Analyzing Friday's trades:

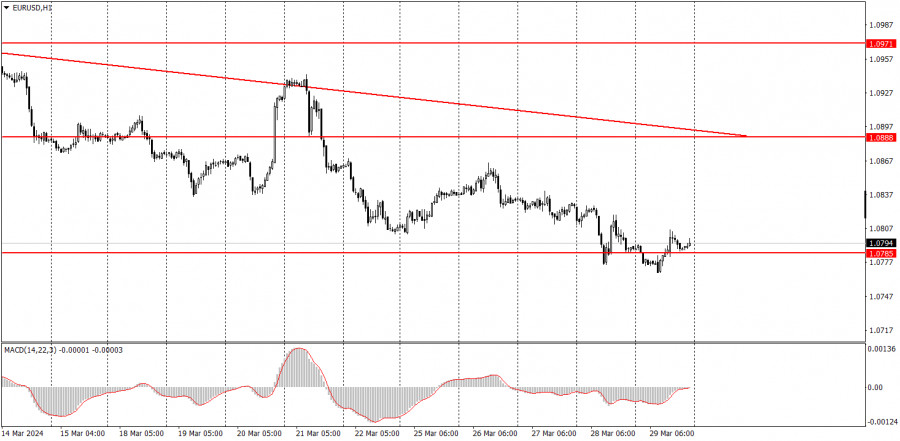

EUR/USD on 1H chart

EUR/USD showed dull movements on Friday. Volatility was very weak once again, and we didn't see any trends. Overall, the downward trend remains intact, but the movements themselves leave much to be desired. We will discuss why it is very difficult to trade the pair at the moment. In the meantime, it's worth noting that the US released at least three reports that could have triggered at least a small market reaction. Yes, the reports were not crucial, and their values were not resonant, but still, some market reaction could have followed.

In the evening, Federal Reserve Chair Jerome Powell spoke, and he reminded us that the American economy is in a fairly good state, and inflation is too high for the Fed to begin monetary easing in the near future. His words should have been interpreted as hawkish, which should have boosted the dollar. However, the market clearly left for the weekend earlier than expected.

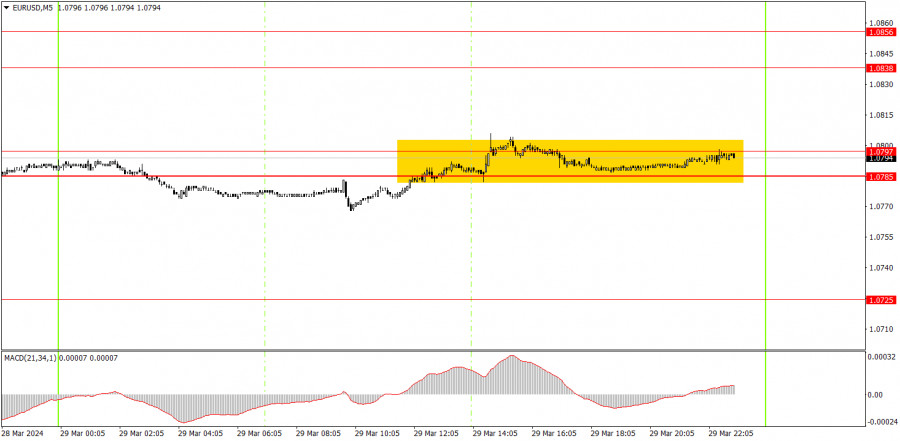

EUR/USD on 5M chart

There were no trading signals on the 5-minute timeframe. The price reached the 1.0785-1.0797 range somewhere in the middle of the European session and traded within it for the rest of the day. In other words, it was within a 12-pip range. It's obvious that it wouldn't have made sense to enter the market with such weak movements. There was basically no potential entry points to consider.

Trading tips on Monday:

On the hourly chart, EUR/USD continues to move downward, which corresponds to the fundamental background. We believe that the euro should fall anyway, as the price is still too high, and the global trend is downward. Unfortunately, the market doesn't always want to trade the pair in a logical manner, and from time to time, we observe unreasonable growth. Moreover, the movements are quite weak.

Today, you can try trading bearish again if the price settles below the area of 1.0785-1.0797. However, you shouldn't expect strong movements, which you should keep in mind when opening positions on the 5-minute timeframe.

The key levels on the 5M chart are 1.0568, 1.0611-1.0618, 1.0668, 1.0725, 1.0785-1.0797, 1.0838-1.0856, 1.0888-1.0896, 1.0940, 1.0971-1.0981, 1.1011, 1.1043, 1.1091. On Monday, we will only highlight the US ISM Manufacturing PMI. This is a fairly important report, but for the rest of the day, we expect weak movements and no trends. Volatility may gradually rise during the US trading session.

Basic trading rules:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, after which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trendline or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginning traders should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/kbhoPCa

via IFTTT