerated from 0.8% to 1.3%, but they continue to remain below the ECB's 2% target.

French inflation dynamics

Is it any wonder that the head of the Bank of France, Francois Villeroy de Galhau, said that the Governing Council should take responsibility for keeping the deposit rate at 4% for too long, which could undermine the eurozone economy? It's time to loosen monetary policy in April or June. Fabio Panetta and Piero Cipollone share the same opinion.

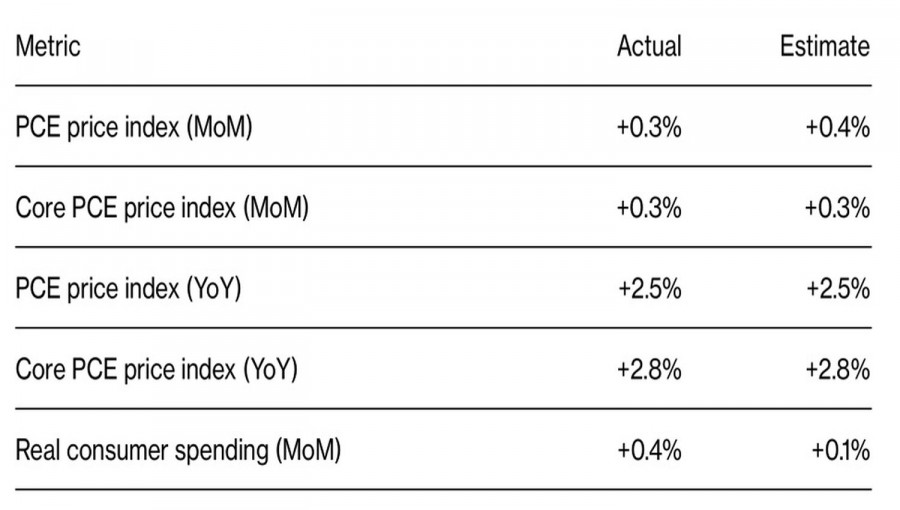

On the contrary, inflation in the US seems to have changed its mind about falling towards the 2% target benchmark. Actual data on PCE turned out to be close to forecasts, while the 0.4% growth in disposable income is another indication of the strength of the American economy.

Actual and forecasts for the US

The outcome is a speech by FOMC member Christopher Waller, calling on the Fed to delay the start of monetary easing and reduce its scale. Even if the Fed cuts rates three times and the ECB four times, the EUR/USD will move towards 1.05.

However, not everyone shares this opinion. Bank of America offers a more bullish forecast for the euro in 2024 at $1.15 and $1.20 in 2025, compared to Bloomberg's consensus estimates of $1.10 and $1.40. They argue that a significant reduction in the federal funds rate will weaken the US dollar.

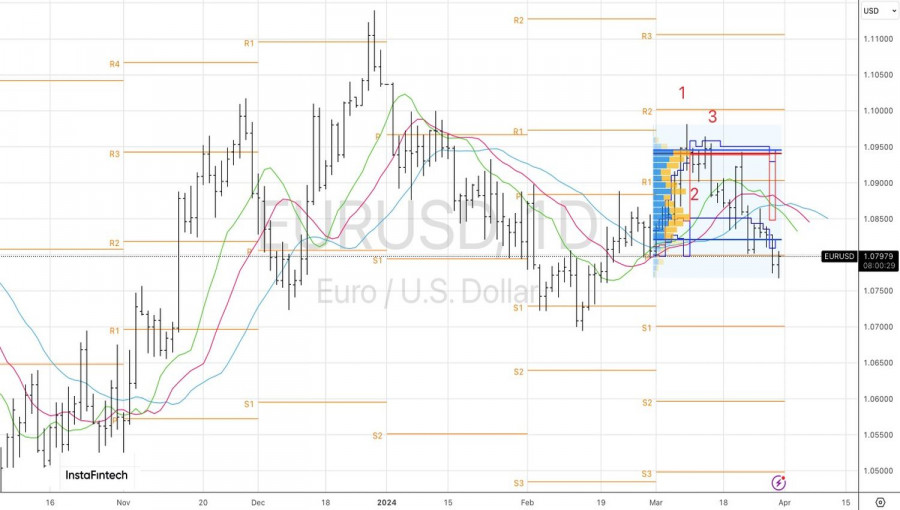

Technically, on the daily chart, EUR/USD is experiencing a bullish counterattack. Their inability to bring the quotes back within the fair value range of 1.082–1.0945 will be a sign of buyer weakness and a reason to sell the pair. Risks of its downward movement towards 1.07 and 1.06 remain high.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/TtJ1mRX

via IFTTT