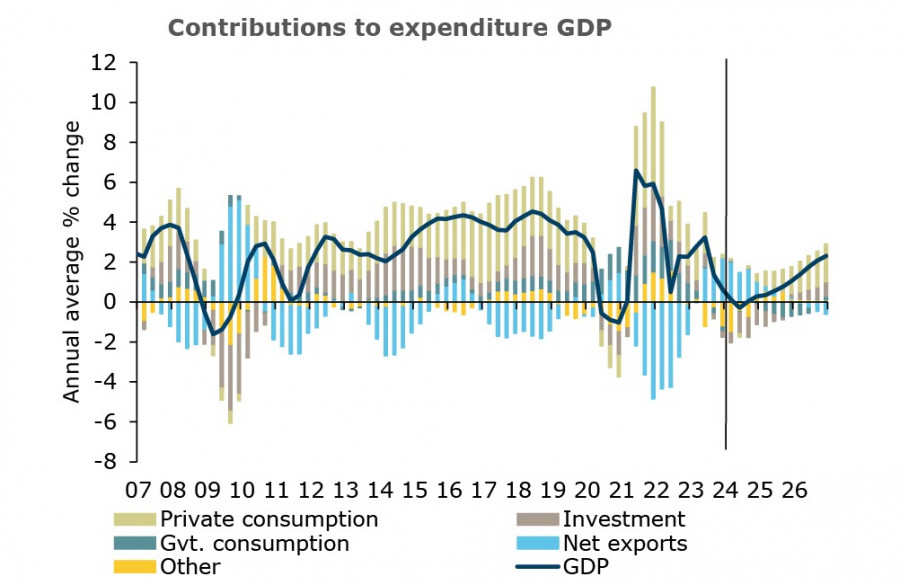

New Zealand's economy is slowing down. Economic activity fell 0.1% in the December 2023 quarter as measured by gross domestic product. This follows a 0.3% fall in the September 2023 quarter, GDP per capita fell by 0.7%. If you look at the dynamics from the Reserve Bank of New Zealand's perspective, everything is fine - the slowdown in the economy is in line with the goal of returning inflation to the target level. If the economy starts to recover faster than forecasts (which assume a return to pre-crisis growth rates of 2.5% y/y in 2026), the RBNZ may either raise the rate higher or stay at the current high level for a longer period of time.

Such a scenario is currently unlikely; markets have settled into the belief that the current interest rate level is the peak and that there will be no further rate hikes. As a result, the main driver of the kiwi's strength, which pushed it up at the end of 2023, has ceased to operate.

In favor of modest growth, which will help contain inflation, plans include not only maintaining the necessary duration of tight monetary policy but also tightening tax and budget policies, which will guarantee a decline in consumer demand and help keep prices under control. The price for this is balancing on the brink of recession, but for the RBNZ, inflation is much more important than economic growth. This process is under strict control since inflation expectations remain too strong - the February ANZ survey showed that 48.2% of respondents expect prices to continue rising.

Another factor that will influence the kiwi's exchange rate is the dynamics of global demand. Concerns are growing that the global economy is moving towards a slowdown rather than growth and that a crisis scenario is more likely than a recovery of growth momentum. Supporting this scenario is still strong global inflationary pressure, which forces major world banks to postpone the start of the rate-cutting cycle. If the slowdown becomes evident, commodity currencies, including the kiwi, will be among the first to suffer.

At the moment, there are noticeably fewer factors capable of helping NZD resume its growth compared to November-December. The kiwi is under increasing pressure.

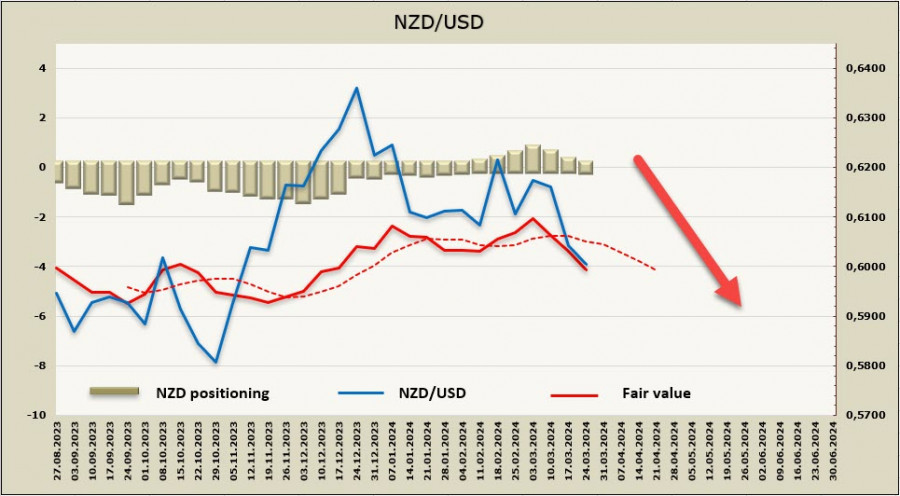

The weekly change for NZD is -0.2 billion, with the net long position liquidated to zero, resulting in a neutral position. The price is heading downwards.

The kiwi is trading near the psychological level of 0.60, where there is also a technical support level at 0.5996, representing a 61.8% correction from the November-December uptrend. We expect another bearish momentum aiming to reach the lower boundary of the bearish channel at 0.5890/5910, with the next support at 0.5850/60.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/WLSvVHt

via IFTTT