For over six months, the market has been discussing potential interest rate cuts in the UK, US, and the European Union. None of the central banks have implemented any rounds of monetary easing yet, as discussions are still ongoing. Probably, there would be much fewer talks about rates if central bank policy makers didn't provide comments on this topic almost daily, emphasizing its importance. And since central bank policymakers consider this an important matter, the market cannot think otherwise.

Previously, we already discussed that the European Central Bank will be the first of the three central banks I'm interested in to cut rates. Even if the ECB does not cut rates in June, as practically everyone in the market expects it to, then it will do so at the next meeting, which will still be earlier than the Federal Reserve or the Bank of England. In the UK, inflation is still too high to talk about easing policy. This week it may drop to levels of 3.0-3.1%, but even that is too high to start a meaningful conversation about rate cuts.

In the US, inflation has been rising steadily for several months and has not decreased since last year. If a couple of months ago there was hope that at some point the downward trajectory would resume, and then the Fed would approach the moment of the first rate cut, now that moment has been pushed back. To put it bluntly, how long might it take for the Consumer Price Index to drop from 3.5% to 2.5%? In my opinion, no less than six months. Therefore, talking about the prospects of rate cuts in the US may not happen until at least 6 months later. I agree with those economists and analysts who expect easing in the last quarter of 2024.

Returning to the ECB, rates will start to decline in June and, according to officials, will decrease once a quarter. Thus, each round of easing will be conducted once every two meetings. I believe these are sufficiently high rates, and the ECB rate is not too high compared to the rates of the Fed and the BoE. All this puts the euro in an extremely disadvantageous position. The wave markings continue to imply a decline in the instrument, and as we can see, so does the news background.

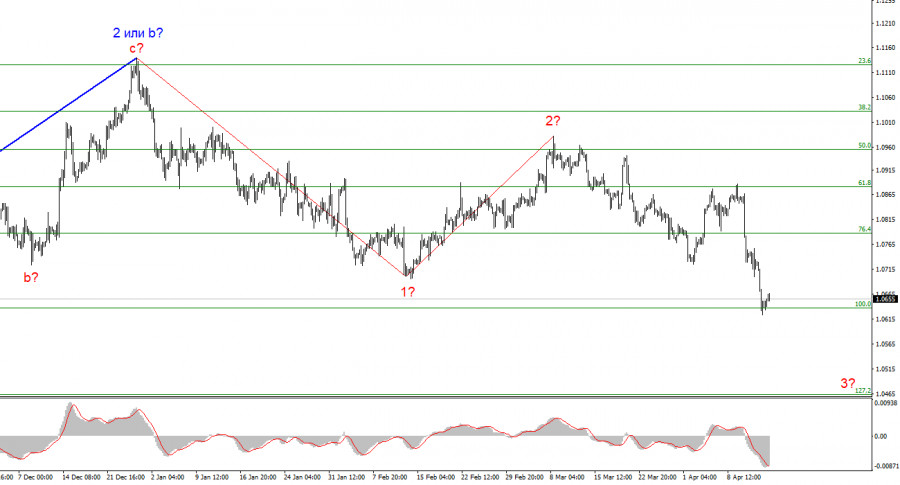

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0463 mark, as the news background works in the dollar's favor. The sell signal we need near 1.0880 was formed (an attempt at a breakthrough failed).

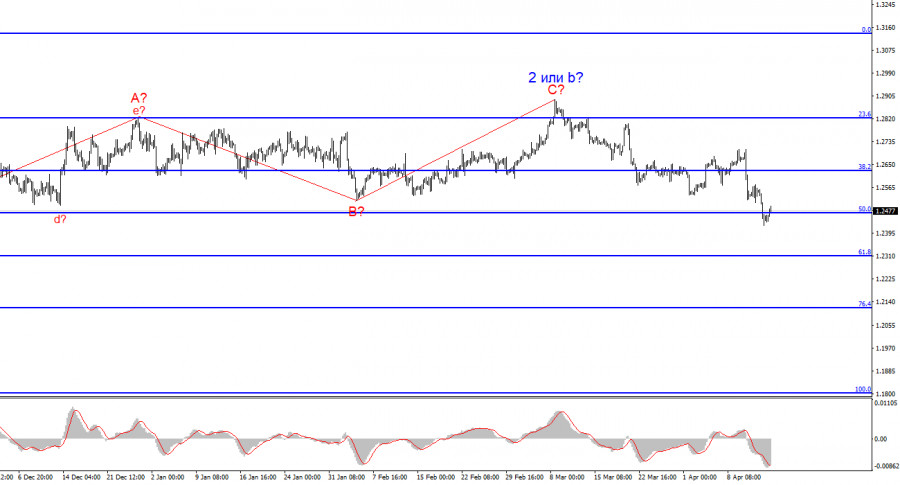

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will have started to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is ready to build a descending wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/3gGylYv

via IFTTT