The euro has grown in the last five days. As I mentioned earlier, from Monday to Thursday, there was no corresponding news background for this. The market interpreted all the information in favor of the euro. Only on Friday did the news background suggest a decline in the US dollar, but on that day, the US currency even edged up! As we can see, it is very difficult to justify the market's actions over the past week.

In the upcoming week, we will be able to understand whether the recent growth was a wave that is necessary to complete corrective Wave 2 or if the market simply ignores the news background and is ready to increase the demand for the euro. The news background for the European Union will be quiet next week. Therefore, it will be hard for the market to find a reason to increase demand for the single currency. Nevertheless, if it does happen, we understand that the news background is currently irrelevant, and the market will buy under any circumstances.

Among the most important reports for the next week, I can highlight inflation in Germany and industrial production for the entire Eurozone. Both of these reports have extremely low chances of influencing market sentiment. With all due respect, these are the only reports that may have a chance of influencing market sentiment. Accordingly, there is hardly any reason to even consider their values and try to guess the actual figures.

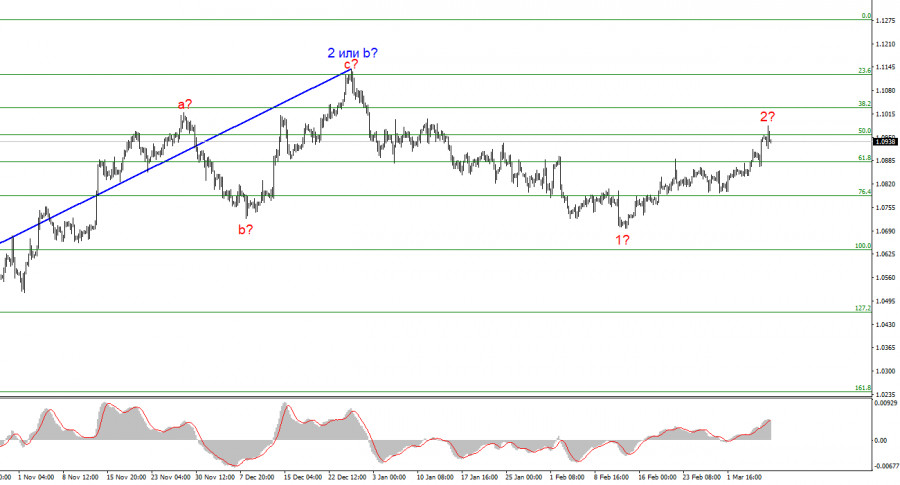

Next week, the US reports (among them the inflation report) and one important level, 1.0956, will be significant. This level simultaneously equates to 61.8% of Wave 1 or a and 50.0% according to an earlier Fibonacci grid. A successful attempt to break through this level will show that the market is prepared to increase demand for the euro. An unsuccessful attempt may suggest that the market is ready to stop building corrective Wave 2.

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci, and I am waiting for the end of the corrective wave.

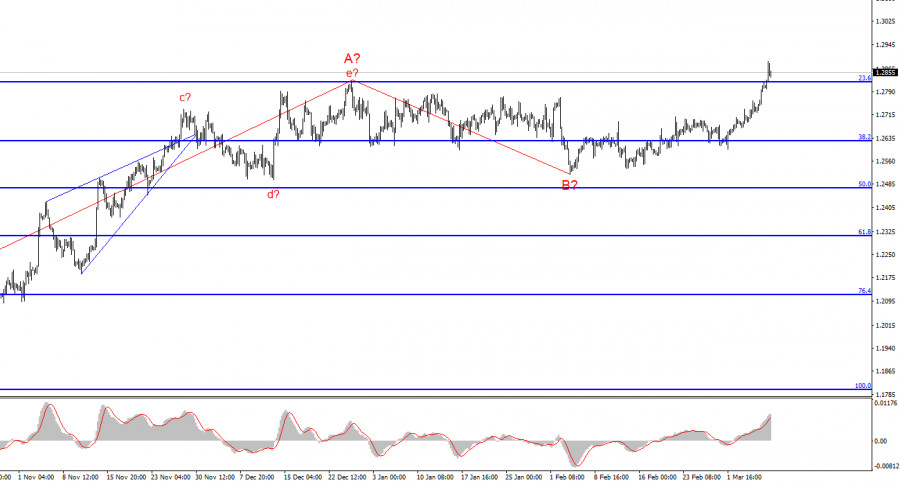

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% according to Fibonacci. A successful attempt to break through the level of 1.2877, which is equivalent to 76.4% according to Fibonacci, will indicate that the market is ready to increase the demand for the instrument. In this case, you may consider long positions.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/TlYLpke

via IFTTT