In previous reviews, I mentioned that the European Central Bank has already set a date for the first easing of monetary policy. However, it's important that we both understand what I meant with these words. The ECB will be ready to cut rates in June if inflation continues to fall in the coming months. If this condition is met, then the ECB has every chance of being the first central bank out of the three to embark on easing. Frankly, a couple of months ago, it was hard to believe this. However, upon reflection, there simply was no other scenario. Inflation in the US has not slowed down in recent months, and inflation in the UK is too high to consider easing policy. Therefore, the ECB was the only candidate to move to a softer policy first.

However, ECB Vice President Luis de Guindos believes there is no need to rush on this matter. He closely monitors the inflation indicator in the services sector, and this sector is causing him some concern. De Guindos believes that inflation in the services sector has proven more resilient than assumed. Therefore, the Bank should wait a little longer before making an important decision.

The ECB will have "far more data" to better evaluate its decisions in June, de Guindos said. "But there could be a different situation that leads to an abrupt adjustment." He believes that wage dynamics remain a key factor influencing the pace of inflation. So there could also be unpleasant surprises between now and the June meeting.

"We track changes in the US economy, but we are data-dependent not Fed-dependent, as President Lagarde has indicated in the past," de Guindos adds. In my opinion, his comments only speak to his cautious approach in interviews. Like with Austan Goolsbee, it's better not to promise anything than to promise and not deliver later. However, I believe these concerns are unfounded. Inflation in the EU continues to decline steadily, almost every month. At some point, it will reach the target level. Given the lack of growth in the European economy, the ECB is interested in transitioning to a softer policy, so European officials are unlikely to delay with this issue. For the market, this is another reason to reduce demand for the euro.

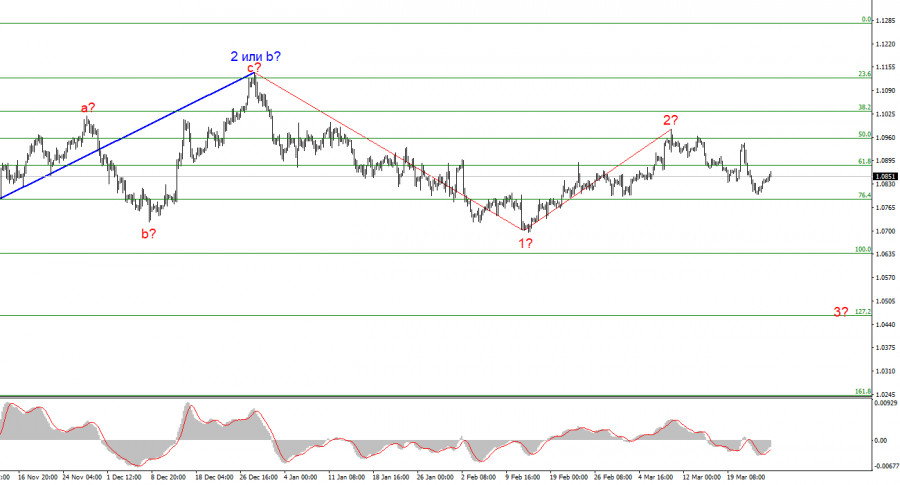

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% according to Fibonacci.

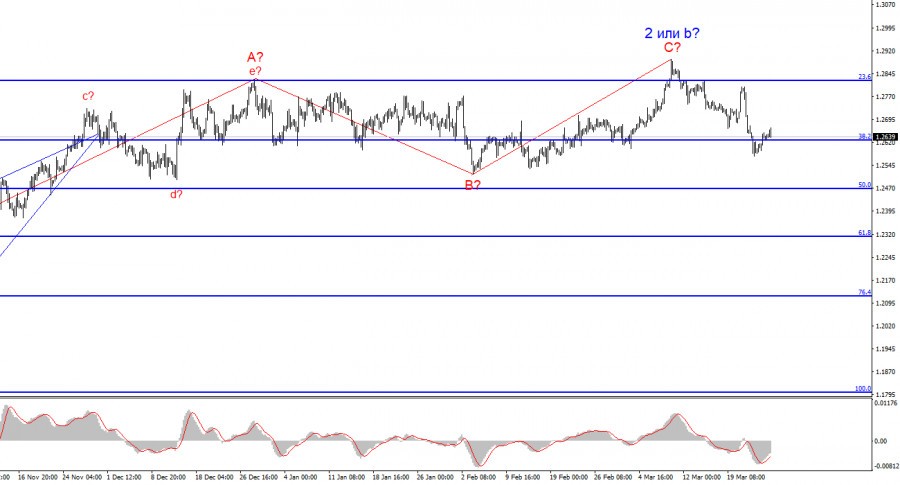

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The construction of wave 3 or c may have already started, but the quotes haven't moved far away from the peaks, so we cannot confirm this.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/8xpL3DV

via IFTTT