The first week of April promises to be quite interesting for the currency pairs. But let's start with the euro, which has been rather sluggish lately but still continues to follow the current wave pattern, which suggests the formation of a downward wave. Therefore, in order for everything to remain the same, the market needs to receive strong news from the US and weak news from the European Union.

On Tuesday, the final assessments of business activity in the manufacturing sectors of the EU and Germany will be released, but the Consumer Price Index in Germany for March will be the highlight of the day. Inflation is expected to decrease to 2.2% on an annual basis, and core inflation will decrease to 2.4%. In my opinion, this report may trigger a new decline in demand for the euro, as the European Central Bank will consider the possibility of easing monetary policy as early as April. Even if this is not the case, the ECB will still move one step closer to lowering interest rates.

The euro area inflation data will be released on Wednesday. Here, the data may not be so optimistic, as inflation may remain unchanged at 2.6%. However, if this measure does not accelerate, the market will have no reason to buy the euro. The unemployment rate in the EU may remain at 6.4%, which is quite high, and core inflation may decrease to 3%, which is also very good for the ECB and bad for the euro.

The final assessments of the services PMI for Germany and the EU will be released on Thursday. Market players do not expect strong growth in these indicators, and the German index may remain below the 50 mark. Nevertheless, some growth may provide slight support to the euro.

On Friday, we have retail trade data for the EU, which is not the most important indicator for the market. Overall, I believe that the single currency will continue to decline, but US reports will also matter, as there will be many of them and they will be quite important. Therefore, sellers may expect support from the European news background, but it is also necessary for the US backdrop to be strong for the greenback.

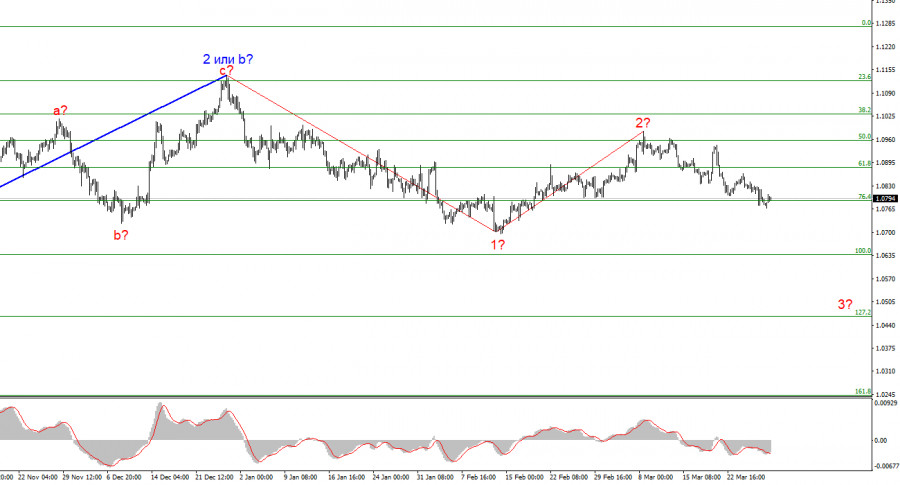

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% Fibonacci.

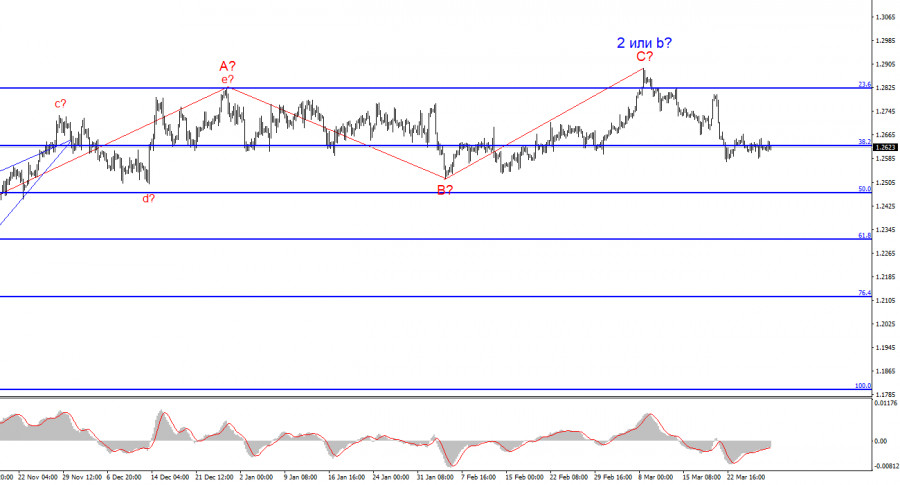

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless we can confirm that wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The construction of wave 3 or c may have already started, but the quotes haven't moved far away from the peaks, so we cannot confirm this.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/0OmnJ2e

via IFTTT