The upcoming week promises to be quite dull, especially for the euro. There will be relatively few significant events in the European Union, but I believe they are not necessary at this time. Over the past two weeks, the market has overcome a barrier that was preventing it from raising the demand for the dollar. First, a series of reports on the US labor market and unemployment showed higher figures than the market expected, and then US inflation accelerated more than forecasted. The combination of these reports made it clear that it is premature to dream about a Federal Reserve rate cut. Since the market had previously been guided by its own expectations of imminent Fed policy easing when selling the dollar, the situation is reversed. The demand may rise because the Fed is unlikely to lower rates in the coming months.

In the European Union, I can only highlight reports on industrial production, inflation, and economic sentiment indices from the ZEW Institute. In my opinion, all of these reports will not significantly affect market sentiment. If individual reports turn out better than market expectations, then the euro may edge up. At some point, the euro may rise to form a minor corrective wave. However, it would be difficult to expect a sharp growth from the euro based on the EU reports.

Even the inflation report, which looks quite extensive, will only serve to confirm the preliminary estimate. The consumer price index in March is expected to stand at 2.4% on an annual basis, while the core index will slow down to 2.9%. I believe these figures are enough for the European Central Bank to start easing policy. In April, the central bank decided to be cautious, but two more inflation reports will be published before the June meeting. If they do not show high values, a rate cut in June is almost guaranteed.

Based on everything I mentioned, I expect the market to continue to reduce demand for the euro, which corresponds to the current wave pattern.

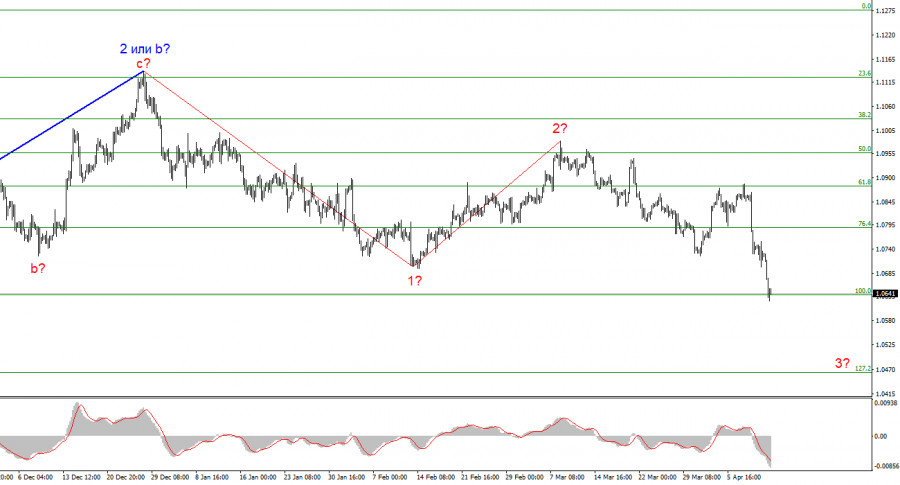

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0463 mark, as the news background works in the dollar's favor. The sell signal we need near 1.0880 was formed (an attempt at a breakthrough failed).

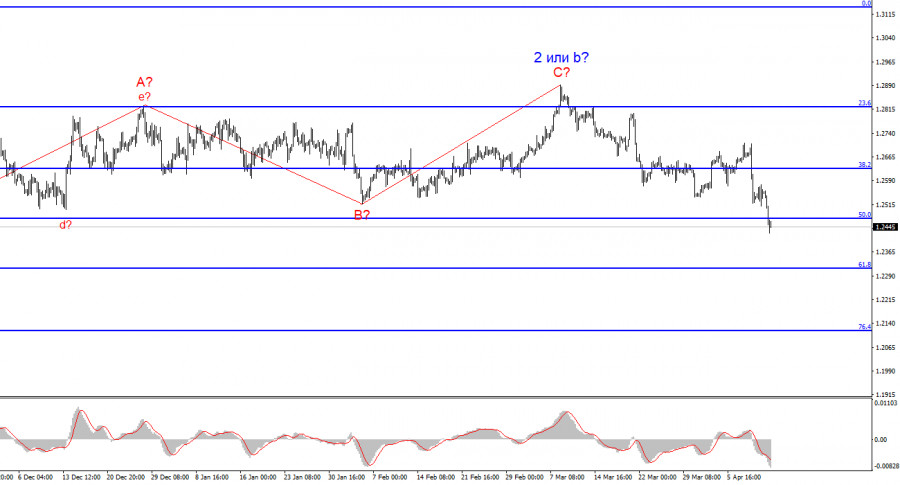

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will have started to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is ready to build a descending wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/kaUWIfj

via IFTTT